Bitcoin's (BTC) much-anticipated breakout above $100,000 remains out of reach, with prices retreating to $94,500 overnight. Key indicators point to further declines, potentially to levels below $90,000.

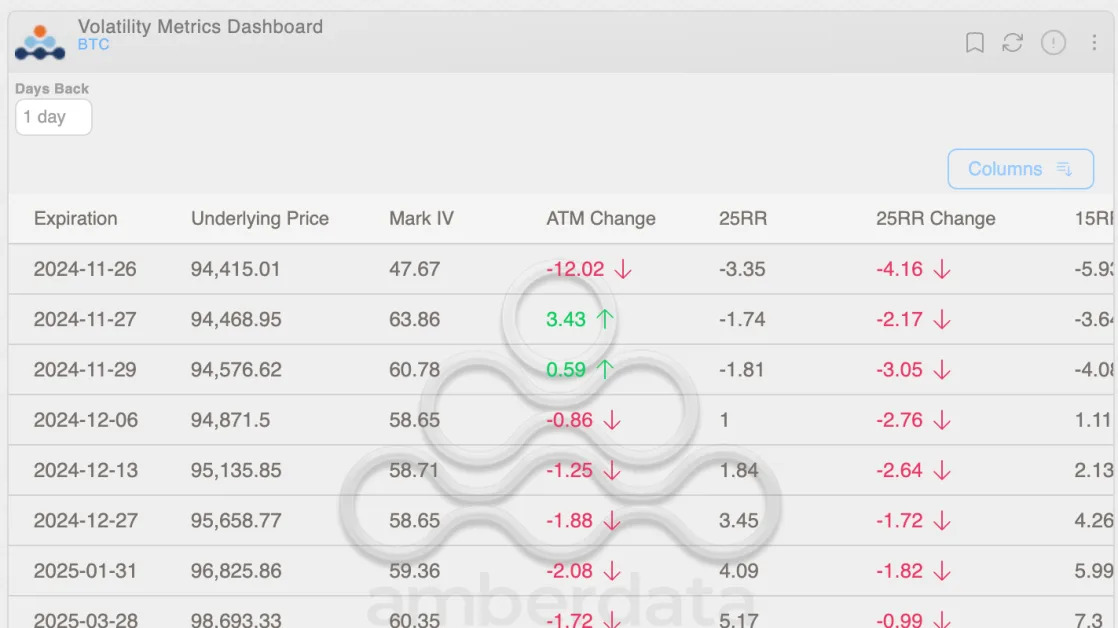

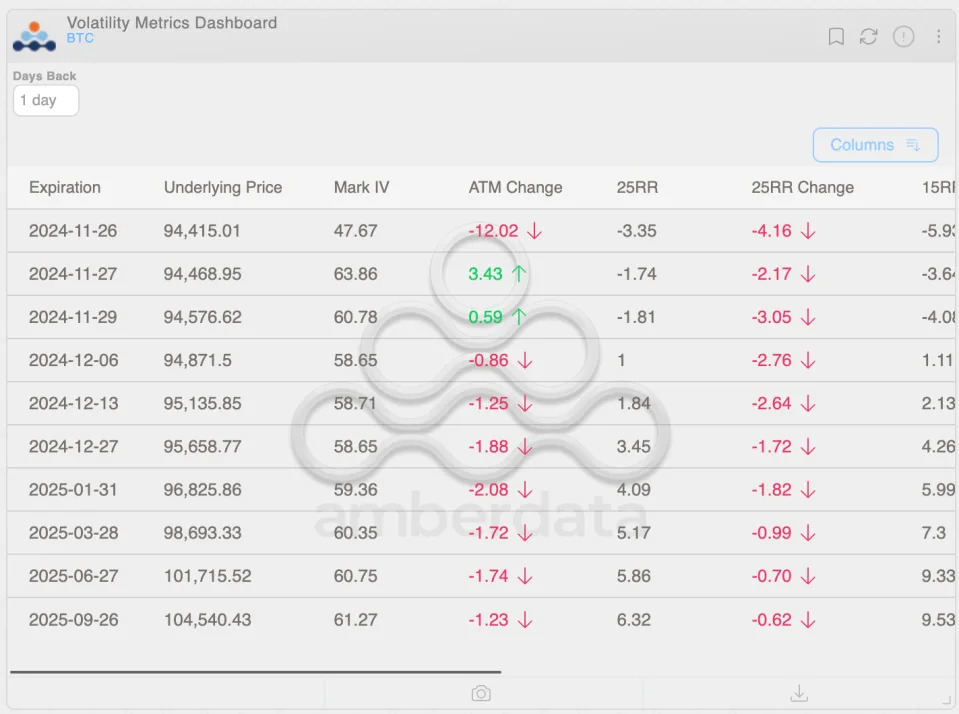

The first indicator is the 25-delta risk reversal, which measures the volatility premium of out-of-the-money calls used to bet on price rallies relative to OTM put options offering downside protection.

On Deribit, calls expiring this Friday now trade at a cheaper valuation to puts, resulting in a negative risk reversal, according to data source Amberdata. The first negative reading in at least a month indicates a bias for protective puts.

Perhaps sophisticated traders are prepping for an extension of Monday's price slide. On Monday, traders sold call spreads and bought put options tied to BTC on the over-the-counter liquidity network Paradigm.

The 24-hour change in the 25RR (risk reversal) shows the call bias has moderated across timeframes. Last week, calls expiring in December and January traded at a bigger premium relative to puts than what we see now.

Coinbase premium evaporates

The stateside demand for BTC, a leading source of bullish pressure for the cryptocurrency during the recent post-U.S. election price surge from $70,000 to $99,500, has weakened. That's evident from the renewed discount in BTC prices on Nasdaq-listed Coinbase compared to offshore giant Binance.

The negative flip in the so-called Coinbase premium indicator follows the bearish order book skew, indicating vulnerability to potential negative news.

RSI divergence

The relative strength index (RSI) divergence occurs when an asset's price moves counter to the momentum oscillator.

In BTC's case, while prices tapped a new high above $99,000 on Friday, the RSI did not, diverging bearishly. The pattern indicates that the bullish momentum has run its course for now and there could be losses ahead.

Intraday charts indicate support between $87,000 and $88,000, meaning an expected deeper decline could find a floor in that range while long-term technical studies continue to lean bullish.