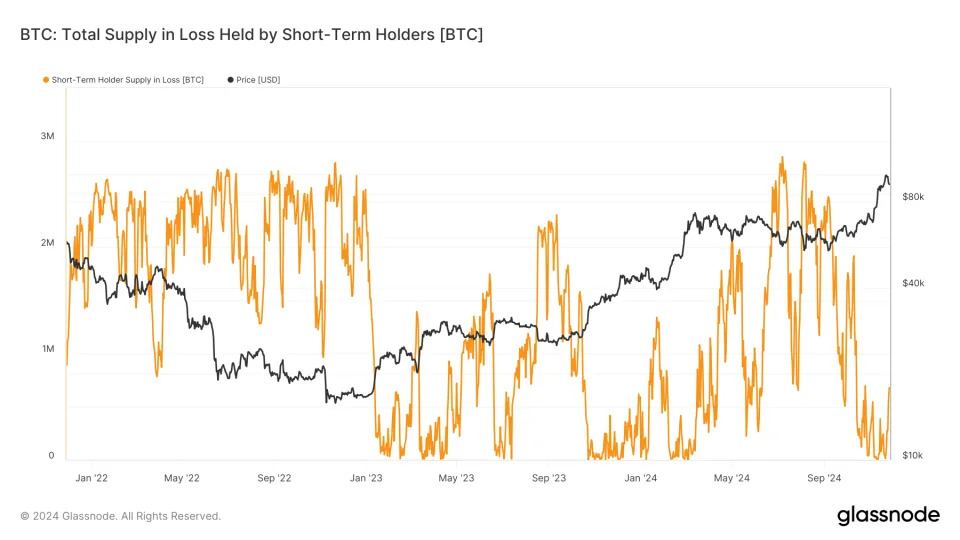

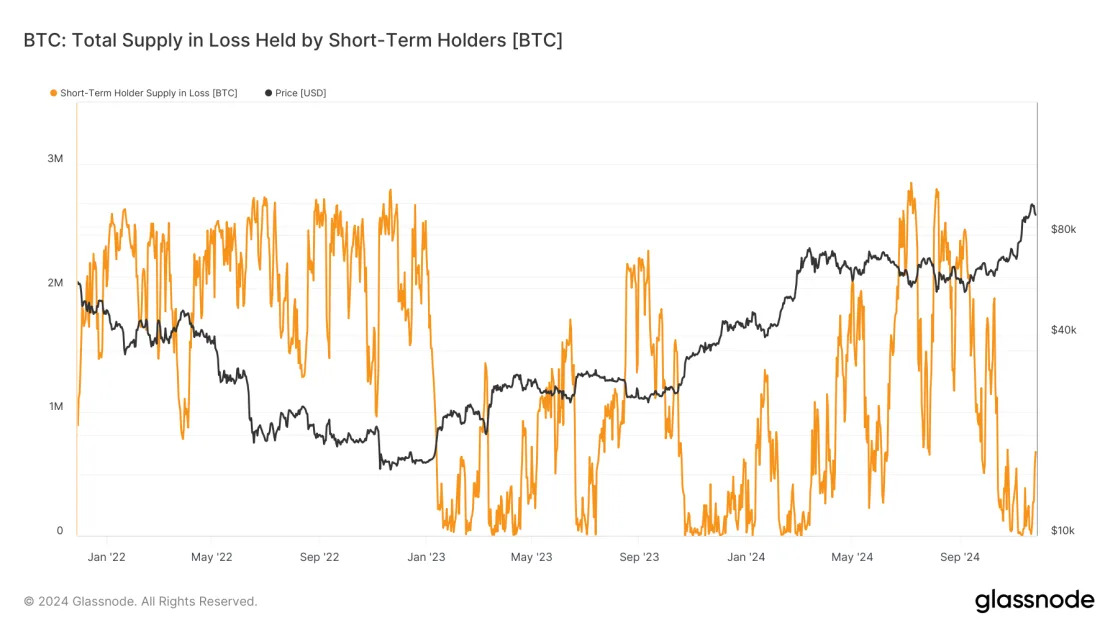

Bitcoin (BTC) volatility is back and investors have two choices either embrace the volatility or have no part of it. However, the current bitcoin cycle has been rather muted in terms of realized volatility and drawdowns compared to previous ones. The recent drop from nearly $100,000 to almost $90,000, just shy of a 10% correction, has kept investors on their toes. Over the past two days, Glassnode data shows that short-term holders or those that have held bitcoin for less than 155 days, have sent $7.8 billion or 83,000 BTC to exchanges at a loss over the past two days. In notional terms, this is the highest number on record. When this cohort tends to send $2 billion or more worth of tokens to exchanges, at a loss, it generally marks a local bottom. With bitcoin changing hands at 7% away from its all-time high, investors that have bought in the past week are the only entity that would be sitting in a loss.

Glassnode data shows that approximately 678,000 bitcoin are sitting in a loss. This comes after record notional profit-taking as bitcoin approached $100,000.