The S&P 500 index has notched 52 record closing highs in 2024. That’s more than one for every week of the year so far and implies a steady rally as the calendar has flipped over.

But of course that wasn’t the case. There were a number of occasions this year when stock markets stumbled. Yet the sign of a sturdy bull run is when an asset’s price can absorb a shock, recover quickly, and trundle on up.

Henry Allen, macro strategist at Deutsche Bank, accepts that the ability of risk assets to bounce back of late may have made the markets “look invulnerable right now” but he notes that three issues which caused tremors in 2024 could still drive a fresh sell-off “particularly if they become a more persistent and longer-lasting problem.”

The first risk he identifies is an economic downturn . Recall, the biggest sell-off in 2024 came at the start of August, triggered by a meek nonfarm payrolls report amid concerns the Federal Reserve was keeping monetary policy too tight. Adding to the angst were a number of poorly-received earnings reports from big tech companies that called into question that sector’s strong rally. Add some swift unwinding of yen carry trades after a Bank of Japan interest rate hike, and the result was was the S&P 500 diving 8.5% from peak-to-trough and U.S. high yield bond spreads widening by 84 basis points, according to Allen.

Fortunately for equity investors the U.S. economic data soon improved and the market rebounded. But Allen reckons that the fact such a sell-off occurred even though the data were not pointing to a recession raises the question of how bad a pullback may have been if the data continued to show an economic contraction. “After all, we know that recessions are one of the worst things possible for risk assets,” he says.

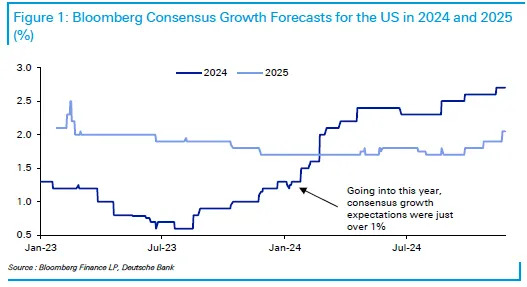

The problem for the U.S. market in 2025, he believes, is that the benchmark for economic growth is now much higher. At the start of 2024, the Bloomberg consensus forecast for U.S. growth was only 1.3%, and so beating that helped risk assets. However, consensus growth for next year is already above 2%, and so “getting an upside surprise should be more difficult now, precisely because growth has beaten expectations over 2023 and 2024,” Allen says.

The second risk is mounting geopolitical tensions . A market sell-off in April centered around escalating tensions in the Middle East, while Brent crude oil saw an intraday peak for the year about $92 a barrel. Iran’s first direct missile attack on Israel added to the anxiety and the S&P 500 fell 5.5% over this period, while U.S. high yields spread widened by 37 basis points, according to Allen.

Again, the tension faded, but as was seen more recently, concerns about an escalation between Ukraine and Russia saw Germany’s DAX index DX:DAX suffer an intraday 2% decline. “So markets are clearly very jittery to any geopolitical escalation…if a fresh conflict or a major escalation did happen, then we know from recent experience that markets can react very negatively, as seen after Russia’s invasion of Ukraine in 2022,” says Allen.

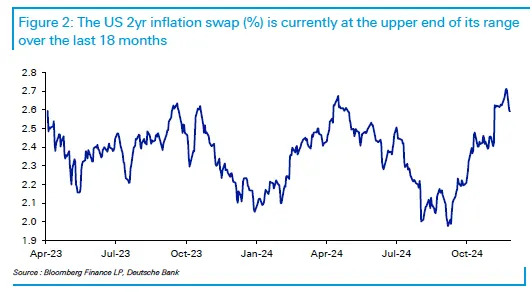

Finally, there’s an inflation shock . Allen recalls that back in the first quarter of the year investors were getting concerned that inflation was becoming more persistent, with U.S. core CPI printing at plus 0.4% for three months in a row, pushing the annualized rate to plus 4.5%. Those fears of sticky price pressures saw traders trim their Federal Reserve rate cut bets and force the 2-year Treasury yield back above 5%.

Fortunately for those long risk assets, inflation subsided into the second quarter. But Allen notes that U.S. inflation remains above the Fed’s 2% target and Deutsche’s economists forecast that both headline and core inflation will stay above that level through 2025 and 2026. “Neither have been beneath 2% since early 2021, so if those forecasts are realized, that would mean there was a period where inflation was above target for 5 years,” he says.

With these three risks lingering in the background, Allen is wary. “And since valuations are more elevated now relative to the last couple of years, that means on paper, the scope for further gains is now more limited.”

Markets

U.S. stock-indices SPX DJIA COMP are slightly higher at the opening bell as benchmark Treasury yields BX:TMUBMUSD10Y fall. The dollar index DXY is lower, while oil prices CL.1 rise and gold GC00 is trading around $2,656 an ounce.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5998.74 |

1.38% |

3.18% |

25.76% |

31.82% |

|

Nasdaq Composite |

19,060.48 |

0.50% |

2.43% |

26.97% |

33.68% |

|

10-year Treasury |

4.216 |

-20.90 |

-7.40 |

33.51 |

-11.71 |

|

Gold |

2688.2 |

-1.10% |

-2.11% |

29.75% |

28.52% |

|

Oil |

68.32 |

-4.03% |

-1.46% |

-4.22% |

-8.15% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

U.S. markets will trade a shortened session on Black Friday, with the NYSE shutting at 1 p.m. Eastern and the bond market closing at 2 p.m.

Retailers are telling shoppers to buy now before tariffs push up prices.

The U.S. dollar fell below 150 to the Japanese yen USDJPY after a stronger-than-expected reading on core Tokyo inflation increased the chances of an interest rate increase by the Bank of Japan in December.

Starbucks is offering a glimpse of North Korean life from its new branch.

South Korea’s most valuable music producer Hybe lost $420 million of its market capitalization by news K-pop group NewJeans want to split from the label’s subsidiary Ador over alleged “mistreatment.”

Best of the web

This is what the world’s first all-EV car market looks like.

A revolution in how robots learn: they’ll use AI to teach themselves.

Oil, raspberries, smartphones: what the U.S. imports from Canada, Mexico and China.

The chart

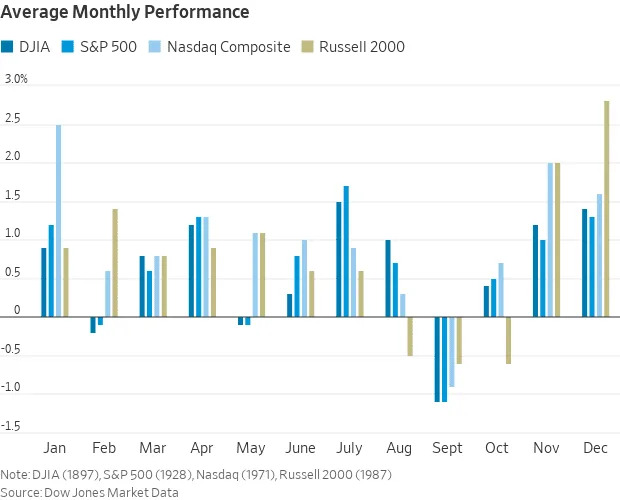

It’s the last (albeit truncated) trading day of November. December awaits, and as most investors know it has a habit of being a good month for stocks. And, as the chart from Kenny Jimenez at Dow Jones Market Data shows, particularly good for small caps.

“The Russell 2000 is up 81% of the time [in December]; it’s highest winning percentage of any month,” he says. “The average December return for the Russell 2000 is 2.8%; the best average return for any month.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

TSLA |

Tesla |

|

MSTR |

MicroStrategy |

|

PGHL |

Primega Group Holdings |

|

PLTR |

Palantir |

|

AMC |

AMC Entertainment |

|

SMCI |

Super Micro Computer |

|

AMZN |

Amazon.com |

|

AAPL |

Apple |

Random reads (bumper festive edition)

‘Do they not know what a banana is?’

Hey, I’m goin’ walkies here!! Vito is top dog .

The rise of the celebrity lookalike contest.

Wearing a salmon on your head is back In fashion for orcas.

The secret behind the inevitable rise of ‘Mar-A-Lago’ face .

Hiker discovers first trace of entire prehistoric ecosystem in Italian Alps .

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .