(Bloomberg) -- In a week in which US inflation data accelerated, Donald Trump threatened some of America’s closest neighbors with aggressive tariffs, and half of Wall Street was on vacation, the S&P 500 still comfortably beat benchmark stock gauges for both Europe and Asia.

Get used to it, say market pros.

On the sellside and the buyside, from UBS to Fidelity International, the verdict is that American capital markets are set to continue their global domination in 2025.

US large-caps are edging toward the best year versus the rest of the world since 1997. Corporate America is borrowing with remarkable ease despite still-elevated interest rates. And day traders are enjoying historic gains across speculative bets from leveraged ETFs to crypto.

The outperformance of US markets was on display again in a holiday-shortened week that still managed to pack in plenty of action, beginning with a positive investor reaction to US President-elect Trump announcing his planned Treasury Secretary. Just days later, his tariff threats were stirring up market volatility, while the Federal Reserve’s preferred measure of underlying inflation subsequently showed an uptick in October.

No matter. The S&P 500 ended the week up 1.1%, while the Cboe Volatility Index — or the VIX, a gauge of hedging demand — dropped to a four-month low. The yield on 10-year Treasuries fell 22 basis points.

In contrast, French debt was a standout loser from domestic political machinations, with yields at one point rising to the highest versus similar German notes since 2012. The Stoxx Europe 600 Index ended the week up just 0.4% while the MSCI Asia Pacific Index gained 0.8%.

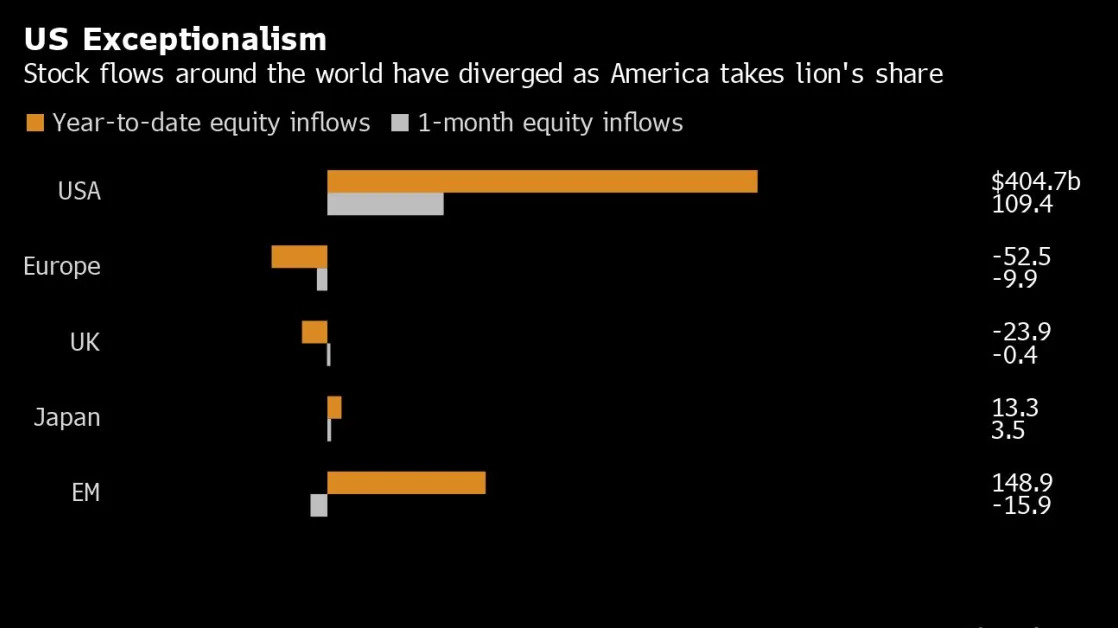

Despite the ever-growing valuation gap between American assets and the rest of the world, inflows into US stocks have accelerated over the past month, EPFR data compiled by Barclays Plc show, while Europe and emerging markets have seen outflows.

“From a bird’s eye view perspective, we much prefer the US,” Caroline Shaw, portfolio manager at Fidelity International, told Bloomberg Television on Wednesday. “Earnings growth is going to be strong still.”

US economic growth has outpaced the rest of the developed world since the pandemic. Optimism the trend will endure is everywhere, rooted in expectations that Trump’s policies will boost domestic markets while his trade protectionism hurts the rest of the world. While economists have upgraded forecasts for US expansion next year, projections for Europe have been cut.

‘Extreme Disconnect’

All that counts on America’s rosy outlook remaining resilient to any blowback to its own policies. Adam Slater at Oxford Economics wrote this week that the market optimism may be premature if “aggressive US tariff increases are met by large-scale retaliation.”

Meanwhile, with global central banks now in easing mode again, Invesco expects Europe to beat the US thanks to the former’s lower valuations and higher weightings of cyclical sectors. Bank of America strategists said the “extreme disconnect” between bullishness on US assets and bearishness toward the rest of the world could result in US underperformance.

But pro-US bets have won again and again while calls to diversify investments across the world have misfired in recent years, with lofty US valuations proving no barrier to further gains. The US market has beaten the rest of the world all but two of the past 15 years since the global financial crisis. That has given it the highest weighting ever in the MSCI World Index, compared with a record low for Europe, according to Barclays.

“You can have a situation where US valuations very, very quickly start to look reasonable if the rest of the companies in the S&P 500 start making as much money or relatively as much money as the Big Tech companies do,” said Ben Kumar, head of equity strategy at Seven Investment Management. “There’s definitely a sense now of you have to own the US because it’s just doing something different.”

For UBS, there are clear reasons to expect further US stock outperformance next year, from potential tax cuts to deregulation.

“The US has the lowest operational leverage of any major market and thus outperforms if global growth slows,” wrote a team led by Andrew Garthwaite. “The US should benefit from Trump relative to elsewhere.”