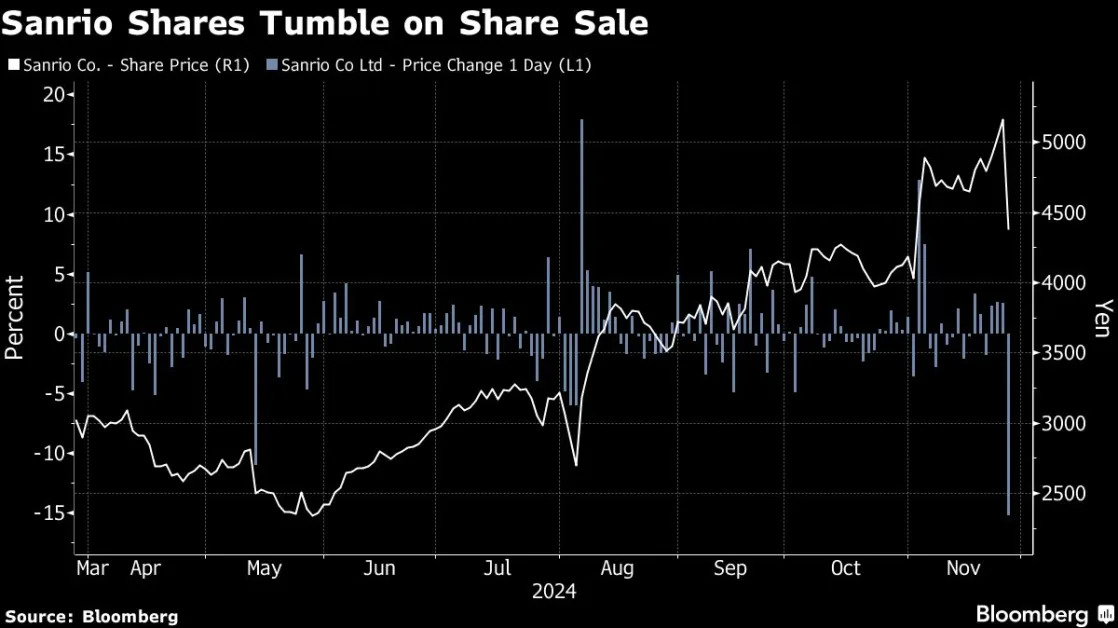

(Bloomberg) -- Sanrio Co. shares tumbled the most since May 2014 after the brand owner of Hello Kitty said holders including its president will sell shares in the open market.

The Tokyo-based company sank as much as 17% in early Tokyo trade, on volume that was more than 300% its three-month average, according to data compiled by Bloomberg. President Tomokuni Tsuji and MUFG Bank Ltd. will sell about 25.9 million shares, with price to be decided as soon as Dec. 10, according to a filing to Japan’s Finance Ministry.

“The sale by banks is part of unwinding of cross shareholdings and Sanrio aims to increase liquidity,” Jefferies Financial Group Inc. analyst Shunsuke Kuriyama wrote in a note. “We expect near term pressure on the share, but the fundamental view on character market and character portfolio diversification is intact.”

Sanrio shares have more than doubled this year, compared with the 13% gain in the Topix index, on the back of successful character development, and as the company benefited from tourists into Japan. Sanrio raised its full-year profit guidance last month.

The sell-down was coming but “I expect it is not terribly well prepared by investors,” Travis Lundy, an analyst at Quiddity Partners, wrote in a note published on Smartkarma. The stock was “expensive and vulnerable to an unwind of momentum-driven holdings.”

(Adds analyst comment)