(Bloomberg) -- Trafigura Group, the commodities trading giant, is positioning for record growth in the beleaguered market for carbon credits, as it bets new regulatory frameworks will propel the instruments into the mainstream of emissions accounting.

Across jurisdictions, “increased and mounting regulation” designed to rein in emissions is reshaping the market for carbon credits, said Hannah Hauman, global head of carbon trading at Trafigura. The development means that a product once treated as a form of “corporate experimentation” is now set to join the ranks of “investment-grade assets and operations,” she said during a recent interview in Azerbaijan.

Carbon credits, which companies use to compensate for their emissions, have emerged as one of the more controversial corners of climate finance. Recurring allegations of greenwashing last year coincided with a 23% slump in the value of the so-called voluntary carbon market on which such credits are traded, as bankers and corporations backed away.

HSBC Holdings Plc has now shelved plans to build a carbon credits trading and finance desk. Shell Plc is taking steps to sell a majority stake in its portfolio of nature-based carbon credit projects. And Delta Air Lines Inc., Alphabet Inc.’s Google and Easyjet Plc are among companies that have retreated from the market.

At the same time, regulators in Europe, the US and Asia have come around to the view that many companies won’t be able to report net zero emissions by mid-century without access to a functioning and effective market for carbon credits, particularly removals-based units. All three regions are developing frameworks to make that possible.

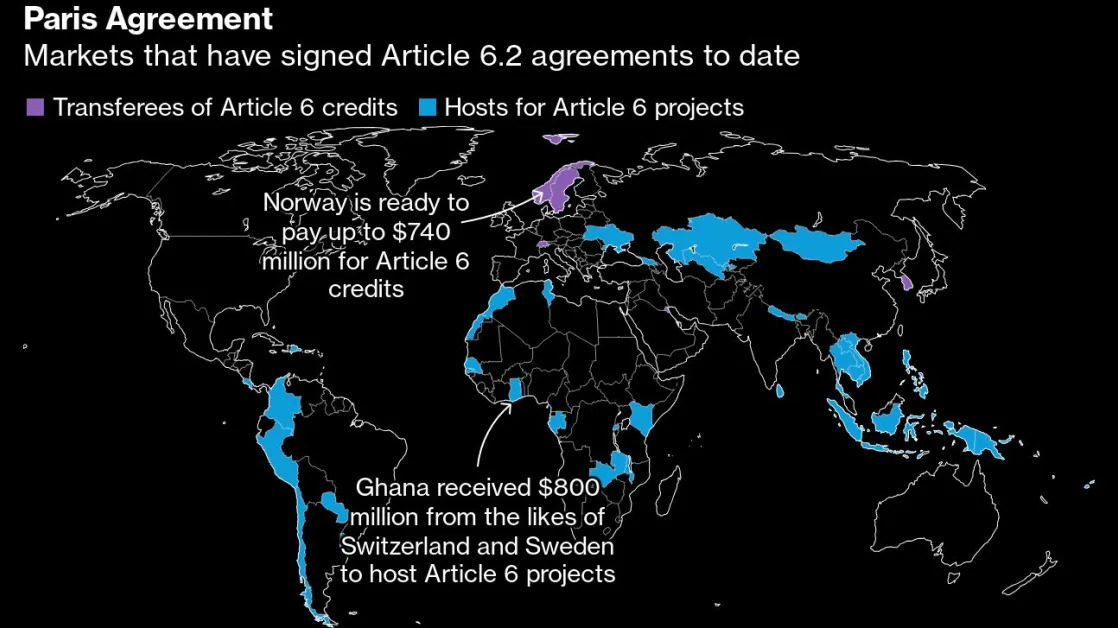

And at the COP29 summit in the Azeri capital of Baku, negotiators landed an agreement to advance rules for a new market guided by the United Nations. There’s a UN-backed global crediting mechanism under what’s known as Article 6.4. And there’s also guidance on how countries can account for the units they exchange as they strive to meet national climate targets, known as Article 6.2.

The decision on Article 6.4 in particular is an “enormous” development, Hauman said. “That’s now basically giving a rubber-stamped rulebook for countries globally” showing them how to participate in the market, she said.

Carbon market experts and climate campaigners, meanwhile, are urging caution. Article 6.2, which focuses on how countries can exchange so-called internationally transferred mitigation outcomes to help meet their climate targets, looks set to become an “anything goes” market, according to Danny Cullenward, senior fellow at the Kleinman Center for Energy Policy at the University of Pennsylvania.

Already the market has been designed to allow countries to set their own terms for what counts as a high-quality credit. And the agreement in Baku now turns what was initially intended as a “multilateral accounting regime” into a “carbon-trading regime,” Cullenward said. That risks undermining both the better designed Article 6.4 market, as well as wider climate action, he said.

A carbon credit is supposed to represent 1 metric ton of emissions that have been avoided, reduced or removed from the atmosphere. They’re sold by project developers — often in developing economies — that invest in areas such as reforestation. Companies buying credits then claim to have compensated for their emissions. In practice, however, studies have uncovered widespread instances of projects issuing more credits than they merit.

Trafigura, which is the world’s largest trader of carbon-removal credits, has had to contend with the fallout of questionable projects in the past. In 2023, it was among firms left with a consignment of what Hauman described at the time as “defunct assets.”

With new regulations now falling into place, Hauman said Trafigura is now needing to develop new carbon credit projects to respond to rising demand. “That’s true in all of our markets,” she said.

Hauman notes that for the first time, companies under pressure to reduce their emissions have a “regulatory line of sight to what’s expected of them between now and 2030.”

“And they can plan, they can price it, they can procure it,” she said. And “they can make investments and gear capital accordingly.”

To date, the carbon market has been shaped less by supply-and-demand dynamics that typically steer commodities, and more by policy developments as well as greenwashing shocks. Meanwhile, legal definitions around carbon credits remain inconsistent globally, adding to pricing complications. The risks are significant enough to have left major banks struggling to get a foothold in the market.

That’s created opportunities for traders like Trafigura, which is already striking new deals. Earlier this month, it announced an agreement to underwrite $500 million for a new carbon credits project to restore the woodlands of Miombo spanning southern and central Africa.

The new regulatory backdrop is “changing the entire paradigm of how markets behave,” Hauman said.

What BloombergNEF Says:

The COP29 summit “closed with a rushed approved text governing a global carbon trading mechanism under Article 6.4 of the Paris Agreement. The deal is largely symbolic as there are still many uncertainties that need to be resolved before the market can get off the ground.”

Importantly, an agreement was struck “to officially allow reforestation and afforestation projects developed under the failed Clean Development Mechanism, transferring them to the new revamped UN-governed carbon trading mechanism. Notable winners of this motion are India and Colombia, who collectively host 27 projects now eligible for Article 6.4. The transfer allows CDM participants to get a head start on populating Article 6.4 credit supply.”

--With assistance from Archie Hunter.

(Adds BNEF reference in final paragraphs.)