(Bloomberg) -- Some clients of Nomura Holdings Inc. are restarting business with the Japanese brokerage after it took steps to address concerns arising from a regulatory probe into market manipulation, according to people with knowledge of the matter.

The country’s megabanks have resumed trading activities with Japan’s biggest securities firm, the people said, asking not to be named because the information is confidential. At least four insurers that had halted their equity or bond dealings with Nomura are also restarting these activities, they said.

Many of the firms returned to Nomura after the brokerage explained to them measures it is taking to prevent a recurrence of the breach, the people said.

The development came after Nomura detailed various steps it’s taking to address the market manipulation case late last month. These include Chief Executive Officer Kentaro Okuda and other top managers giving up part of their pay to take accountability. The company pledged to enhance its compliance framework and internal controls to prevent similar incidents from occurring and regain trust.

“Such decisions are at the discretion of our clients and we are not in a position to make comment,” a Nomura representative said.

The Ministry of Finance suspended Nomura from so-called “special entitlements” of Japanese government bond dealers from Oct. 15 to Nov. 14, after the firm admitted to manipulating the bond futures market in 2021. Nomura paid a ¥21.8 million ($141,000) fine imposed by the Financial Services Agency over the breach.

In investment banking, not all operations have returned to normal. While Nomura has won some mandates to underwrite corporate and municipal bonds, its name is absent from several large-scale deals.

According to a Bloomberg survey of lead managers, as of Monday, 20 Japanese companies were preparing to issue bonds in November at the earliest. Nomura isn’t the lead manager for 16 of those transactions.

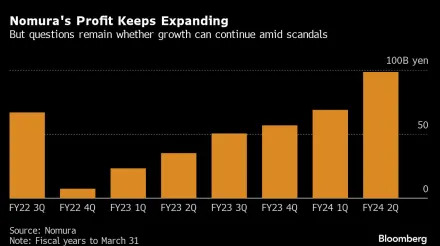

During its most recent earnings briefing this month, Chief Financial Officer Takumi Kitamura said the impact on profits from the bond trading breach would probably be limited.

Nomura’s shareholders have shrugged off the revelations. The stock has risen 19% since the country’s securities watchdog revealed its findings of market manipulation on Sept. 25. The benchmark Topix index has gained less than 2% in that period.

Like its competitors, Nomura has been benefiting from a pickup in Japan’s financial markets that has buoyed business ranging from wealth management to trading and investment banking. Nomura’s net income more than doubled last quarter from a year earlier to ¥98.4 billion.