The feverish post-election stock market rally came to a screeching halt last week.

For the week, the S&P 500 ( ^GSPC ) fell more than 2%, while the Dow Jones Industrial Average ( ^DJI ) shed more than 500 points or nearly 1.3%. The tech-heavy Nasdaq Composite ( ^IXIC ) sank over 3%.

Two firm inflation readings and commentary from Federal Reserve Chair Jerome Powell weighed on markets last week, with growing uncertainty over the Fed's rate path outweighing previous investor excitement over Trump's potential policy agenda.

In the week ahead, a few economic data releases are expected to add to that narrative, with activity in the services and manufacturing sector and a consumer sentiment reading headlining the schedule.

Earnings, however, will bring attention back to some of the biggest names in the corporate world after a few weeks of macro and political events dominating investor mindshare.

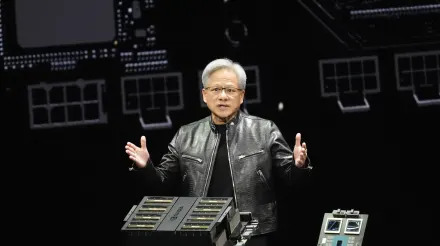

Key among these reports will be earnings from AI leader Nvidia ( NVDA ), which is set to report results after the bell on Wednesday. Quarterly results from Walmart ( WMT ), Target ( TGT ), BJ's ( BJ ), and Deere & Company ( DE ) will also be in focus.

A pause in the rally

Since the Federal Reserve slashed its benchmark interest rate by half a percentage point on Sept. 18, bond yields have ripped higher. The 10-year Treasury ( ^TNX ) yield rose by 80 basis points between that date and the days following the election to trade near 4.5%.

That move in rates hadn't been an issue for the stock market rally until last week.

While strategists have pointed out that a move higher in rates supported by stronger-than-expected economic growth could be welcome news for stocks, recent inflation data has thrown a wrench in that thesis.

On Wednesday, the "core" Consumer Price Index (CPI), which strips out the more volatile costs of food and gas, showed prices increased 3.3% annually for the third consecutive month during October. On Thursday, the "core" Producer Price Index (PPI) revealed prices increased by 3.1% over last year in October, up from 2.8% the month prior and above economist expectations for a 3% increase.

Later on Thursday, Powell said in a speech the Fed doesn't need to be "in a hurry" to lower interest rates given the strength of the US economy. Markets moved lower on the comments , and the selling continued on Friday , with the Nasdaq Composite sliding more than 2.2% for the session.

"Slower progress on inflation in recent months may prompt the Fed to reevaluate its pace of easing moving forward," Wells Fargo's economics team led by Jay Bryson wrote in a weekly note to clients on Friday.

As of Friday afternoon, investors were pricing in a 58% chance the Fed cuts interest rates by 25 basis points at its December meeting, down from the nearly 86% chance seen a month ago, per the CME FedWatch Tool.

Schwab Asset Management CEO and chief investment officer Omar Aguilar told Yahoo Finance Powell's comments and the Fed debate add uncertainty and "additional volatility and, therefore, the opportunity for investors to take something off the table and take some profits."

All eyes on Nvidia

Amid all the macro headlines influencing the stock market in November, S&P 500 companies have posted solid third quarter earnings.

The S&P 500 has grown earnings by 5.4% compared to the same quarter a year prior, marking the fifth straight quarter of earnings growth, per FactSet data. And one of the index's largest contributors to that expected growth is slated to report earnings this week.

Nvidia is expected to report earnings per share of $0.74 on revenue of $33.21 billion, according to Bloomberg consensus data. Both metrics would represent more than 80% growth compared to the same period a year prior.

"We expect a similar story to the last several quarters with a beat and raise in the $2B range [for current quarter revenue guidance]," Jefferies analyst Blayne Curtis wrote in a research note previewing the release.

Curtis noted that expectations have continued to "creep higher" as Nvidia shares have rallied more than 7% in the past month and are up more than 180% this year. But Curtis believes the stock "continues to work" as Nvidia continues with the release of its latest AI chip, Blackwell.

Given Nvidia's large weighting in the S&P 500, its earnings for the past couple of quarters have been viewed as a key catalyst for the market's overall direction .

And while investors will be listening for any clues about which Big Tech companies continue to spend with the AI chip leader, the actual price action of Nvidia's stock after earnings hasn't been a barometer for broader market performance in the near term.

For example, Nvidia's ( NVDA ) August earnings release did little to impress investors and the stock fell about 6% the day after its earnings release.

But that sour sentiment didn't permeate through the market as the S&P 500 closed flat on that same day. This marked the second straight quarter that the broader S&P 500 didn't move with Nvidia following its earnings release.

The other side of the Trump trade

Some of the biggest winners i n the market since Donald Trump won the presidential election on Nov. 5 have reversed course.

The Nasdaq 100 ( ^NDX ) has given back nearly all of its gains . The S&P 500 closed Friday below where it opened the day after the election. And the small-cap Russell 2000 ( ^RUT ) index, which soared more than 9% following Trump's victory, has now given back about half of those gains.

For small caps, the story isn't much different than a week ago, when we noted Piper Sandler chief investment strategist Michael Kantrowitz's concern about earnings momentum for companies in the index.

"In the last 20 days ... we've definitely seen small cap estimates at the margin move pretty sharply lower," Kantrowitz said. He added that investors would want to see earnings accelerating to signal the start of a recovery.

"[It's] not something we're seeing quite yet," Kantrowitz said. "So something we'll be monitoring."

The move in small caps is emblematic of the uneven trading action in the two weeks following the election, as any impact from the Trump administration's policies largely remains to be seen.

"Key economic positions have not been announced, and we remain in a policy uncertainty backdrop," Citi US equity strategist Scott Chronert wrote in a note to clients when explaining the recent drawdown in the market rally.

"We are working from euphoric sentiment levels and implicit growth expectations at post-2008 highs," he added. "Overall, there is a lot of pressure on macros and fundamentals to deliver, which may explain some recent profit taking after a rapid post-election run."

Weekly calendar

Monday

Economic data: NAHB housing market index, November (42 expected, 43 previously)

Earnings: Trip.com ( TCOM )

Tuesday

Economic data: Housing starts month-over-month, October (-1.4% expected, -0.5% previously); Building permits, month-over-month, October (1.2% expected, -3.1% previously)

Earnings: Lowe's ( LOW ), Walmart ( WMT ), XPeng ( XPEV )

Wednesday

Economic data: MBA mortgage applications, Nov. 15 (0.5% prior)

Earnings: Nvidia ( NVDA ), Jack In The Box ( JACK ), NIO ( NIO ), Palo Alto Network ( PANW ), Snowflake ( SNOW ), Target ( TGT ), TJX ( TJX ), Williams-Sonoma ( WSM )

Thursday

Economic data: Initial jobless claims, week ending Nov. 16 (217,000 previously); Leading index, October (-0.3% expected, -0.5% previously); Existing home sales month-over-month, October (+2.3% expected, -1% previously); Kansas City Fed manufacturing activity, November (-4 previously)

Earnings: Baidu ( BIDU ), BJ's ( BJ ), Deere & Company ( DE ), Gap ( GAP ), Intuit ( INTU ), Ross Stores ( ROST ), Warner Music Group ( WMG )

Friday

Economic data: S&P Global US manufacturing PMI, November preliminary (48 expected, 48.5 previously); S&P Global US services PMI, November preliminary (55 expected, 55 previously); S&P Global US Composite PMI, November preliminary (54.1 previously); University of Michigan consumer sentiment, November final (73 expected, 73 previously)

Earnings: No notable earnings releases.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer .