(Bloomberg) -- Samsung Electronics Co. shares are having their best day since January 2021, as perceptions grow that the South Korean tech company is starting to look like a bargain after a multi-month slump.

The world’s largest maker of memory chips and smartphones saw its stock surge as much as 8.6% Friday, snapping a five-day losing streak.

Despite the latest rally, Samsung remains down nearly 32% this year, pressured by worries over it missing out in the artificial intelligence boom and lately, the risk of falling victim to Donald Trump’s protectionist trade policy. With some traders attributing Friday’s surge to technical factors, it remains to be seen whether the gains will be sustainable.

Samsung’s share price increase is a “technical rebound from below 50,000 won ($35.70),” a move that is positive for investor sentiment, said Daiwa Securities analyst SK Kim.

Shares of South Korea’s biggest firm were at 53,800 won in mid-afternoon trade. The 50,000-won mark is a key psychological support level for the country’s retail investors.

The stock is trading at a discount of more than 10% to the consensus estimate for its one-year forward accounting book value, according to data compiled by Bloomberg.

Some investors remain cautious about the outlook.

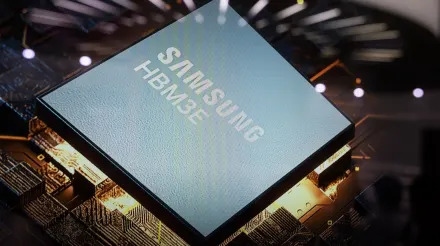

“A lower valuation is justified given trade risks around Korea and also the catch-up in HBM, which will take time, and a weak memory environment,” said Sat Duhra, a fund manager at Janus Henderson Group, referring to high bandwidth memory. “There are better tech stocks to own here - most of them are in Taiwan.”

--With assistance from Abhishek Vishnoi and Winnie Hsu.