(Bloomberg) -- Economists and strategists across Wall Street have dialed back their expectations for US interest-rate cuts next year based on this week’s presidential election of Donald Trump and comments by Federal Reserve boss Jerome Powell.

Fed policymakers lowered their target for the overnight lending rate Thursday by a quarter percentage point to 4.5%-4.75% and remain widely expected to do so again at their last meeting of the year on Dec. 18. But a handful of banks that previously looked for the cuts to continue for at least the first several of the Fed’s eight meetings of 2025 scrapped that view this week.

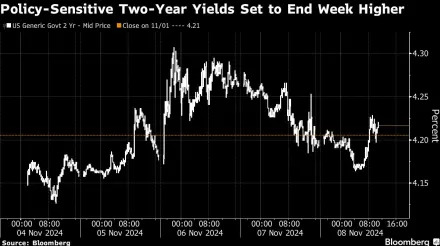

Among the latest to do so were Barclays Plc and Toronto-Dominion Bank. Teams at both cited the possibility of tighter restrictions on immigration and higher import tariffs under a Trump administration. Those policies could spur inflation and alter the Fed’s course, they said. Short-dated Treasury yields rose in US trading Friday as interest-rate futures priced in a slower pace of 2025 rate cuts.

“While some investors may expect the Fed to begin to hike rates in such a scenario, we would expect the Fed to pause rate cuts as they assess the impact on inflation and growth,” a team led by TD’s Oscar Munoz and Gennadiy Goldberg wrote in a Nov. 7 note.

TD sees the Fed holding interest rates steady from January to July, giving officials time to assess the impact of Trump’s new policies, before resuming cuts as the economy slows.

At Barclays, a team led by chief US economist Marc Giannoni upped their forecasts for inflation next year and lowered their expectations for GDP. They forecast the Fed will cut interest rates twice in 2025 vs three times previously.

Goldman Sachs Group Inc. economists pinned their forecast change to Powell’s comments following Thursday’s rate cut. A team led by Jan Hatzius wrote the Fed “might want to move more cautiously to make sure it gets the stopping point right.” Goldman’s new forecast is for quarter-point rate cuts at each meeting until March and final moves in June and September.

On Wednesday — after the election and before the Fed meeting — JPMorgan Chase & Co. and Nomura also updated their forecasts, with JPMorgan predicting that “policy uncertainties” would call for quarterly rate cuts from March, rather than at each meeting.