(Bloomberg) -- Donald Trump’s decisive win of the US presidential election has world leaders already preparing for how his next administration will shape the global economy.

In China, factories ramped up shipments ahead of Christmas holidays and likely in anticipation of worsening trade tensions. Emerging markets were hit hard as the dollar and US yields soared. And back in the US, economists predict Trump’s proposals — particularly on tariffs — would stoke inflation and depress growth.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

Speaking after the Federal Reserve cut interest rates by a quarter point, Chair Jerome Powell said Trump’s re-election will have “no effect” on the central bank’s policy decisions in the near-term. The Bank of England also lowered borrowing costs for the second time this year.

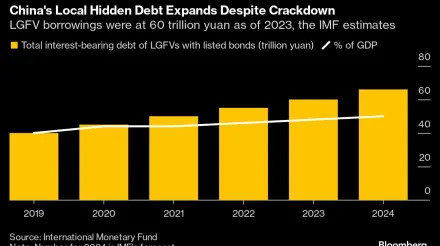

China gave indebted local governments a 10 trillion yuan ($1.4 trillion) lifeline but stopped short of unleashing new stimulus, preserving room to respond to a potential trade war when Trump takes office next year.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

The former and soon-to-be next president has promised an escalation of tariffs on all US imports and the biggest mass deportation of migrants in history. He also wants a say in Federal Reserve policy. Many economists reckon the platform adds up to higher inflation and slower growth ahead.

Trump’s stunning and decisive election victory has already led to a frantic repricing in financial markets around the world. Powell will need to reassure global investors that the Fed can manage the impact of a second Trump term — especially if accompanied with a Republican sweep of Congress — that’s already shifting expectations for the path of monetary policy.

Asia

Chinese officials unveiled details of a program to refinance “hidden” local debt onto public balance sheets at a press briefing in Beijing on Friday. While policymakers didn’t announce measures to directly stimulate domestic demand, Finance Minister Lan Fo’an promised “more forceful” fiscal policy next year, signaling bolder steps could come after Trump’s inauguration in January.

China’s export growth surged in October to the fastest pace since July 2022, extending a months-long boost to the economy that may be jeopardized by Trump’s reelection and his tariff threats. Last year, Chinese companies shipped $500 billion in goods to America, accounting for 15% of the value of all its exports.

When Trump first started a trade war with China in 2018, Beijing found itself on the back foot and unsure of how to respond. This time President Xi Jinping is better prepared for a fight, even as he has more to lose.

Europe

The BOE’s path to further easing has been complicated both by Chancellor of the Exchequer Rachel Reeves’ Oct. 30 budget and the election of Donald Trump as US president. The UK now plans a £70 billion ($90.4 billion) a year spending binge, almost half of which is financed by borrowing. Trump is threatening higher tariffs in a new global trade war.

Traders braced for the possibility of more bond sales in Germany after a government figurehead for fiscal conservatives was sacked, leading some in the market to contemplate a new administration that could be more tolerant of higher debt.

A third of Britain’s official “shopping basket” has slipped into deflation, providing another green light for the BOE to cut interest rates. The share of items that are cheaper than a year earlier is the highest since the spring of 2021, before pandemic disruptions and Russia’s invasion of Ukraine sent prices soaring, according to Bloomberg analysis of almost 220 goods and services that make up the Consumer Prices Index.

Emerging Markets

Inflation smashed through the top of the central bank’s tolerance range in Brazil and accelerated much more than expected in Chile as surging energy costs give policymakers another reason to worry. Interest rate futures rose in both nations as investors bet policymakers will turn more hawkish.

A distressed-debt rally driving gains in high-yield funds still has room to run in countries as diverse as Argentina and Ukraine, according to the hedge fund with the one of the best performances in the asset class.

World

Vietnam is among the world’s most trade-dependent nations — exports account for about 85% of its economy and the US is its largest market. Vietnam had a surplus of around $100 billion with the US last year, the fourth-largest imbalance with the US after China, Mexico and Canada, and one that just keeps growing. At some point this is likely to put Vietnam in Trump’s sights.

In addition to the Fed and BOE, policymakers in Sweden, Pakistan, Czech Republic, Peru, as well as Gulf nations including Saudi Arabia, the United Arab Emirates and Qatar also cut. Australia, Malaysia, Poland, Norway, Serbia and Romania held. Brazil’s central bank doubled the pace of tightening and spelling out more explicitly the need for spending cuts to help tame above-target inflation.

--With assistance from Philip Aldrick, Andrew Atkinson, John Boudreau, Rebecca Choong Wilkins, Alice Gledhill, Selcuk Gokoluk, James Hirai, John Liu, Matthew Malinowski, James Mayger, Colum Murphy, Tom Rees, Andrew Rosati, Catarina Saraiva, Fran Wang and Carolina Wilson.