Snowflake (NYSE: SNOW) used to be a high-flying tech stock that excited many investors. But that sentiment has changed, and the stock is nearing all-time low prices. This can either be seen as a buying opportunity or a sign of things to come, but it's not entirely clear which it is.

I came up with three reasons Snowflake could be a fantastic buy right now, but also one reason to sell. Even though it's three reasons to one, the one thorn in Snowflake's side could be enough to avoid it entirely.

Reason to buy No. 1: Artificial intelligence tailwinds

Snowflake's products center around its data cloud offering. Its software provides everything its clients could want in terms of data collection, storage, and processing. This offering has amassed a large clientele, with nearly 10,000 customers using the product.

Of that group, 485, or about 5%, spend at least $1 million annually with Snowflake. That's a large customer base and shows Snowflake is doing something right.

But that figure could soon explode higher because data is vital to artificial intelligence (AI). Although AI models are great, if you put in bad information, you'll get a worthless model. That's why having a vast, diverse data stream to feed these models is so important. As a result, using a product like Snowflake to capture real-time data is important.

Right now, the biggest demand in the AI space is in the hardware and base-model segment. Eventually, the demand will shift toward the application segment, requiring large data input. This is a huge tailwind that will benefit Snowflake immensely in the future.

Reason to buy No. 2: Snowflake still has a strong growth rate

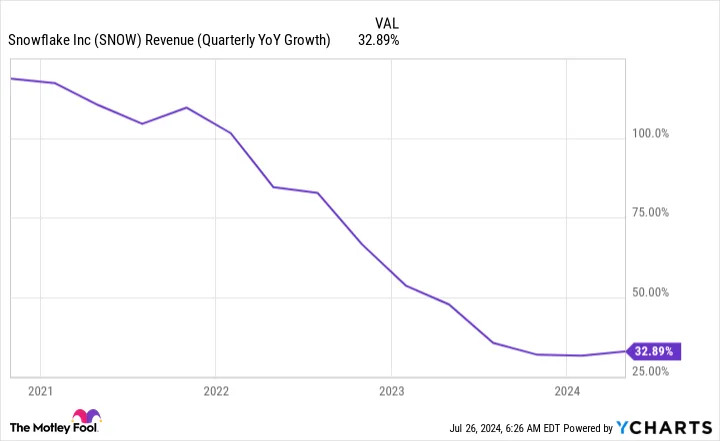

Part of the reason Snowflake's stock sold off is that its growth rate has been slowing.

While investors love to see eye-popping numbers in the revenue growth space, 33% growth isn't anything to be concerned about. Management forecast growth to slow, however, with second-quarter product revenue expected to increase by about 27%. For its 2025 fiscal year (ending Jan. 31, 2025), product revenue is predicted to grow around 24%.

One important caveat here is the word "product." This only accounts for sales tied directly to its software, not any other revenue it derives from setup or support services. Regardless, growth is starting to slow.

This is normally a red flag, but investors need to remember that Snowflake is approaching $1 billion in quarterly revenue, so growing by 50% or more in a quarter is becoming more difficult.

Investors need to adjust their expectations because the company's growth is still strong compared to many other companies in its industry.

Reason to buy No. 3: The stock has never been this cheap

As a result of the sell-off and still-strong growth, Snowflake's stock has reached a valuation point it has never touched in its previous time on the markets. With a price-to-sales (P/S) ratio of about 14, it's far cheaper than many of its peers.

Let's look at some growth rates and P/S valuations of some of Snowflake's software peers.

|

Company |

Latest Revenue Growth Rate |

P/S Ratio |

|---|---|---|

|

Snowflake |

33% |

14.2 |

|

Palantir |

21% |

26.7 |

|

CrowdStrike |

33% |

19 |

|

The Trade Desk |

28% |

22.1 |

Data source: YCharts.

While I'm not going to argue that 14.2 times sales is dirt cheap by any stretch, it's still less pricey than some of its peers despite growing faster.

Reason to sell: Snowflake is a long way away from profitable

My only holdup with Snowflake's stock is its lack of progress in turning a profit. It isn't close to breaking even, and isn't getting any better, either.

For the past two and a half years, Snowflake essentially hovered around the 40% operating-loss margin mark. This is concerning, as most companies focus more on turning a profit when their growth begins to slow.

This could start to change with a new CEO, but until I see steady improvement, this will always be a red flag.

With these four factors in mind, I believe Snowflake's stock is ripe for a turnaround. A directional shift in the company could easily correct my reason to sell, so I think Snowflake is a buy right now.

Before you buy stock in Snowflake, consider this: