Authors' views and opinions are their own and not associated with CoinDesk Indices. Produced by CoinDesk Indices and not associated with CoinDesk editorial.

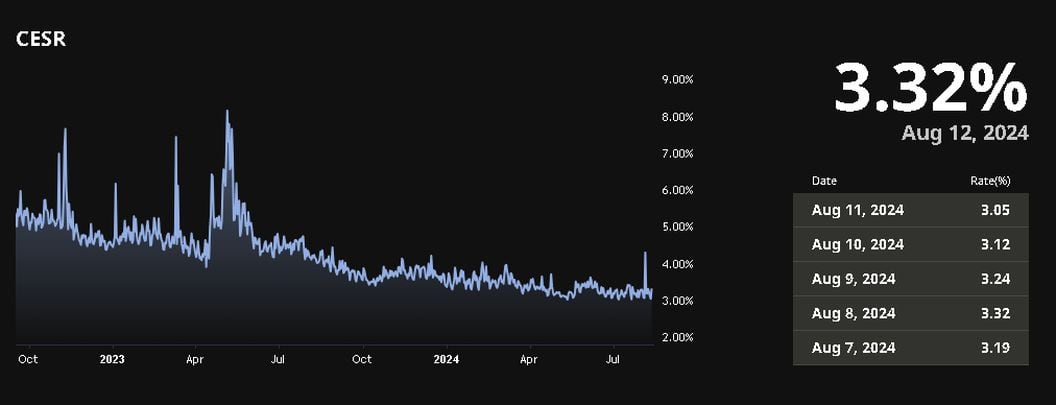

The digital asset market continues to evolve, introducing innovative instruments and strategies tailored for institutional investors. One of the most notable advancements in this space is CESR™ , the composite ether staking rate, a benchmark designed to provide a standardized measure of staking yields for Ethereum validators.

Market Commentary

Recent developments in the Ethereum ecosystem, particularly the growing interest in ETH ETFs, are driving a surge in overall interest in Ethereum. Although ETH ETFs cannot stake directly, their popularity may lead to volatility in ETH staking yield rates. This is uncharted territory where a larger amount of outstanding ETH may remain unstaked due to ETFs, potentially altering the distribution of rewards among validators. While this scenario has begun to be reflected in the ETH staking yield calculations, the sample size is still small given the recent launch.

CESR serves as a reliable reference rate for Ethereum staking yields, offering two main benefits. First, it aids in treasury cash flow management by providing a predictable benchmark for staking returns, enabling institutions to integrate these returns into their financial forecasting and planning. Second, it allows validators like Twinstake to offer fixed-rate yields to clients through pooled validator networks, ensuring more predictable income streams for investors. This dual functionality supports risk management and strategic decision-making for institutional investors.

Recently, Nonco announced a milestone partnership with Twinstake , marking another transaction by a staking provider using CESR. This pioneering trade underscores the growing interest and adoption of CESR-based financial products. Such innovations are essential for institutional investors, providing them with tools to better manage their balance sheets by locking in yields and enhancing cash flow predictability.

CoinFund and CoinDesk Indices, pioneering the development and maintenance of CESR, continue to enhance the infrastructure of digital asset markets. These developments not only support the operational needs of institutional treasuries but also enable more sophisticated risk management and strategic planning.

Building on this momentum, various major Ethereum validators are set to engage in similar CESR-based swaps in the coming weeks, further solidifying CESR's role as a key benchmark in the staking and derivatives market. This trend highlights the growing recognition of CESR's value in financial planning and risk management for institutional investors.

Educational Lead: The Role of CESR

CESR is a crucial benchmark in the digital asset market, akin to the role that traditional reference rates play in conventional finance. Just as the London Interbank Offered Rate (LIBOR) once served as a reference rate for interest rate swaps, and the daily settlement price of the S&P 500 is used to calculate P&L for stock index derivatives, CESR provides a standardized measure for Ethereum staking yields. This benchmark allows market participants to gauge the performance of their staking activities, develop hedging strategies, and create derivative products with confidence.

CESR represents the mean annualized staking yield of the Ethereum validator population, capturing both consensus rewards and transaction fees. Published by CoinDesk Indices and administered by CoinFund, CESR offers a transparent and reliable standard for the Ethereum staking market.

By providing a consistent and reliable measure of staking yields, CESR serves as a vital tool for institutional investors to manage their risk, enhance financial planning, and support strategic decision-making in the digital assets realm.

How Nonco is Leveraging CESR

Nonco has integrated CESR into its suite of financial products, offering innovative CESR-based OTC swaps. These swaps allow investors to hedge their staking yields by exchanging fixed for variable rate returns. Additionally, Nonco can create bespoke products tailored to customer needs, such as popular fixed-for-variable rate swaps. By using CESR, Nonco ensures that its clients have access to the most accurate and up-to-date staking yield data, providing a predictable income stream and managing risk effectively.

Adoption of CESR

The adoption of CESR is growing across the industry. Various institutional investors and asset managers are recognizing the benefits of a standardized staking yield benchmark. For instance, prominent asset managers are now benchmarking their staking yield performance to CESR, demonstrating its critical role in the market. This widespread adoption underscores the importance of CESR in providing stability and transparency to Ethereum staking yields.

To learn more visit Nonco’s website .