-

Miners are increasing their network hashrate despite a recent drop in bitcoin prices, signaling a positive sentiment after a capitulation event that has typically marked price bottoms.

-

A significant miner capitulation was observed with a spike in Bitcoin outflows to 19,000 BTC on August 5, the highest since March 18. This came as bitcoin's price touched $49,000, suggesting miners sold off to cover costs as profit margins tightened.

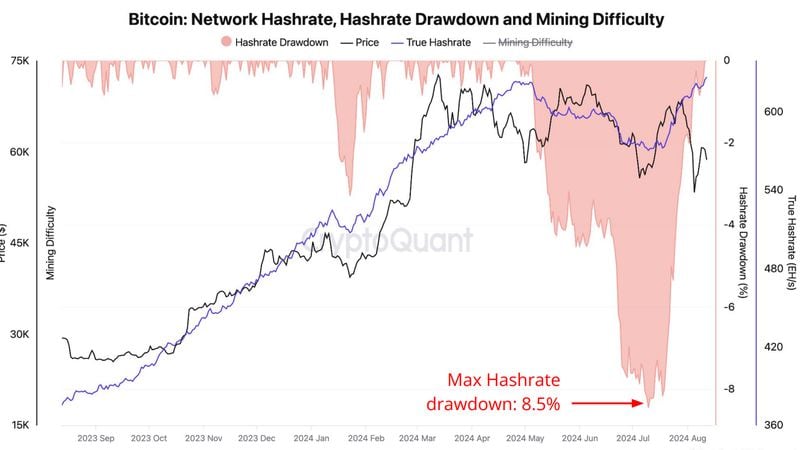

Bitcoin (BTC) miners are expanding their capacity again as network hashrate reached a fresh all-time high this week following a capitulation event, on-chain analysis firm CryptoQuant shared in a report with CoinDesk.

Network hashrate set a new record of 627 exahash per second on Tuesday, recovering from the 8.5% drawdown in early July. Such expansion comes despite a recent drop in bitcoin prices and record-low hash price – or the average revenue per amount of mining power – indicating positive sentiment among miners after a bout of selling in the past few months.

Hashrate refers to the computational power used by miners to mint new bitcoin and verify new transactions on the Bitcoin network. Millions of calculations are solved each second to ‘win’ new blocks, in a process broadly called mining.

“We may have seen a miner capitulation event last week as miner outflows spiked after prices touched $49,000,” CryptoQuant said. “Bitcoin daily miner outflows spiked to 19K BTC on August 5, the highest level since March 18.”

Miners are entities that supply computing power to any blockchain network in return for “rewards” in the form of BTC tokens. They typically sell bitcoin to keep operations afloat continually as running such systems is costly: Only five popular mining rigs were profitable in early July as prices floated around the $54,000 mark.

“Miners sold some Bitcoin as their average operating profit margins were squeezed to 25%, the lowest since January 22,” the firm added.

A miner capitulation event is typically seen near local bottoms for Bitcoin prices during bull markets.

Since 2023, a spike in miner outflows coincided with local bottoms in March 2023 after the Silicon Valley bank sell-off – and January 2024, the price correction following the bitcoin spot ETF launch in the U.S.

BTC trades just above $61,000 in Asian afternoon hours Wednesday, up 2.8% in the past 24 hours to lead gains among crypto majors.