We're headed to the Bitcoin Nashville conference this week and looking forward to a lot of deep discussions about building on the original blockchain – as well as hearing what former President Donald Trump has to say . (We understand the security will be quite tight.) I'll be moderating a panel at a side event examining how Bitcoin DeFi scales. We're aiming to get some good photos for next week's issue.

This week:

-

Ethereum spot ETFs haul in net $107M on first day – with big (Grayscale) asterisk.

-

Recap of the $230M WazirX hack.

-

Feature: Alkimiya – an Ethereum-based protocol to hedge Bitcoin fees.

-

Top picks from the past week's Protocol Village column : Inscribing Atlantis, Hemi, Avail, Lightning Labs, Base.

-

$80M+ of blockchain project fundraisings: Caldera, Bitlayer Labs, NPC Labs, Zivoe, Chainbase, Allium Labs

Network news

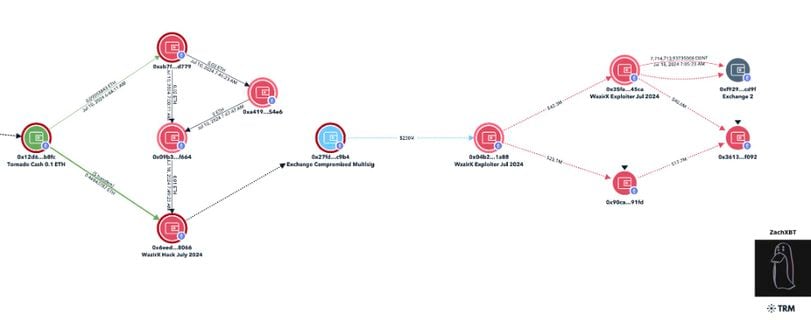

The blockchain sleuth ZachXBT posted a visual of his early efforts to trace the flow of funds after the WazirX hack. (ZackXBT/X)

ETH ETF LAUNCH: Newly approved spot Ethereum ETFs started trading on Tuesday, hauling in a net $107 million of fresh investment – including $484.1 million of outflows from the Grayscale Ethereum Trust (ETHE), and $590.9 million of inflows into vehicles launched by managers including BlackRock, Fidelity and Bitwise. While analysts have predicted a far-lower uptake for the new funds than bitcoin spot ETFs that started trading about six months ago, Bloomberg analyst James Seyffart described the first day of trading for the Ethereum ETFs as " very solid ."

BOOTY OR BOUNTY? A $230 million exploit of the Indian crypto exchange WazirX got blockchain sleuths pointing fingers at North Korea-linked hackers , and various parties blaming each other for the security lapse. The funds were allegedly stolen from a WazirX multisignature wallet, or " multisig "– one that requires two or more private keys to execute a transaction. "Despite us taking all necessary steps to protect the customer assets, the cyber attackers appear to have possibly breached such security features, and the theft occurred," the exchange wrote in a preliminary report . WazirX identified the multisig wallet's provider as crypto custody firm Liminal in a follow-up post , hours after the initial confirmation. It later deleted the post, and Liminal said in a blog post that "there is no breach in Liminal's infrastructure, wallets and assets." The loot included shiba inu (SHIB) tokens along with ETH, MATIC, PEPE and USDT. A gallows-humor-meets-geekdom moment arrived when blockchain records appeared to show that the exploiter had created a token called " WazirX Hacker Sends His Regards ." The exchange filed a police complaint , and the matter is under investigation. But as of Friday, tokens on WazirX were trading at deep discounts to their prices on other global crypto exchanges, a sign of immense local selling pressure. Earlier this week WazirX announced that it would pay a bounty of as much as $23 million , or 10%, to the hacker in exchange for the return of the funds. On a running blog post chronicling the incident day-by-day, WazirX updated that it's now "actively contacting projects associated with the stolen tokens to seek their support in the recovery process." One poster on X responded by noting that the looter had apparently already "converted almost all of the stolen crypto to ETH," inquiring, " Don't you think it's too late? "

'COPYCAT WEBSITE' Decentralized crypto-exchange giant dYdX said Tuesday that the website for dYdX v3, an older version of its trading platform, was " compromised ," and warned users against visiting dydx.exchange until further notice. "The attacker has taken over the v3 domain ( dydx.exchange ), and deployed a copycat website that when users connect their wallets to it, it asks them to approve via PERMIT2 transaction to steal their most valuable token," a member of dYdX's community team said in the project's Discord server. The attack did not appear to impact funds traders already have on dYdX, as only the web domain, and not the underlying smart contracts, appear to be being targeted, according to statements in dYdX's Discord server. The larger dYdX v4 venue (which last week saw $6 billion in trading volume) was said to be unaffected.

ALSO:

-

Vitalik Buterin argued against supporting candidates just based on their " pro-crypto " stances.

-

Ryan Selkis stepped down as CEO of Messari, the crypto data and research firm he co-founded, following a series of inflammatory tweets about politics, civil war and his desire for an immigrant to get expelled from the country.

-

With U.S. Vice President Kamala Harris securing widespread endorsements as the presumptive replacement for Joe Biden atop the Democratic 2024 presidential ticket, crypto lobbyists are scrambling to assess whether she might look for a "reset" in policies toward digital-asset regulation. (Her memecoin soared to an all-time high , fwiw.)

Ethereum-Based Protocol Alkimiya Creates Market for Hedging Bitcoin Fees

Akimiya founder and CEO Leo Zhang (Alkimiya)

Blockchain protocol Alkimiya launched, introducing a tool that allows users to hedge against volatile Bitcoin transaction fee rates.

The hardest part might be getting hardline bitcoiners – sometimes known as "maximalists" or "maxis" – to use the new protocol, since it's built atop the Ethereum blockchain . Target users for the platform, described as a "blockspace markets protocol," could include traders, mining pools and foundations.

"While we recognize that Bitcoin maxis may initially hesitate to use an Ethereum-based solution, our primary focus is on creating the most robust and efficient marketplace for trading Bitcoin transaction fees," Alkimiya founder and CEO Leo Zhang said in an email interview with CoinDesk.

There may be little doubt about the usefulness of a solution like Alkimiya's: In April, when Casey Rodarmor's Runes protocol for minting fungible tokens atop Bitcoin went live, the Bitcoin network fee rate shot up to $125 per transaction from $4.80.

Protocol Village

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

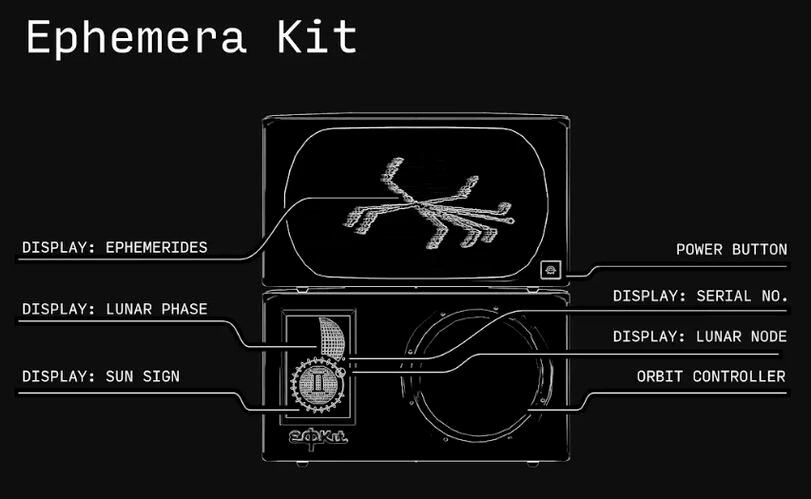

Ephemera Kit (Inscribing Atlantis)

1. Inscribing Atlantis, led by Hell Money podcast co-host Erin Redwing , announced that its " Ephemera " auction will be launching for the first time at the Bitcoin Nashville conference, and will run from July 18 through Bitcoin block height 854,784 (approx. Aug. 2). According to the team: "This project ties Bitcoin block time to astronomical time by inscribing planetary ephemeris data on satoshis (the smallest unit of Bitcoin) from the exact moment they were mined. Through Ephemera, participants can select dates they want to memorialize on Bitcoin, creating a unique digital archaeological record. This initiative explores the concept of Deep Time, aiming to leave a lasting legacy by linking our digital age with the cosmos." The planetary data is inscribed using Bitcoin's Ordinals protocol, created by the independent Bitcoin developer Casey Rodarmor, who is Redwing's fellow co-host on Hell Money. "It's basically my gamified way of trying to get people to participate in my community archeological project ," Redwing told CoinDesk in an email.

2. Hemi Labs announced the Hemi Network, "a modular layer-2 blockchain network focused on delivering superior scaling, security, and interoperability between Bitcoin and Ethereum." According to the team : "Hemi Labs was co-founded by early Bitcoin core developer Jeff Garzik and blockchain security pioneer Max Sanchez, who was the principal developer behind Hemi’s unique method for inheriting Bitcoin’s unique security characteristics – the Proof-of-Proof (“PoP”) consensus protocol."

3. Avail , a blockchain " data availability " project spun out of Polygon in early 2023 that has raised $75 million of funding, is finally launching . The project's main network was set to go live on Tuesday, along with a native token, AVAIL, according to a press release. "The launch of Avail DA marks the first step in Avail’s mission to give developers the tools they need to boost blockchain scalability, enhance liquidity and provide seamless usability across any blockchain ecosystem," according to a press release.

4. Lightning Labs announced the release of Taproot Assets on Bitcoin's Lightning Network, claiming to be the "first multi-asset Lightning protocol on mainnet." According to a blog post by Lightning Labs' Ryan Gentry: "With this release, assets can be minted on bitcoin and sent via the Lightning Network instantly for low fees. As such, we now have the ability to make bitcoin and Lightning multi-asset networks in a scalable manner anchored in bitcoin's security and decentralization. This step forward will give users access to the world's currencies on an open, interoperable payments network while routing through bitcoin liquidity, making bitcoin the global routing network for the internet of money."

5. Base , the layer-2 network backed by the publicly traded crypto exchange Coinbase, said that fault proofs are now live on the Base Sepolia testnet. According to a blog post : "Today’s launch paves the way for bringing fault proofs securely to mainnet, and completing other milestones to reach Stage 1 decentralization... In Stage 1 decentralization, or 'limited training wheels,' the chain state is verified with fault proofs but there is an override mechanism that can act in the event of a bug. The override mechanism requires consensus from both chain operators and a designated number of external stakeholders, which reduces the dependence on chain operators alone."

Money Center

Fundraisings

-

Caldera , a "rollup-as-a-service" platform that helps developers quickly spin up layer-2 blockchains , has closed a $15 million Series A funding round led by Peter Thiel's Founders Fund. CEO Matt Katz said in an interview with CoinDesk that the new funds will help him expand Caldera's 15-person team so they can build out the Metalayer, an interoperability ecosystem meant to simplify the process of launching applications across multiple blockchains. The fundraise was led by Founders Fund, with participation from Dragonfly, Sequoia Capital, Arkstream Capital, Lattice.

-

Bitcoin layer-2 blockchain Bitlayer Labs said it raised $11 million in a Series A funding round at a valuation of $300 million. The investment was led by ABCDE and Franklin Templeton, one of the issuers of a spot bitcoin (BTC) exchange-traded fund in the U.S. Bitlayer's layer 2 is based on the BitVM paradigm, which was unveiled last October, laying out a path for Ethereum-style smart contracts on the original blockchain.

-

NPC Labs , a developer looking to build a GameFi ecosystem on the Base protocol, has closed an $18 million funding round led by Pantera Capital.

-

Zivoe , a real-world asset credit protocol atop Ethereum, raised $8.35 million in their last round, aiming to broaden credit access by connecting blockchain liquidity with real-world borrowers, according to the team.

-

Omnichain data network Chainbase has raised $15 million in Series A funding with Tencent Investment Group, Matrix Partners and Hash Global among the investors.

-

Data platform Allium Labs , which provides enterprise-grade blockchain data to companies like Visa, Stripe and Uniswap Foundation, has raised $16.5 million in a Series A funding round, it announced Thursday.

Data and Tokens

-

Bitcoin Traders Brace For 'Fat Tails' as Focus Shifts to Trump's Nashville Conference

-

HNT Token Beats Bitcoin With 40% Surge as Helium's Mobile Subscriber Count Tops 100K

-

Tokenized Asset Manager Superstate Debuts New Fund to Profit From Bitcoin, Ether 'Carry Trade'

-

BlackRock's $500M Tokenized Fund Pitches for Ethena's RWA Investment Plan

Calendar

-

July 24-25: Blockchain Rio , Rio de Janeiro.

-

July 25-27: Bitcoin 2024 , Nashville.

-

Aug. 19-21: Web3 Summit , Berlin.

-

Sept. 1-7: Korea Blockchain Week , Seoul.

-

Sept. 12-13: Global Blockchain Congress, Southeast Asia Edition , Singapore.

-

Sept. 18-19: Token2049 Singapore .

-

Sept. 19-21: Solana Breakpoint , Singapore.

-

Sept. 25-26: European Blockchain Convention , Barcelona

-

Sept. 30-Oct. 2: Messari Mainnet , New York.

-

Oct. 9-11: Permissionless , Salt Lake City.

-

Oct. 9-10: Bitcoin Amsterdam .

-

Oct. 10-12: Bitcoin++ mints ecash : Berlin.

-

Oct. 15-17: Meridian , London.

-

Oct. 21-22: Cosmoverse , Dubai.

-

Oct. 23-24: Cardano Summit , Dubai.

-

Oct. 25-26: Plan B Forum , Lugano.

-

Oct. 30-31: Chainlink SmartCon , Hong Kong.

-

Nov. 10: OP_NEXT Bitcoin scaling conference, Boston.

-

Nov 12-14: Devcon 7 , Bangkok.

-

Nov. 15-16: Adopting Bitcoin , San Salvador, El Salvador.

-

Nov. 20-21: North American Blockchain Summit , Dallas.

-

Feb. 19-20, 2025: ConsensusHK , Hong Kong.

-

May 14-16: Consensus , Toronto.