-

Bitcoin futures trade at par or meagre premium to spot prices.

-

The decline in premium dents the appeal of cash and carry arbitrage strategies.

Bitcoin's (BTC) latest price crash has narrowed the gap between futures and spot prices, denting the appeal of carry trades that seek to profit from discrepancies between the two markets.

The leading cryptocurrency by market value has crashed over 18% to $50,000 in 24 hours, reaching its lowest level since February 2024. The sell-off, which is part of broad-based risk aversion in global markets, is likely caused by the sharp rise in the anti-risk Japanese yen and the U.S. bond market shenanigans .

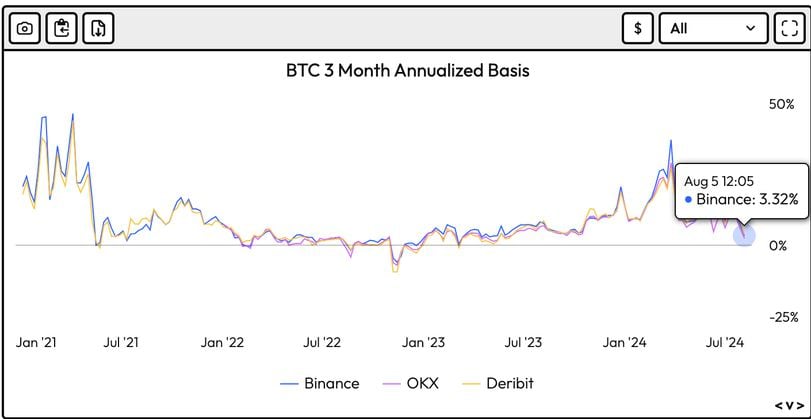

According to Velo Data, the annualized three-month futures premium on leading crypto exchange Binance has dropped to 3.32%, the lowest since April 2023. Crypto exchanges OKX and Deribit are seeing a similar slide in futures premiums.

Meanwhile, futures on the regulated Chicago Mercantile Exchange, a preferred by institutions, are now trading pretty much in line with spot prices.

It means the return on the classic cash and carry strategy, involving a long position in the spot market or the U.S.-listed ETFs and simultaneously selling futures, is now less than or at par with the 10-year U.S. Treasury note.

The strategy was quite popular among institutions in the first quarter when futures traded at a premium of over 20% and supposedly accounted for a notable share of inflows into the spot ETFs.