It's been well reported that the allure of crypto has proven too much to resist for the family of former President Donald Trump, even in the midst of a major national campaign with fewer than two months to the election. CoinDesk reporters managed to get their hands on the secret "white paper" that lays out the family's plan to make the U.S. the "crypto capital of the planet."

ALSO:

This article is featured in the latest issue of The Protocol , our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday.

Network News

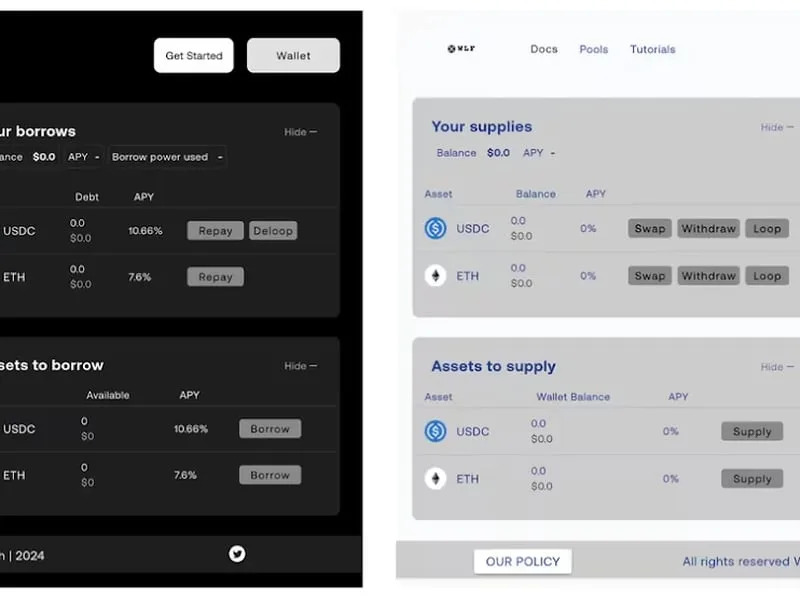

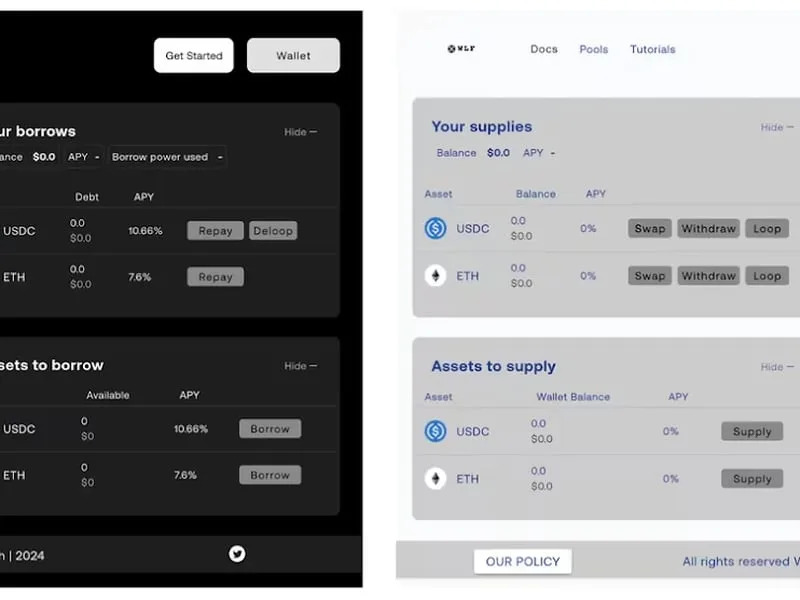

The similarities are remarkable between the user interfaces for Dough Finance, left, and now-deleted code from World Liberty Financial (GitHub)

DEFI DON: It's only been a few weeks since The Protocol detailed Donald Trump's family's increasingly cozy relationship with blockchain, with son Eric Trump tweeting he had " fallen in love with crypto " and former president's own words inspiring scads of mostly worthless and duplicative memecoins. On Aug. 23, the elder Trump promoted a forthcoming decentralized finance (DeFi) platform called " The DeFiant Ones " to his 7.5 million followers on the social application Truth Social, before last week announcing that the endeavor would instead be called " World Liberty Financial ," part of a plan to make the U.S. "the crypto capital of the planet." Details remained scant, but a few of my CoinDesk colleagues have managed to scrape public sources and track down documents to bring more of the Trumps' plan to light.

As reported by our Danny Nelson , metadata associated with the website worldlibertyfinancial.com says "the only crypto DeFi platform supported by Donald J. Trump" will connect users to "decentralized finance's best tools for secure, high-yield crypto investments." It calls on users to "join the financial revolution today!" A trademark filed for World Liberty Financial in mid-July also points to an association with DeFi, and the lawyer who filed the trademark papers, Alex Golubitsky, confirmed to CoinDesk late last week that the trademark relates to Trump's crypto ventures.

Then on Tuesday, CoinDesk's Sam Kessler, along with Nelson and Cheyenne Ligon, reported on a secret white paper for World Liberty Financial that the president's inner circle has been privately shopping around. The story reads : "The document and other reporting describe a borrowing and lending service strikingly similar to Dough Finance, a recently hacked blockchain app built by four people listed as World Liberty Financial team members. Other participants include all three of Trump's sons, including 18-year-old Barron, who is identified as the project's 'DeFi visionary.'" (DeFi is short for "decentralized finance.")

The project's figurehead is none other than the Republican presidential nominee himself, bearing the title, "Chief Crypto Advocate," with Eric and Donald Trump Jr. involved as "Web3 Ambassadors."

As if this weren't all entertaining enough, the project is reportedly aided by a cast of characters who, in other times and other contexts, might give campaign-vetters pause. They include Zachary Folkman, listed in the white paper as World Liberty Financial's head of operations, and Chase Herro, its data and strategies lead. A limited liability corporation for World Liberty Financial is registered to Folkman, who, along with Herro, is the co-creator of Subify, which bills itself as a censorship-free competitor to both Patreon and OnlyFans – both services that let customers pay content creators, with the latter skewing toward explicit content. Folkman previously registered a company called Date Hotter Girls LLC and posted seminars on YouTube on how to pick up women . Herro has appeared as a guest on popular podcasts including YouTuber Logan Paul's podcast "Impaulsive," where he has discussed his past stints in prison for drug-related charges, and how he got rich as a "self-made businessman."

Herro, Folkman, World Liberty Financial and the Trump campaign did not respond to requests for comment. In an epilogue: Shortly after CoinDesk reported on project's whitepaper, social-media accounts for at least two Trump family members were hacked in an apparent effort to promote a crypto scam .

On Wednesday, the team reported that the current plan calls for some 70% of project's new WLFI tokens will go to project insiders , an unusually high proportion that compares with 5%-20% in other examples.

ELSEWHERE:

Mt. Gox Wouldn't Have Happened With Modern Tools, Mark Karpeles Says

Mark Karpeles (left), former CEO of Mt. Gox, talking to CoinDesk's Sam Reynolds at Korea Blockchain Week on Sept. 4. (Parikshit Mishra/CoinDesk)

As Mt. Gox wrapped up its bankruptcy redemption payments , it ended a nearly decade-long legacy, and the book is closed on what might be the greatest hack in all of crypto .

Mark Karpeles, the failed exchange’s CEO, was once a hated man in the crypto community , and Japanese prosecutors wanted to send him away for a decade . But now, Karpeles belongs to an exclusive club of the 1% which have fought the law in Japan and won – something nearly unheard of in a country with a 99% conviction rate where the justice system prefers to coerce confessions rather than contest a case.

Now, with all this behind him, Karpeles is off on a new adventure: launching a new crypto exchange called EllipX, which takes the best modern practices of exchanges and lessons learned from Mt. Gox as well as continuing work on a crypto ratings agency called Ungox.

“I can say very confidently that Mt. Gox hack wouldn't have happened if we had even some of the tools we have today,” Karpeles said in an interview with CoinDesk's Sam Reynolds at Korea Blockchain Week in Seoul.

Read the full story by CoinDesk's Sam Reynolds

Protocol Village

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

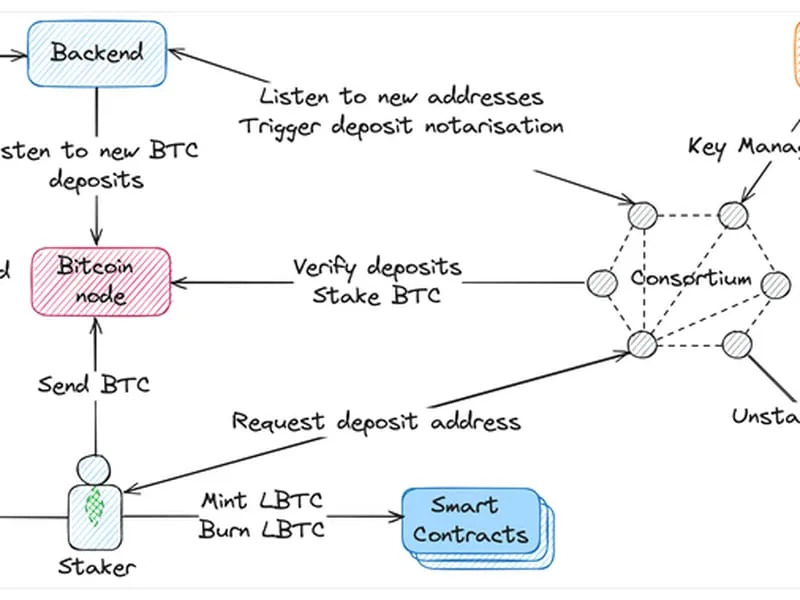

Schematic illustrating Lombard's V1 architecture (Lombard)

-

Lombard has publicly launched LBTC, a "cross-chain, yield-bearing Bitcoin token designed for DeFi use." According to the team: "The launch follows a successful private beta that attracted more than $165 million in deposits from over 600 institutional allocators. LBTC allows users to stake Bitcoin through Babylon and utilize it across various DeFi protocols. Initial integrations include major DeFi protocols such as Symbiotic, Morpho, Pendle, Corn, Gauntlet, Derive, EtherFi and Gearbox."

-

Arbitrum , the largest layer-2 network atop Ethereum with $14.1 billion of total value locked, launched the Stylus upgrade on Tuesday , adding support for WebAssembly languages like Rust, C and C++, and expanding beyond Solidity, which has been the standard for writing smart contracts on Ethereum.

-

Cardano , the layer-1 blockchain launched in 2017 by Ethereum co-founder Charles Hoskinson, activated its highly anticipated “Chang” upgrade on Sunday, marking the ecosystem's long-planned shift towards decentralized governance.

-

Ripple is enhancing the XRP Ledger by integrating Ethereum-compatible smart contracts via a new sidechain , expanding its functionality beyond basic transactions to include complex applications like decentralized exchanges and token issuance.

-

Polygon , a layer-2 network atop the Ethereum blockchain, was on track to activate an upgrade on Wednesday that swaps out its longstanding MATIC token for a new POL token , allowing for more flexibility on issuance of new supply.

Money Center

Fundraisings

Data and Tokens

Regulatory and Policy

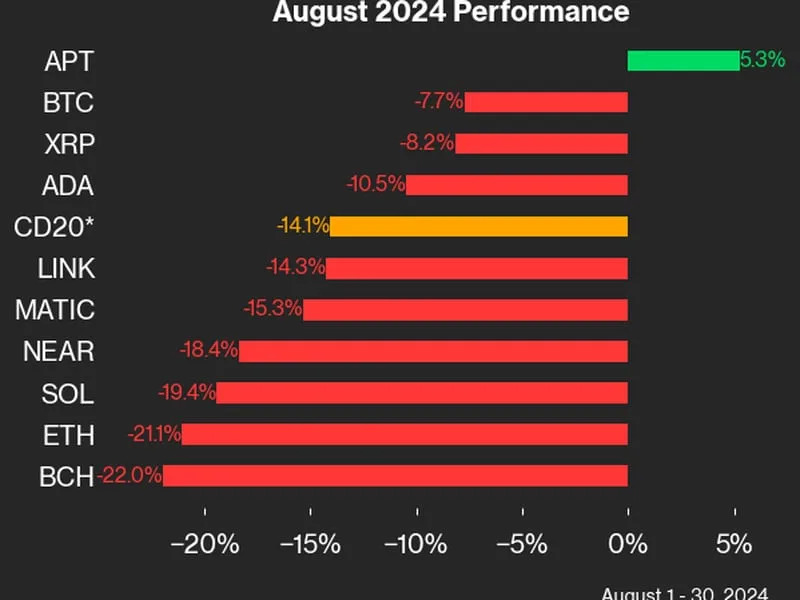

An Ugly August for Crypto

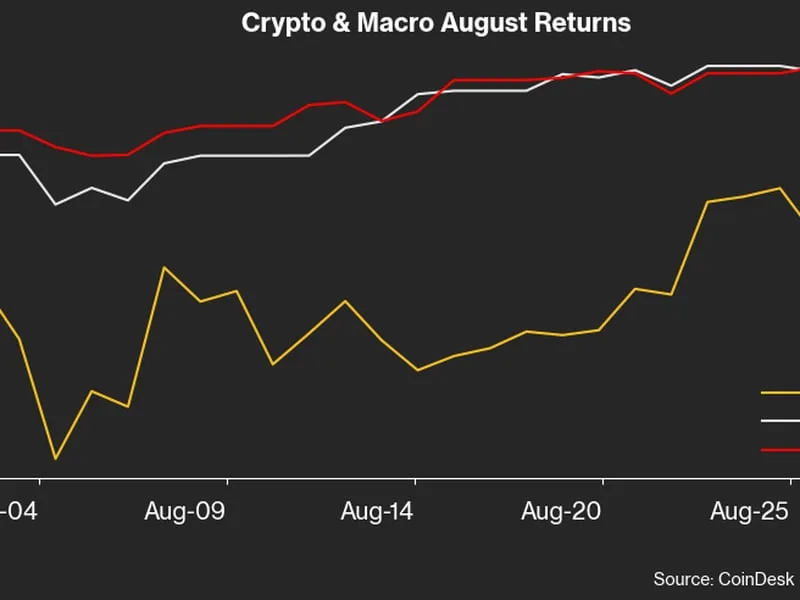

The CoinDesk 20 index of major digital assets slid 14% last month. Almost all members in the red, and drastic underperformance when compared with the Standard & Poor's 500 Index of U.S. stocks as well as gold:

Aptos, one of the "Move" language chains that emerged from the long-since-shuttered Facebook/Meta blockchain projects, was the month's only gainer, with a 5.3% price rise for its APT token. Bitcoin slid 7.7% and Ethereum's ETH tumbled 21%, its worst performance in two years.