The tech-driven Nasdaq Composite index is up 14% year-to-date. While that growth is positive, the index is underperforming compared to the first eight months of last year, when it rose 34%. Geopolitical concerns, economic uncertainty, and cooling enthusiasm over AI have led to some pullback from investors since July.

Recent fluctuations in the Nasdaq have highlighted the importance of a long-term perspective on tech stocks. Wall Street's bullish and bearish views on tech are often cyclical, but the Nasdaq has climbed 115% over the last five years, outperforming the S&P 500 's 89% rise in that period.

Despite recent skepticism, the industries' leaders have delivered impressive quarterly reports this year. Growth markets like artificial intelligence (AI), digital advertising, and cloud computing are delivering consistent gains that will likely push companies' stocks high over the next decade.

Here are the best stocks to invest $50,000 ($25,000 to each one) in right now if you've got $50,000 available for investing that you don't need for anything in the short or medium term.

1. Nvidia ($108 per share)

Nvidia 's (NASDAQ: NVDA) stock has taken a deep dive after a recent tech sell-off and a quarterly report that displeased investors, with its share price down 17% since mid-August. Even the company's second-quarter fiscal 2025 earnings release on Aug. 28, where the company beat expectations on multiple counts, couldn't encourage a rally from investors.

However, the recent dip in its share price and a potent position in tech suggests now could be an excellent time to buy its stock at a compelling valuation.

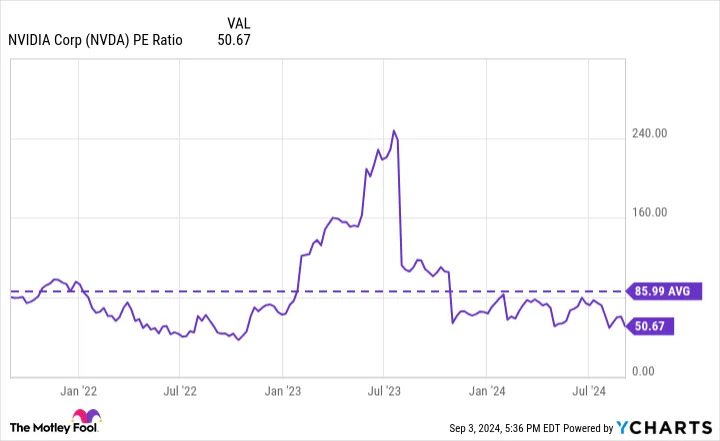

The chart above shows Nvidia's price-to-earnings (P/E) ratio at about 51. On its own, that figure doesn't scream bargain. However, compared to Nvidia's three-year trend for the metric, the company's stock is trading at one of its best values in months. The chipmaker's stock rose 382% over that period, suggesting a P/E of 51 isn't necessarily a deal breaker for investors.

Moreover, despite cooling excitement over AI in recent months, the industry likely has much more to offer companies, and Nvidia is well placed to continue being a leading recipient of that growth with most of the market in AI graphics processing units (GPUs).

AI software leaders like Microsoft , Alphabet , and Amazon (NASDAQ: AMZN) have a growing rivalry, requiring the latest and most powerful chips to stay competitive. As a result, Nvidia will likely continue to enjoy high demand for years.

An investment of $25,000 in Nvidia 2019 would be worth $645,000 today. While past growth isn't always indicative of what's to come, Nvidia's potent role in AI and tech suggests a similar investment right now could deliver major gains in the coming years.

2. Amazon ($175 per share)

Amazon has had an impressive year. Its stock is up 28% over the last 12 months, beating the S&P 500's rise of 22%. Meanwhile, success in e-commerce, AI, cloud computing, and digital advertising has delivered impressive operational gains. Since last September, Amazon's quarterly revenue and operating income have climbed 3% and 31%, while free cash flow has soared 186%.

The company appears to be on a promising growth trajectory, and Wall Street seems to agree. JMP Securities recently boosted its Amazon price target from $245 to $265, maintaining an outperform rating for the stock. The investment firm cited the retail giant's advertising potential with Prime Video for the bullish vote of confidence.

Since introducing an ad-supported tier to its streaming platform, digital ads have become an increasingly lucrative division for the company. In the second quarter of 2024, Amazon's ad revenue increased 20% year over year.

Moreover, Amazon's cloud platform, Amazon Web Services, offers an exciting opportunity as it expands its library of AI solutions. AWS is, without question, the most profitable part of the company's business, accounting for more than 60% of its total operating income. In Q2 2024, AWS' operating income increased by 74% year over year, while Amazon's total operating income more than doubled. The company's cash hoard is expanding quickly, allowing it to maintain its market dominance and keep improving its tech.

Amazon stock also trades at a bargain compared to the past. This chart shows its P/E is far lower than its three-year average, making now an excellent time to invest.

Amazon has leading roles in multiple tech areas and could have much to offer investors over the long term. An investment of $25,000 in Amazon five years ago would be worth $50,000 today. In the next five years, its stock could outperform past growth with a more diversified business and cash in the bank.

Before you buy stock in Nvidia, consider this: