(Bloomberg) -- China’s stock market is facing darker prospects after a weak earnings season dashed hopes for any imminent recovery in flagging consumption that has weighed on the world’s No. 2 economy.

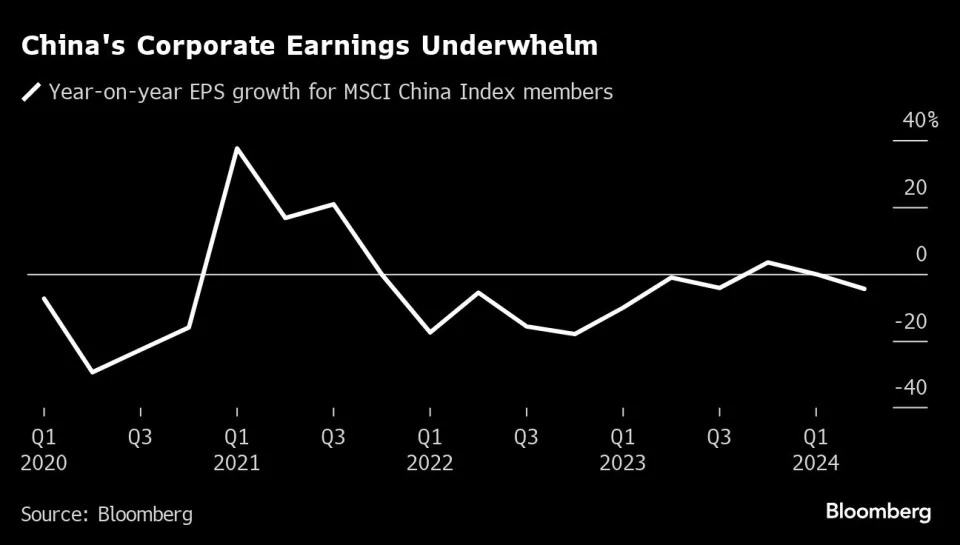

Earnings per share for the MSCI China Index fell 4.5% from the year earlier in the second quarter, its worst in five quarters, according to data from Bloomberg Intelligence. Underscoring the contraction was weakening support from the country’s eight biggest tech firms, whose overall EPS growth at 19% was the slowest since the last quarter of 2022.

The dismal performance has sent an unambiguous signal that China’s anemic consumption is becoming more entrenched as the housing crisis persists and other growth engines sputter. It also reinforces the view that the stock market is unlikely to stage any meaningful rebound unless the government ramps up efforts to turn the economy around.

The MSCI China Index is down more than 13% from a peak in May, while the onshore benchmark CSI 300 Index’s 5.2% year-to-date loss makes it one of the world’s worst-performing major gauges. The measure is staring at an unprecedented fourth straight annual decline.

“The biggest drag on this earnings season is weakening domestic demand,” said Minyue Liu, an investment specialist for Greater China and global emerging-market equities at BNP Paribas Asset Management. “We need to see more coming from Beijing, including direct help focusing on the domestic market.”

Weighing heavy on investors’ minds was the slowdown in the consumer tech sector, which has been the lynchpin supporting China’s earnings in recent quarters.

PDD Holdings Inc.’s $55 billion stock crash in one session last week rang a loud alarm bell, as the e-commerce firm that has thrived on low-priced goods spooked investors with an unusually gloomy outlook. Kuaishou Technology and Baidu Inc. also slumped after their financial results raised red flags about the health of the Chinese consumer economy.

As the nation’s tech giants intensify cost control to boost profitability, investors are shifting their focus toward their ability to generate revenue in an increasingly tough climate.

“Overall, the guidance from many of these tech companies on the sales outlook suggests lingering consumer weakness, and that is what is holding back market sentiment at the moment,” said Marvin Chen, a Bloomberg Intelligence analyst. “Deceleration in Tech 8 growth may reflect the limits of margin expansion without top-line growth,” he said, referring to China’s top eight tech firms.

The earnings picture is even more bleak in other industries.

Real estate and consumer staples firms, the most direct casualties of weaker purchasing power, were among the biggest laggards in the latest earnings season: major developer China Vanke Co. suffered a half-year loss for the first time in more than two decades, while retailers including Li Ning Co. have toned down sales guidance.

Banks are also under pressure as falling interest rates and depressed loan demand has driven margins to record low levels.

All that has fueled pessimism about the outlook of Chinese stocks. The consensus EPS growth estimate for MSCI China this year has slid to about 11%, from 15% at the beginning of the year and a peak of 16% late last year, a Bloomberg Intelligence analysis shows.

“We expect more disappointing earnings results to come through and trigger further consensus downward revisioning,” Morgan Stanley strategists including Laura Wang wrote in a note last week. “We therefore continue to caution against premature optimism at the broad index level and see a largely range-bound market.”