(Bloomberg) -- Oil steadied near the lowest close since June 2023 as an industry report pointed to a big draw in US crude stockpiles, with the market taking a breather following a sharp selloff this week.

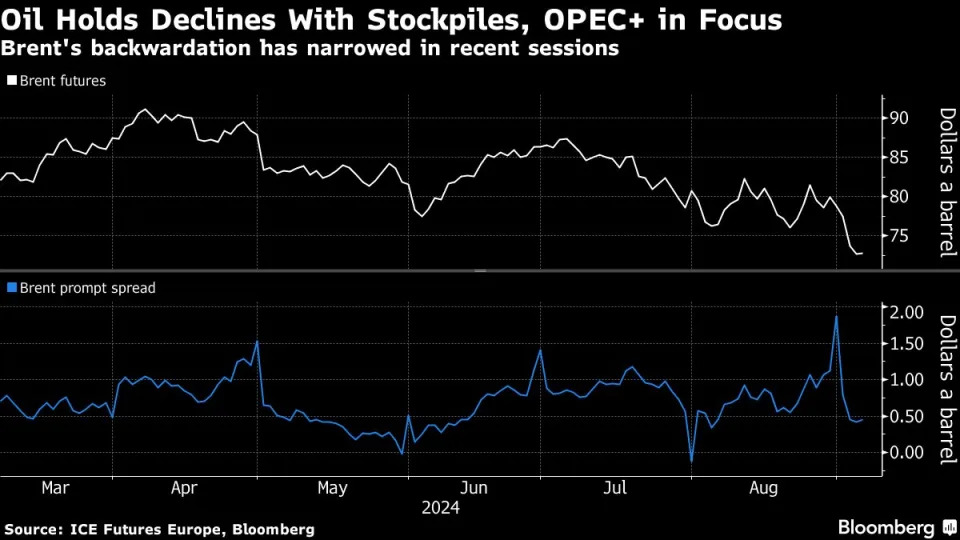

Brent traded near $73 a barrel after losing almost 8% since the start of the week. West Texas Intermediate was above $69. The American Petroleum Institute reported crude inventories dropped by 7.4 million barrels, according to people familiar with the data. That would be the biggest decline since June, if confirmed by official figures later Thursday.

Crude has tumbled on persistent concerns about the economic outlook in key consumers, specifically China, and expectations of adequate global supply. Indications that OPEC+ is considering a delay to a planned output boost from October failed to halt the recent slide.

Traders were also tracking Libyan production as a tussle between rival eastern and western governments threatens supply. Oil is still trickling out of the North African nation, albeit at a slower rate. A key Libyan central banker said a deal to resolve a dispute between the rival authorities appears imminent.

Widely watched timespreads have also collapsed alongside the decline in futures. Brent’s prompt spread — the gap between the two nearest contracts — was last at 42 cents a barrel in backwardation. That is down from more than a dollar for most of last week.

The latest selloff was “large relative to the fundamental news” and leaves room for financial demand to recover, even as prices risk dropping further, Goldman Sachs Group Inc. analysts including Yulia Grigsby said in a note. Citigroup Inc.’s team led by Anthony Yuen said crude could bottom at around $70 to $72 a barrel.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.