Are you looking for investment income? Dividend stocks are an obvious place to start your search, but there are so many! For most people, limiting your prospects to the 30 stocks that make up the Dow Jones Industrial Average will not only make the hunt more manageable, but also ensures you own high-quality names.

Even so, which Dow stocks? It's tempting to simply plow into the index's three highest-yielding names and call it a day. But there's something you might want to know about that strategy before using it.

The Dow's highest-yielding dividend stocks right now

In case you're wondering, the Dow names sporting the highest-dividend yields right now are telecom behemoth Verizon Communications (NYSE: VZ) , chemical company Dow Inc. (NYSE: DOW) , and oil giant Chevron (NYSE: CVX) , with trailing yields of 6.5%, 5.3%, and 4.5%, respectively. You could certainly do worse.

As veteran investors can attest, however, every investment comes with a trade-off. In the case of above-average dividend yields you're likely to see below-average dividend growth and/or below-average capital appreciation. It's also possible that stocks with strong dividend yields simply pose above-average risk to their owners.

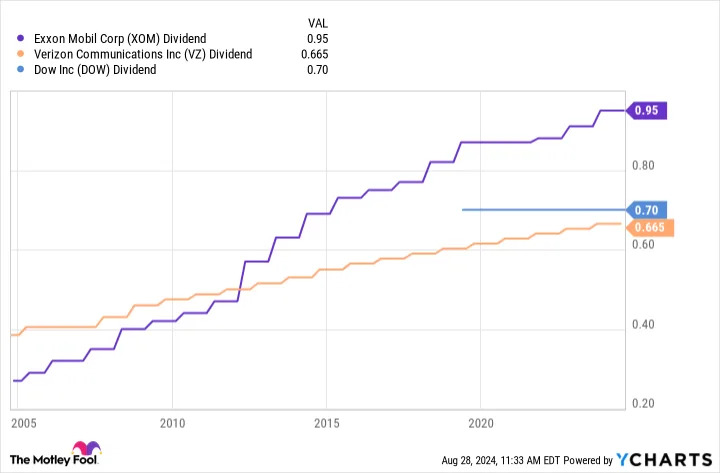

In the case of Verizon, Dow, and Chevron, it's mostly the first two trade-offs. That is, these are all solid companies, but none of them are in growth industries that will support great dividend growth or price gains. Respectable growth? Sure. Great growth? No.

If your only priority is above-average yields and inflation-beating dividend growth though, these three tickers will do nicely. Clearly, the need for wireless telecom services is never going away, and neither is the need for industrial chemicals. Even the old-school energy business is reasonably well protected for the foreseeable future. Thanks to population growth and ever-expanding industrialization,

Goldman Sachs believes global consumption of crude oil will continue growing through 2034, and will still be needed for many, many years after that. Energy giant ExxonMobil similarly predicts we'll be using as much oil in 2050 as we're using right now.

Given this outlook, Chevron's dividend is going to be fine for a long, long while as well. And in at least two of the three cases, future dividend growth will extend impressive dividend-growth histories. (Dow split from its parent in 2019 -- right before the COVID-19 pandemic -- and as such hasn't had a fair chance to raise its dividend payment yet.)

There's good reason to expect some solid capital appreciation from these three names, too, despite their unusually high dividend yields right now.

Dogs of the Dow

Ever heard of the Dogs of the Dow stock-picking strategy? If not, it's not complicated. The strategy simply calls for buying the Dow's 10 highest-yielding stocks at of the end of any given calendar year, and holding them for the entirety of the following year. The theory is that these highest-yielding blue chips are unduly undervalued, and ripe for a price rebound; the dividends they'll be dishing out in the meantime are just a nice added bonus.

The thing is, the strategy works! Although not successful every year, more often than not these high-yield tickers do end up outperforming the Dow itself as well as the S&P 500 . The tactic is even more productive with the so-called Small Dogs of the Dow (sometimes called the Puppies of the Dow), which are just the five lowest-priced Dogs of the Dow stocks in any given year. In both cases investors are scooping mathematically undervalued blue chips and then reaping the reward for not overthinking their picks (as opposed to talking themselves out of what would have been a smart trade).

Obviously, this rules-based strategy doesn't quite apply here and now. We're not at the end of the year, and we're only interested in three stocks -- not 10, or even the five lowest-priced tickers of those 10. The underlying premise applies all the same, though. That is, you're buying proven, dividend-paying blue chip stocks at a discount. The calendar and quantity aren't factors if you're a true long-termer just looking for some reliable income stocks to own.

Just do it already

Admittedly, the idea seems too simple to be effective. Picking stocks is (in theory) supposed to be complicated, requiring lots of research that still ultimately leads to a judgment call. This approach is anything but a complicated judgment call. And to be fair, there's certainly no guarantee this approach will pan out for you.

At least embrace the underlying idea, however. Investors have a knack for making things more difficult than they need to be, often undermining their net returns as a result by not entering a position they arguably should have.

Or, said in simpler terms, don't overthink things when your universe of possibilities is already limited to the market's top blue chips. If you're looking for above-average dividend income right now -- with reasonable hope for more of the same in the future -- the Dow's three highest-yielding names should do just fine.

Before you buy stock in Verizon Communications, consider this: