(Bloomberg) -- Oil steadied after a three-day rally, with the threat of a halt in Libyan supply countered by a still-shaky demand outlook.

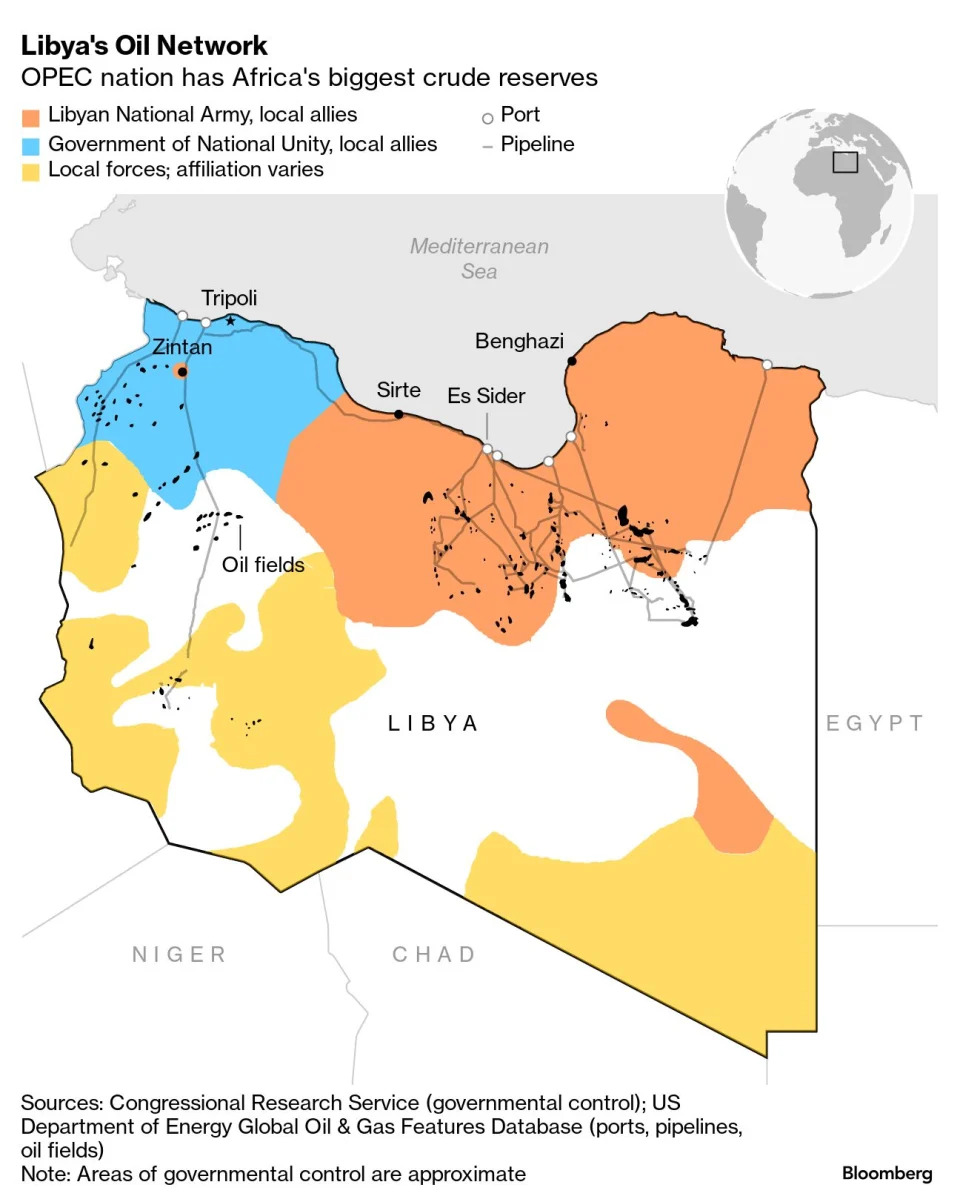

Brent crude traded above $81 a barrel after rising 7% in the sharpest three-day rally since April last year, while West Texas Intermediate was near $77. Libya’s eastern government declared force majeure — a legal clause allowing missed shipments — on all oil fields, terminals and facilities as it struggles with its Tripoli-based rival for control of the OPEC member’s central bank and oil riches.

“Libya is once again at risk of losing all eastern oil exports,” RBC Capital Markets LLC analysts including Helima Croft said in a note. If the eastern oil fields are all closed, the country would only have one major deposit left in operation, they said.

Crude has returned to a gain for the year, buoyed by signs the Federal Reserve will soon cut interest rates, geopolitical tensions and OPEC+ supply discipline. That has been partly offset by a weak demand outlook, especially in China, the world’s No. 1 importer.

The outlook for crude is still downbeat, with top Wall Street banks increasingly souring on the energy commodity. Goldman Sachs Group Inc. and Morgan Stanley have revised their Brent price forecasts lower, each expecting prices to average below $80 a barrel next year.

The threat to exports from Libya followed an exchange of fire between Israel and Iran-backed Hezbollah over the weekend that rekindled fears that it would affect physical exports from the Middle East. While both parties said that they had concluded military operations for now, the market is still watching for signs of further fallout from the war in Gaza.

Timespreads have strengthened in response to the latest ratcheting up of tensions in the Middle East and North Africa. The gap between Brent’s two nearest contracts was more than $1 a barrel in a bullish, backwardated structure, compared with 62 cents a week ago.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.