The stock market has set several new all-time highs this year. Because of that, most stocks are up sharply, which is leaving fewer bargains.

However, there are a few stocks that still look like great deals. American Water Works (NYSE: AWK) , Enbridge (NYSE: ENB) , and Clearway Energy (NYSE: CWEN) (NYSE: CWEN.A) stand out to three Fool.com contributors right now because of their compelling investment potential. However, that might not last, which is why investors might want to scoop up these phenomenal dividend stocks before it's too late.

A powerful dividend growth stock

Neha Chamaria (American Water Works): American Water Works stock yields just a little over 2%. That dividend yield may underwhelm income investors, but even low-yield stocks can be great investments if they're paying regular and steadily rising dividends backed by earnings and cash-flow growth. You'd be surprised to know that with reinvested dividends, American Water Works stock has more than tripled investors' money in just 10 years!

That's how powerful dividend growth stocks can be. And, with American Water Works stock's one-year performance flat as of this writing, you may want to pick up some shares before it's too late. After all, its stable business model and attractive long-term financial goals are too compelling to ignore.

American Water Works has been around for more than 135 years and is the largest regulated water and wastewater utility in North America today. It serves nearly 14 million people across 14 states and on 18 military installations. Since it's a regulated business, American Water Works can generate stable and predictable cash flows. And to grow its cash flows, all it has to do is regularly invest in its infrastructure to get rate hike approvals while grabbing acquisition opportunities on the go. For instance, the utility expects to invest $3.1 billion in infrastructure improvements this year and has impending acquisitions worth nearly $483 million.

Backed by steady rate growth and acquisitions, American Water Works expects to grow its earnings per share (EPS) by a compound annual growth rate of 7% to 9% in the long term. Here's the best part: the water stock also aims to grow its dividend in line with EPS, or by 7% to 9% per share every year. Now that's solid dividend growth, and coming from a utility, should be safe and bankable. too.

Enbridge is providing the energy that's needed

Reuben Gregg Brewer (Enbridge): Enbridge is usually lumped in with midstream companies. This is perfectly appropriate since 75% of its earnings before interest, taxes, depreciation, and amortization (EBITDA) comes from oil and natural gas pipelines. However, that doesn't really do the business justice, because Enbridge's goal is to provide the world with the power it needs.

In fact, the remaining 25% of EBITDA is derived from natural gas utilities (22%) and renewable power (3%). Natural gas is expected to be a transition fuel as the world shifts away from dirtier forms of energy, like coal and oil. Renewable power, like solar and wind, is clearly the long-term direction of the energy sector, though it is still a relatively modest contributor to the global grid today. The plan is to keep shifting the mix toward cleaner alternatives as demand increases.

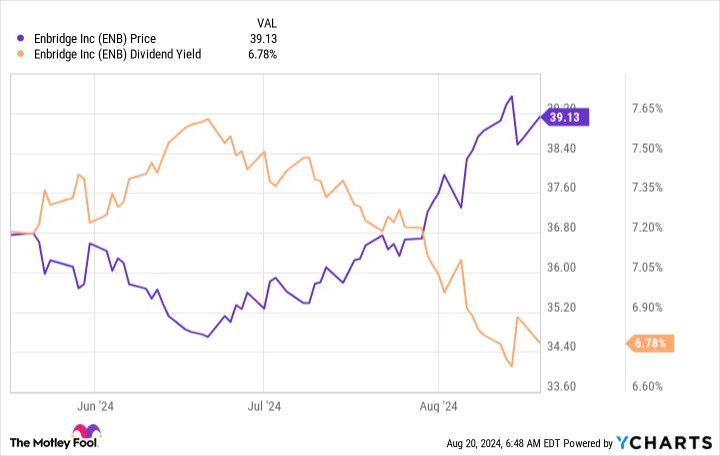

That's the business that backs Enbridge's dividend, currently yielding 6.8% and underpinned by an investment-grade-rated balance sheet and a distributable cash-flow payout ratio that is comfortably within management's target range. The business model has supported the 29 annual dividend increases the company has racked up. Here's the thing, Enbridge's yield had been over 7.5% just a short while ago, before the stock started to rally. Basically, investors are starting to appreciate Enbridge's business approach a little more. If that continues, the still attractively high yield here might not last much longer.

This sale could be about to end

Matt DiLallo (Clearway Energy): Shares of Clearway Energy currently sit about 30% below their high from early 2022, right before the Federal Reserve started boosting interest rates. Higher rates have made it more expensive for companies to borrow money, which has slowed growth. Rising rates have also weighed on the value of higher-yielding dividend stocks like Clearway. Their stock prices decline to make their dividend yields rise so that they're more enticing investments compared to lower-risk options like bonds. In Clearway's case, its sell-off has driven its dividend yield up to nearly 6%.

That high yield might not last much longer. The Federal Reserve appears poised to start lowering interest rates. As it does, the share prices of high-yielding stocks like Clearway should rise as they gain investor favor, causing their yields to fall.

That catalyst adds to Clearway's compelling long-term total return potential. The clean power producer plans to grow its dividend toward the upper end of its 5% to 8% annual target range through 2026, a phenomenal growth rate for such a high-yielding stock. Powering that plan is its capital recycling strategy. It sold its district thermal business a few years ago and has been redeploying the proceeds into higher-returning renewable energy investments. It recently signed deals to deploy the remaining proceeds from that sale, giving it clear visibility to achieve its current dividend growth target.

The company is already working toward extending its growth visibility into 2027 and beyond. Recent contract renewals for its natural gas power plants are coming in at a level that could power dividend growth toward the low end of its target for 2027. In addition, the company has made offers to acquire additional renewable energy assets that it can fund with its existing financial capacity. Meanwhile, if interest rates fall, it can externally fund acquisitions again, which could enable it to grow faster in the future.

Investors currently have the opportunity to lock in Clearway's high dividend yield while interest rates remain high. On top of that, Clearway offers high upside potential from a future recovery in its stock price as rates fall, and it can accelerate its growth rate.

Before you buy stock in Enbridge, consider this: