Over the past couple of years investors haven't been able to buy semiconductor stocks fast enough. A big reason for this is because sophisticated chips known as graphics processing units (GPUs) are one of the core power sources of artificial intelligence (AI) applications such as machine learning and even autonomous driving.

As the AI narrative continues to push the markets higher, chip stocks will likely remain in high demand. As it stands today, Nvidia is widely considered to be the market leader among AI-powered chip companies. However, Nvidia just told investors that the company's new Blackwell series GPUs are going to be delayed due to a design flaw.

While I'm no supporter of schadenfreude, I see this setback at Nvidia as a once-in-a-lifetime moment for the company's biggest competitor, Advanced Micro Devices (NASDAQ: AMD) . Let's examine the full situation at hand and assess how AMD could take advantage of Nvidia's hiccup.

A tale of two chip companies

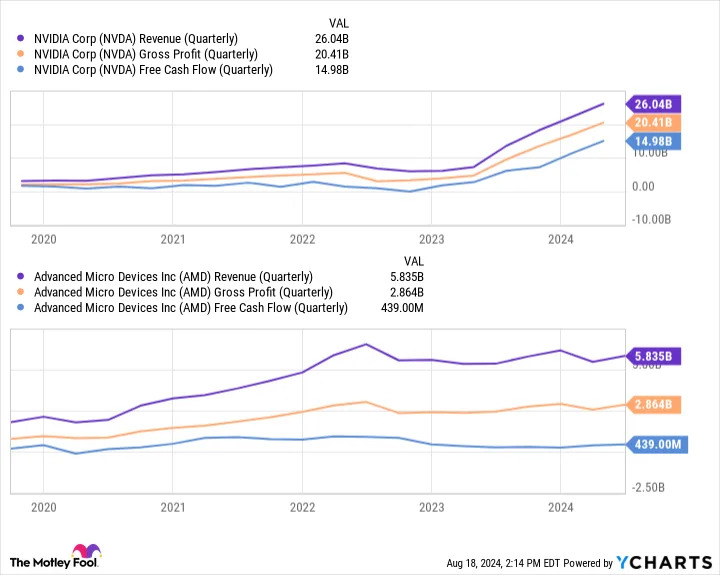

The charts below illustrate a number of important financial metrics for Nvidia and AMD.

On one side of the equation, Nvidia's sales and profits are consistently soaring -- leading to an increasingly steeper slope among the colored lines depicted below. Yet on the other side, Nvidia's chief rival is demonstrating noticeable inconsistencies in its operation.

The dynamics illustrated above clearly indicate that chip buyers not only prefer Nvidia, but are also willing to pay top dollar. Although Nvidia has remained the supreme semiconductor company since the inception of the AI revolution, AMD has an incredible opportunity to leapfrog Nvidia right now.

Why this might be AMD's defining moment

Wall Street analysts estimate that Nvidia has nearly 80% of the AI-powered chip market. While AMD has done what it can to compete with Nvidia's stunning pace of innovation, I think the company has largely attempted to distract investors from Nvidia's overwhelming lead through a series of questionable acquisitions.

To me, AMD's time is close to running out and it can't afford to rely on acquisitions as a source of product development and inorganic growth. One silver lining for AMD right now is that the company's MI300X accelerator GPU is the fastest product to reach $1 billion in sales over the company's history.

Clearly, there is a lot of demand for AMD's GPUs, but it's just not even in the same breadth as Nvidia's demand. Now with Blackwell shipments delayed until possibly sometime next year, AMD has a chance to seize the moment.

It's important to stay grounded

While the Blackwell delays are by no means good news, investors need to be real here. I surmise some companies will opt for alternative solutions to Blackwell in the interim, but I don't think Nvidia will have a hard time selling these chips once it finally repairs its design flaw.

So even though AMD likely isn't going to suddenly capture an overwhelming amount of market share and outright dethrone Nvidia, I think the company has a chance to enhance its profile by disrupting Nvidia's momentum.

For now, it'll be almost impossible for investors to know if AMD is penetrating the market while Nvidia focuses on righting the Blackwell ship. I think some prudent actions could be to monitor press releases among major AI developers such as Microsoft , Amazon , Alphabet , or Oracle and see if any of them are striking new partnerships with AMD or buying more MI300X chips.

Although I don't own AMD stock at the moment, I am intrigued by the current dynamics of the chip market and see the company as both a hedge to Nvidia and similar to a long-term call option on the AI market more broadly.

Investors with a higher tolerance for risk, however, may consider buying AMD now. Given the company is playing second fiddle to Nvidia, it's hard to imagine a scenario where AMD falls behind in the midst of this Blackwell situation.

Another strategy could be to wait a couple of months until AMD publishes its next earnings report and see if the company generated abnormal growth compared to prior periods. Investors should also listen to management's commentary regarding the source of new business.

In either case, I am bullish that AMD will take advantage of Nvidia's stumble and perhaps ignite the catalyst needed for longer-term sustained growth as the two companies continue going head to head in the chip realm.

Before you buy stock in Advanced Micro Devices, consider this: