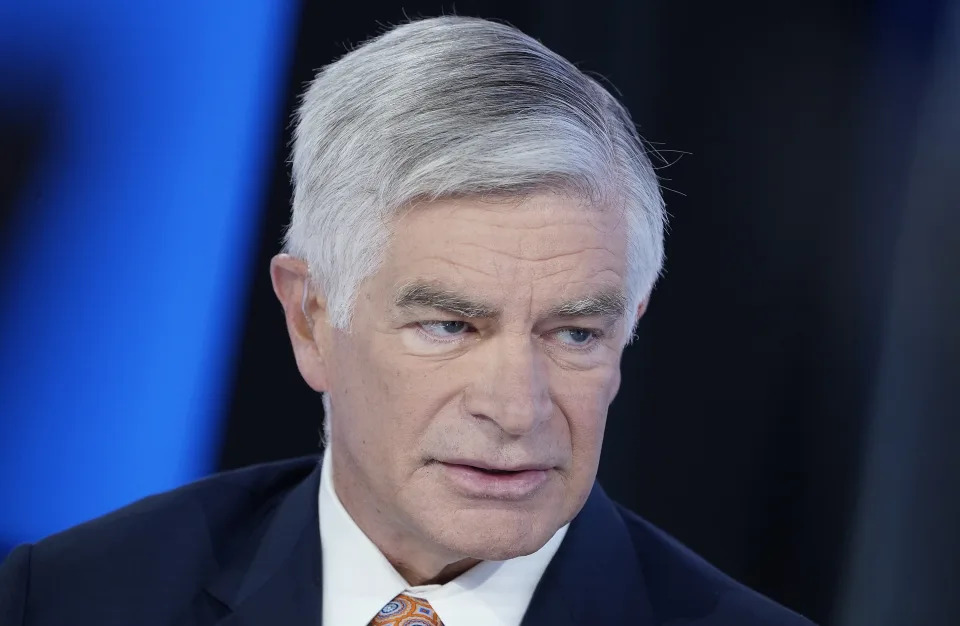

Atlanta Fed president Raphael Bostic is accelerating his estimate of when rate cuts could begin, telling Yahoo Finance that September or November is "definitely in play" and that an initial 25 basis point reduction "could be the most appropriate way forward."

"For most of this year, my view and my outlook was that we would do one cut this year and it would be in the fourth quarter," he said during an interview Friday at the Kansas City Fed's annual economic symposium in Jackson Hole, Wyo.

"Inflation has come down faster than I expected. Labor markets have weakened considerably ... that all suggests to me that it is going to be appropriate to pull forward the beginning of our rate move."

Thus, "being open to something in the third quarter — September or November — is definitely in play."

The central bank policymaker made his comments after Fed Chair Jerome Powell said in a speech at Jackson Hole that " the time has come for policy to adjust ," giving markets the all-clear sign that lower rates are coming.

Powell's speech comes just over three weeks out from the Fed's Sept. 17-18 meeting, which should see the central bank announce its first interest rate cut since 2020.

Federal funds rate: What it is and how it affects you

But Powell was silent on whether the first cut would be 25 basis points or 50 and whether September was, in fact, the starting point, saying "the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

Another Fed policymaker, Philadelphia Fed president Patrick Harker, told Yahoo Finance in a separate interview Friday that he expects the central bank to start with a 25 basis point cut, and he would be open to a larger cut if the labor market deteriorates suddenly.

"Starting at 25 makes a lot of sense to me," Harker said.

Bostic added a 25 basis point move "could be the most appropriate way forward" if inflation stays consistent with the cooling trends of the last several months.

"I am trying to wait and see what happens."

He, like other policymakers, is keeping a close eye on the jobs market as labor conditions cool.

Companies are not as eager to hire as they were a year ago, but Bostic said he is not yet hearing about a lot of layoffs on the horizon. Wages, he noted, are still higher than the rate of inflation.

When asked if the labor market can cool without tipping the economy into a recession, he said "it can and we will have to see whether it does."

But a recession "is not in my outlook."

If companies do in fact start laying workers off, that could change the Fed’s calculus, he acknowledged: "That is a different scenario and would require a different policy response."

Market bets that a larger move will come in September moved up Friday morning. Markets are pricing in a 34.5% chance the Fed cuts by 50 basis points by the end of its September meeting, up from a roughly 24% chance seen the day prior, per the CME's FedWatch Tool.

Former Cleveland Fed president Loretta Mester — who stepped down from the central bank’s rate-setting committee less than two months ago — told Yahoo Finance in an interview that she wouldn’t want to start with 50 basis points because "that is really signaling the Fed is behind the curve and I don’t believe the Fed is."

"I think a reasonable baseline would be doing 25," she added.