(Bloomberg) -- Mexico’s annual inflation slowed much more than expected while economic growth remained feeble, according to separate reports published Thursday, paving the way for another interest-rate cut next month.

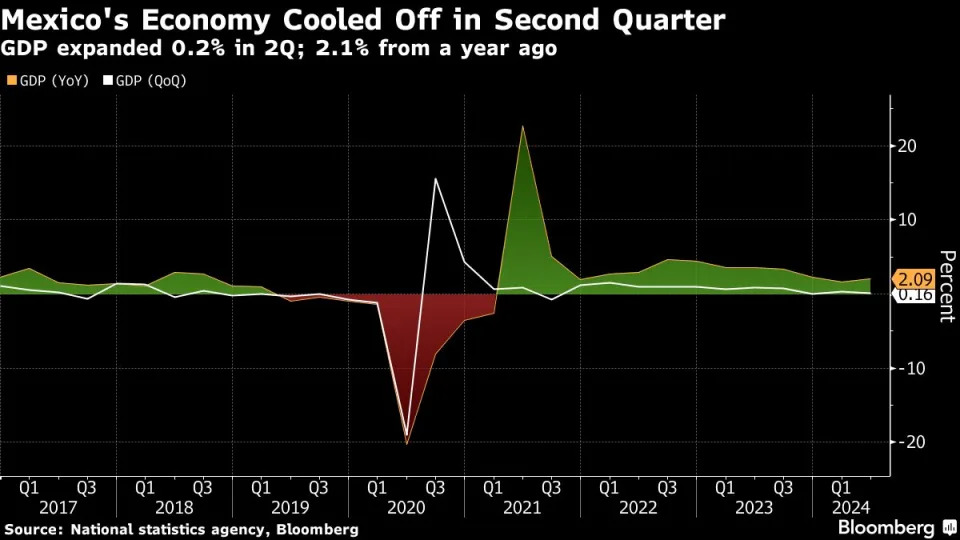

Official data showed consumer prices increased 5.16% in the first two weeks of August compared to the same period a year earlier, matching the lowest forecast in a Bloomberg survey of analysts. Gross domestic product rose 0.2% in the second quarter, while economic activity inched up just 0.04% on the month in June, the national statistics institute reported.

The barrage of data clears the way for Banxico, as the Mexican central bank is known, to deliver a second-straight rate cut of a quarter-point at its September meeting. The statistics vindicate policymakers after their controversial decision to lower borrowing costs to 10.75% this month even as annual inflation runs well above the 3% target. Going forward, board members will also get relief as the Federal Reserve indicates it’s ready to begin its own easing.

“These CPI and GDP prints should dissipate any remaining doubts among market participants about Banxico making the right decision to lower the degree of monetary restriction,” said Gabriel Casillas, managing director at Barclays Capital Inc, who expects the key rate to fall to 10% at year’s end.

In the second quarter, agriculture declined by 0.24%, while manufacturing gained 0.26% and services rose just 0.14%, according to the statistics institute.

Mexico’s economy is in a downturn even after extra spending ahead of June’s presidential election, said Gabriela Siller, head of economic research at Grupo Financiero Base. “We expect the Mexican economy to grow around 1.3% this year, which would be a marked slowdown from 2023,” she said. “For next year, we may see a further slowdown, of 0.8%.”

In early August, agricultural goods as well as fruits and vegetables — which are product groups that had pressured previous inflation readings — tumbled 1.3% and 3.06%, respectively, compared to the prior two-week period.

Closely-watched core inflation, which excludes volatile items and which central bank Governor Victoria Rodriguez says better reflects medium-term trends, eased to 3.98%, below the median economist estimate of 4.08%.

“A weak economy and falling core inflation so far in August pave the way for Banxico to keep cutting,” said Carlos Capistran, chief economist for Canada and Mexico at Bank of America Securities. “We expect Banxico to cut 25bp in September.”

On Aug. 8, Banxico lowered its key interest rate for the first time since March, saying it would consider additional reductions despite a previous rise in consumer prices, mainly among some food and energy goods.

Although the central bank highlighted the 18 consecutive months of reductions in the core inflation rate, it lifted its forecast for headline consumer price increases in the last quarter of 2024 to 4.4% from 4% previously, and also for the first quarter of 2025, to 3.7% from 3.5%. The decision to cut provoked scrutiny over the past week.

In an interview with Bloomberg News, Deputy Governor Omar Mejia said a prolonged slide in core inflation and a recent economic slowdown were among factors that supported the bank’s decision to ease. He also said shocks on prices of fruits and vegetables “are typically short-lived, and the impact they could have on core inflation are practically nil.”

The majority of Banxico members underscored the economic activity weakness in the second quarter, according to the minutes of the August monetary policy meeting published later Thursday. Some policymakers said the slowdown was greater than expected and growth would be modest, while also highlighting that consumption maintained dynamism and construction boosted investment.

Most central bank members said they expect that the effects of recent supply shocks affecting non-core prices will dissipate quickly, thus allowing headline inflation to resume a downward trajectory. All policymakers said the disinflation process is expected to continue.

Analysts in a Citi survey published Aug. 20 forecast that policymakers will again lower borrowing costs by a quarter-point in September. They maintained their 2024 year-end inflation forecast at 4.60%, and lowered their estimate for year-end 2025 slightly to 3.86% from 3.90%.

--With assistance from Rafael Gayol and Jay Zhao-Murray.

(Updates with the central bank minutes in thirteenth and second-to-last paragraphs)