(Bloomberg) — US investors could be forced to offload around $800 billion of Chinese equities “in an extreme scenario” of financial decoupling between the world’s two largest economies, Goldman Sachs Group Inc. estimates.

Currently around 7% of market capitalization of Chinese companies’ American Depositary Receipts, or ADRs, are held by US institutions that may not be able to trade in Hong Kong, Goldman analysts including Kinger Lau wrote in a note dated Wednesday. That means such investors may not be able to go to the Asian financial hub to purchase shares if companies like Alibaba Group Holding Ltd. ( BABA ) face an involuntary delisting from the US.

Goldman ( GS ) is joining a group of global banks that have started assessing the worst outcome for investors as the once-unthinkable prospect of a financial divorce between the US and China grows with an escalating trade war. Concerns about American stock exchanges kicking Chinese firms out, which became an issue during President Donald Trump’s first term, have resurfaced after Treasury Secretary Scott Bessent’s recent comment that all options are “on the table” in trade talks with China.

“The extreme levels of uncertainty in the global trading system have led to extraordinary volatility in the global capital markets, and concerns about global recession and decoupling risks between the two largest economies globally in other strategic cohorts,” the analysts wrote. They estimate that in a forced delisting scenario, ADRs and the MSCI China Index could see 9% and 4% valuation drawdown from current prices, respectively.

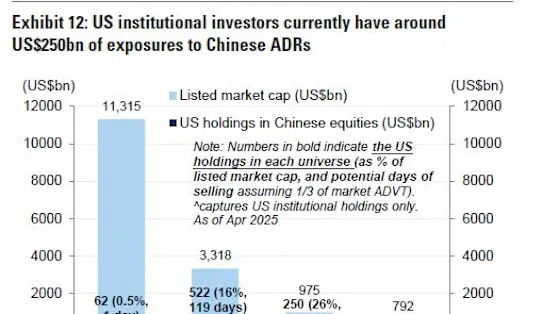

US institutional investors currently own about $250 billion worth of Chinese ADRs, or 26% of the total market value, according to Goldman. Their exposure to Hong Kong stocks amounts to $522 billion or 16% of the market’s total. They own about 0.5% of China’s onshore equities known as A shares. Together, that amounts to more than $800 billion worth of Chinese shares.

It may take just one day for US investors to complete sales of their A shares, while it may require 119 and 97 days to exit Hong Kong stocks and ADRs, respectively, Goldman estimates.

Meanwhile, in the same extreme scenario, Chinese investors might need to unload their US financial assets, which could amount to US$1.7 trillion, they wrote, adding that around US$370 billion of which would be in equities and US$1.3 trillion in bonds.

Among US passive funds, the Kraneshares CSI China Internet Fund, the largest China-focused exchange-traded fund in the US, could be more impacted in the event of forced liquidation due to ADR delisting, Goldman said. The fund has the highest weighting of ADRs at 33%, half of which do not carry Hong Kong listings, as well as a 72% ownership by US investors, the bank’s analysts added.

Earlier, JPMorgan Chase & Co. ( JPM ) estimated that ADR delistings could lead to removal from global indexes, resulting in aggregate passive outflows of around $11 billion.

(Updates with new chart and more details)