(Bloomberg) -- Stocks in Asia were primed for gains Thursday after further signs the Federal Reserve will cut interest rates next month lifted Wall Street.

Share futures for Japan, Australia and Hong Kong all rose, while a gauge of US-listed Chinese shares climbed 2.4%. Contracts for US equities also edged higher in early Asian trading after the S&P 500 and Nasdaq 100 indexes both advanced Wednesday.

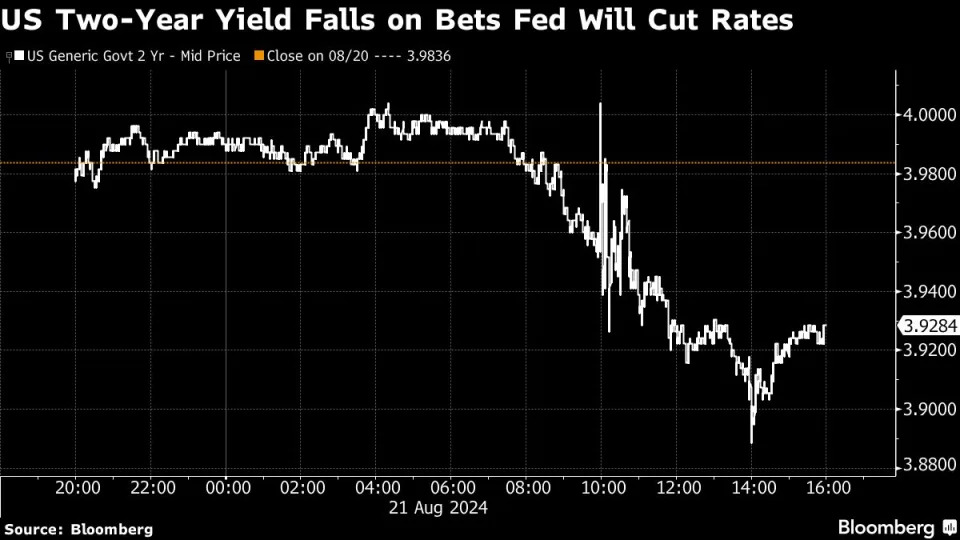

Shorter-term Treasuries outperformed Wednesday, with two-year yields falling almost 10 basis points before paring the move. Treasury 10-year yields fell one basis point to 3.80%. Traders were once again pricing in more than 1 percentage point worth of Fed easing by the end of 2024, starting next month.

The moves followed minutes from the latest Fed policy meeting that showed several officials acknowledged a plausible case for cutting rates, before the central bank voted to keep them steady. Fed Chair Jerome Powell will have a chance to offer investors further clarity when he speaks in the Jackson Hole economic symposium on Friday.

“The Fed minutes removed all doubt about a September rate cut,” said Jamie Cox at Harris Financial Group. “The Fed’s communication strategy is to make its meetings less of a market moving event, and they are following the script to the letter.”

A likely revision to US job growth added further evidence for traders to expect a September rate cut. The number of workers on payrolls will likely be revised down by 818,000 for the 12 months through March — or around 68,000 less each month — according to the Bureau of Labor Statistics’ preliminary benchmark revision. It was the largest downward revision since 2009.

In Asia, the yen strengthened against the dollar for a fifth consecutive session to trade at the highest level in two weeks. Bank of Japan Governor Kazuo Ueda is expected to face scrutiny over the central bank’s rate hikes when he responds to questions from lawmakers on Thursday.

Elsewhere, China launched an anti-subsidy investigation into dairy imports from the European Union, as trade tensions escalated between the two sides. The probe will target several dairy products, including fresh and processed cheese, China’s Ministry of Commerce said in a statement Wednesday.

Jackson Hole

The Jackson Hole economic symposium kicks off Thursday — with Fed Chair Powell expected to speak on Friday morning. And the S&P 500 is on pace to enter the event with the second strongest year-to-date performance since the year 2000, according to data compiled by Bespoke Investment Group.

While performance leading up to Jackson Hole has been positive in 2024, the index has risen only a third of the time during the symposium across these prior instances with an average decline of 1.37% over the few days it takes place, Bespoke said. The index has also averaged declines the next day, week, and through the next Fed meeting. That’s roughly a three-week period after the last day of the symposium.

To Jennifer McKeown at Capital Economics, central bankers are unlikely to offer much forward guidance at the Jackson Hole symposium, preferring to stress their “data dependence.”

“Since most economies are expanding, inflation is easing back to target and financial markets have stabilized after the recession scare a few weeks ago, there is less pressure for them to steer markets than there has been around past events,” she noted. “But they risk keeping rates too high for too long.”

In commodities, oil steadied on Thursday after slumping in the session before. Gold was also little changed after trading near a record high on the expectations of a Fed interest rate cut.

Key events this week:

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.