Investors shouldn't be rushing into the latest rally in stocks, billionaire investor Mark Mobius says.

In a recent interview with CNBC , the Mobius Capital Partners founder advised investors to keep at least 20% of their portfolio in cash while they wait for a buying opportunity. Mobius cautioned investors to be alert as a troubling signal flashes in the economy.

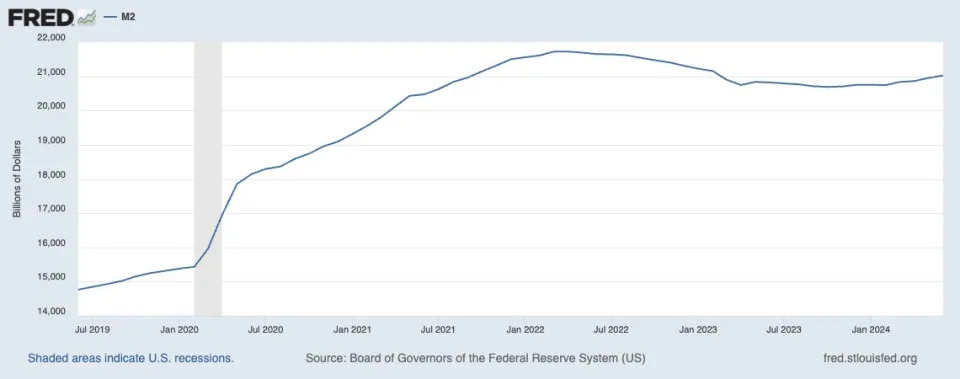

M2 money supply surged during the pandemic, but has contracted for most of the past few years, with the total stock of M2 now 3% lower from its peak several years ago, according to Federal Reserve data.

That's the largest drawdown in the total money supply seen in nearly a century, Mobius said, adding that stock bulls shouldn't get too excited over the latest rally in stocks.

"This decline is historically significant because M2 had not seen such a drop in over 90 years," Mobius said. "The main concern is that if the M2 money supply has declined since April 2022 and hasn't kept pace with economic growth, there could be less capital available for the discretionary spending that has driven the current economic expansion and bull market on Wall Street."

Other forecasters have flagged the contraction in the money supply as a potential sign of an economic slowdown. The M2 money supply has only contracted four times in total over the past century, and was followed by a recession in each instance , according to veteran economist Steve Hanke.

The trend has also coincided with a number of other warnings over the strength of the economy. The job market has slowed steadily over the last year, with unemployment recently spiking to its highest level since the pandemic. Some sectors, like housing and manufacturing, are already seeing a slowdown as high interest rates weigh on activity.

In the meantime, investors should be waiting for a buying opportunities in the market, and doing their research on companies with strong financials, Mobius added.

"Look for companies with little or no debt, moderate earnings growth, and high return on capital, and get ready to re-enter the market," he said of the future. "Companies with weak balance sheets, low or no earnings growth, and high debt, will be in deep trouble."

Investors are headed into a more uncertain investing environment, with markets keeping a close eye on recession risks, geopolitical tensions, and the upcoming presidential election.

Traders, though, are generally feeling more confident about stocks than they did at the start of the month. 43% of investors said they felt bullish on stocks over the next half-year, according to AAII's latest Investor Sentiment Survey .

Read the original article on Business Insider