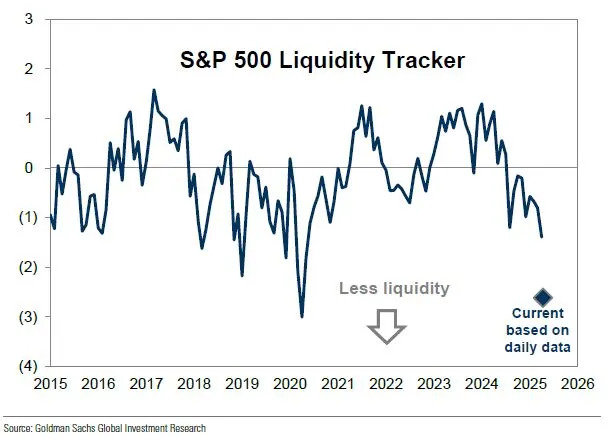

(Bloomberg) — The equity market’s liquidity has deteriorated sharply in the last few weeks, contributing to a spike in volatility as tariff worries rocked markets, according to Goldman Sachs Group Inc. strategists.

Sudden drops in liquidity are usually associated with a wider distribution of equity returns as well as “periods of falling risk appetite and tightening financial conditions” — two conditions that were met during the past month, strategists led by David Kostin wrote in a late Friday note.

Last Wednesday’s S&P 500 ( ^GSPC ) intraday trading band was the widest since the global financial crisis, as US President Donald Trump’s tariff disputes and reprieves caused global markets to gyrate. The weekly realized S&P 500 volatility jumping to its highest levels since the Covid pandemic and to the 99th percentile compared with the previous half a century, they wrote.

“Uncertainty around the economic outlook and the trajectory of trade policy has made the market particularly sensitive to news flow,” the strategists said. “Equity market liquidity has deteriorated in a negative feedback loop with recent volatility.”