(Bloomberg) -- Investors should sell any rallies in the S&P 500 Index until the Federal Reserve steps in and the US and China de-escalate the global trade war, according to Bank of America Corp.’s Michael Hartnett.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen

The strategist said President Donald Trump’s tariffs and the resulting market turmoil were turning US exceptionalism into “US repudiation.” He recommends a short position on stocks — until the S&P 500 hits 4,800 points — and a long bet on two-year Treasuries.

Higher bond yields, lower stocks and a weaker dollar are “driving global asset liquidation, will likely force policymakers to act,” Hartnett wrote in a note. But investors should “sell the rips in risk assets.”

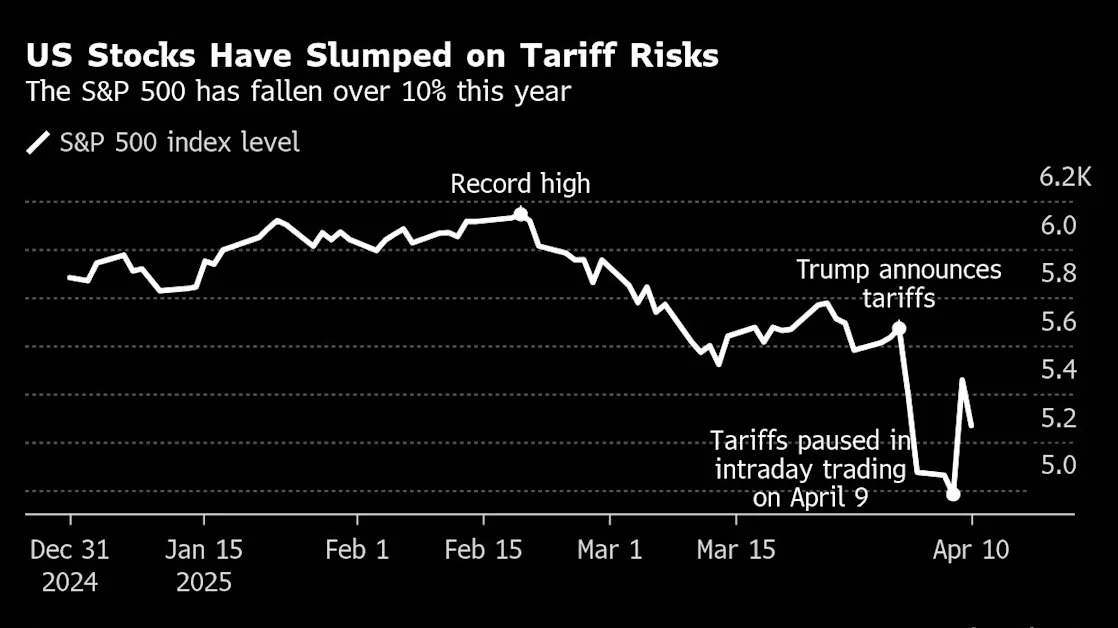

The S&P 500 has slumped over 10% this year as Trump’s unpredictable tariff policy hammered global sentiment. The president’s announcement of sweeping levies last week cratered equities worldwide and fueled worries about a recession.

This week Trump said he was pausing some tariffs for 90 days, although he raised duties on China to 145% after the world’s second-biggest economy said it would apply tit-for-tat levies. On Friday, China said it will increase tariffs on US goods to 125%.

The S&P 500 rallied the most since 2008 after tariffs were paused, but resumed declines Thursday in a sign of low conviction in the rebound. Hartnett said he would be short until the Fed cuts interest rates “hard” to break the cycle of liquidation and for the US and China to pause the trade war.

He recommended buying the S&P 500 around 4,800 points — a decline of another 9% from Thursday’s close — “if policy panic makes recession short/shallow.” But he said many investors had shown “tremendous pushback” to that view as they expect a slump in earnings estimates to send the index toward 4,000.

--With assistance from Michael Msika.