Relentless optimism in the face of market chaos paved the way to monster gains for individual investors who kept buying the dip as stocks cratered.

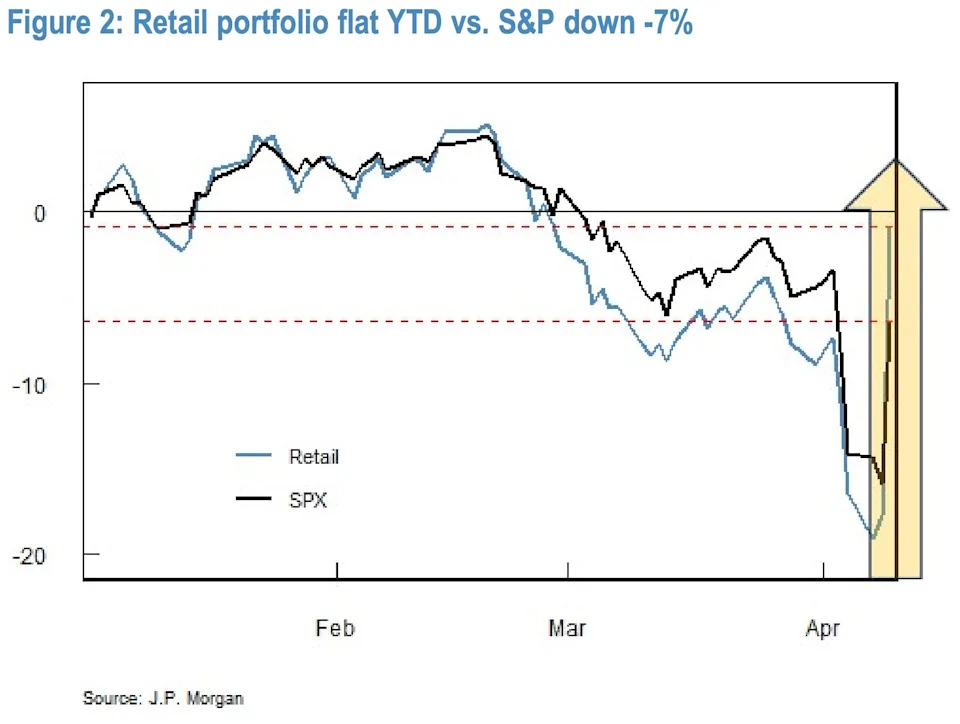

Retail portfolios netted a 17% gain on Wednesday after indexes did a stunning about-face following an abrupt 90-day pause to US tariff policy . According to JPMorgan, that's helped boost retail's year-to-date performance to -0.8% compared to a 7% loss for the benchmark S&P 500 .

"The willingness of Retail investors to place confidence on market upside despite radical policy uncertainty has clearly paid off," JPMorgan analysts wrote on Wednesday.

Retail traders seemed unshaken by the market's massive fallout since last week, sparked by aggressive tariffs unveiled by the White House on April 2. While many analysts feared President Donald Trump's reciprocal duties could unleash a global trade war and kick off a recession , risk-on retail investors stayed bullish.

In the same week that the S&P tanked 14% peak-to-trough, individual investors bought $11 billion of stock through Wednesday, the bank said, exceeding the last 12-month average.

After a record $4.7 billion in inflows last Thursday , Tuesday and Wednesday raked in another $3.5 billion and $4.8 billion, respectively. $1.5 billion in outflows occurred Monday, the highest level in the past two years.

Nvidia , an enduring favorite among the retail crowd, was the biggest winner. The cohort bought $3.5 billion worth of single stocks, and the chipmaker accounted for about $3 billion of that, JPMorgan said.

Meanwhile, it may be the case that dip-buying accelerated on Wednesday due to Trump's own prompting. The morning before he paused reciprocal duties on all countries but China, the president called on investors to "BE COOL," adding that " THIS IS A GREAT TIME TO BUY. "

The pause caused indexes to spring up as much as 10%. In reaction, online retail traders suggested that this was a form of market manipulation, and the phrase briefly trended on X.

Read the original article on Business Insider