Bitcoin (CRYPTO: BTC) soared to an all-time high of $106,182 per coin in January. With the fourth Bitcoin halving firmly in the rearview mirror and a more crypto-friendly regime in the White House, the original cryptocurrency looked ready to skyrocket like it did in 2020 and 2017.

But it hasn't worked out that way. Bitcoin is down to $79,200 as of this writing on April 8. That's a hair-raising 25% price crash, well ahead of the S&P 500 (SNPINDEX: ^GSPC) stock market tracker's 19% drop.

Is this the start of a three-year crypto winter like the one you saw after the 2017 peak, or is it a temporary pullback like in the spring of 2021? Nobody knows for sure, but here's how I look at the Bitcoin situation today.

Bitcoin's volatile roller coaster

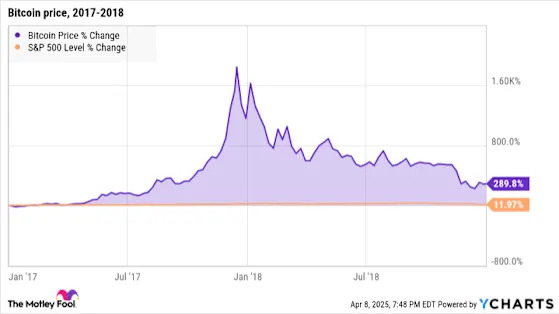

Bitcoin has a long history of extreme volatility. The oldest cryptocurrency swung from $785 per coin at the start of 2017 to $19,345 in mid-December. About one year after that, it ended 2018 at $3,880 per coin. The S&P 500 gained a modest 12% over that period, which looks like a horizontal line by comparison:

The recent price swings are actually quite modest from a historical perspective. The cryptocurrency's daily standard deviance is about 2.7% in 2025. This volatility measure was twice that size in 2017 and just astronomical in 2009 and 2010:

Past performance is no guarantee of future results, but this volatility chart shows a couple of helpful trends.

Not just fancy chart art

You didn't come here for the math, and I can't blame you for distrusting Bitcoin's charting patterns. Technical analysis is more performance art than financial science, and the chart-based musings above are kinda-sorta an example of that nonsense.

Then again, I'm also basing the discussion on more than the basic chart squiggles. There are reasons for Bitcoin's four-year cyclicality, because the economic model of producing more coins keeps changing at that pace. Every turn of the wheel is unique, as the economic environment around the crypto sector keeps changing. Still, the halving events make a real difference -- hard to predict with pinpoint accuracy, but still useful as a guiding rule of thumb.

My two Satoshis (digital micro-cents): Why Bitcoin's future still looks bright

And after all of that, I'm convinced that Bitcoin will recover from the recent price cuts. It could take a few months, and there may be more pain to come, but I'll be shocked if the tide doesn't turn in the second half of 2025.

This digital currency was designed as a secure long-term storage facility for monetary value, also known as wealth. Strategy (NASDAQ: MSTR) chairman and co-founder Michael Saylor will talk your ear off on that topic while turning every possible stone to buy more Bitcoin for the company. One of my college-age kids just started her investment journey with an early Roth IRA account, and about 2% of that portfolio holds a popular Bitcoin ETF.

I'm no Saylor-style Bitcoin maximalist, but a small amount of exposure to the original crypto name seems appropriate for most investors. Getting in below $85,000 per coin is a serious discount from just three months ago, making the cryptocurrency about 25% more interesting.

Before you buy stock in Bitcoin, consider this:

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $469,399 !*

Now, it’s worth noting Stock Advisor ’s total average return is 731% — a market-crushing outperformance compared to 146% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor .