The bitcoin ( BTC ) price is likely to become more volatile after dipping below $75,000 twice in the past week as it extends its drop from the all-time high of $109,000 reached on Jan 20.

That's taken it into what Glassnode shows as an “air pocket” between $70,000 and $80,000 created after the largest cryptocurrency soared following President Donald Trump's election victory in November.

The largest cryptocurrency climbed to over $100,000 from $70,000 after the vote without ever revisiting its starting point. Historically, when bitcoin rallies without consolidating at key levels, it often returns to retest them later. This lack of price interaction implies low supply, increasing the likelihood of rapid movement.

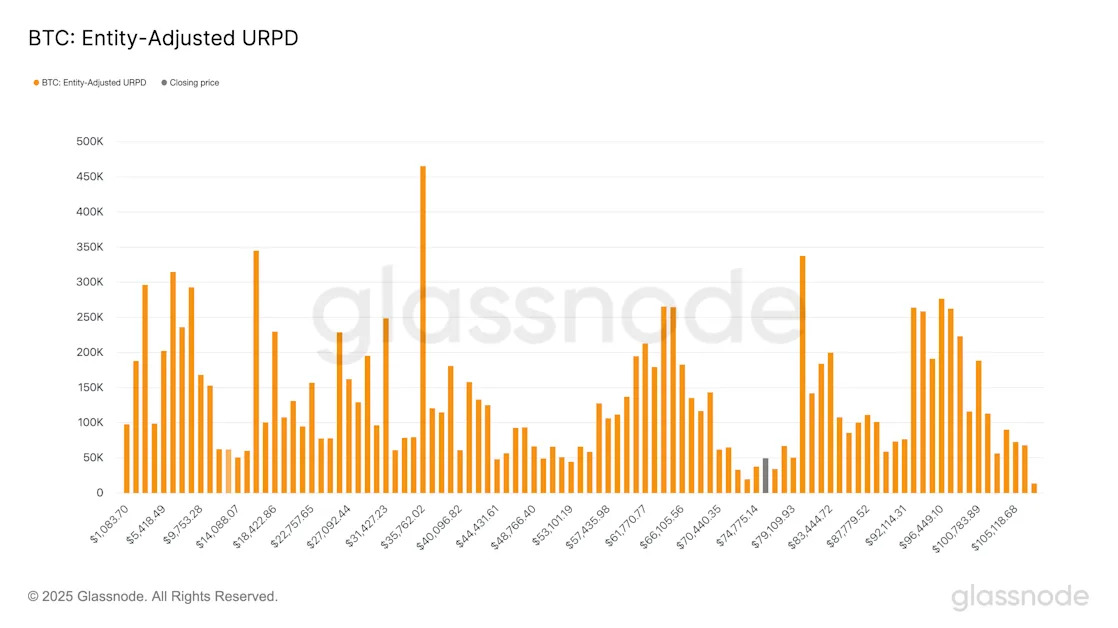

One way of showing this is to look at bitcoin's unspent transaction output (UTXO), which represents the amount of bitcoin received but unspent, i.e. still available for use in transactions.

The UTXO Realized Price Distribution (URPD) shows the prices at which existing bitcoin UTXOs last moved. In this version, each holder’s average acquisition price is used to sort their full balance into the appropriate price bucket.

In order to establish a sustainable move — either higher or lower — bitcoin will likely need to consolidate within this "air pocket" range. As illustrated in the chart, less than 2% of total supply sits here, suggesting that price action in this region could remain volatile due to the lack of supply.

Around 25% of bitcoin's supply is currently held at a loss, primarily by short-term holders who bought within the last 155 days.