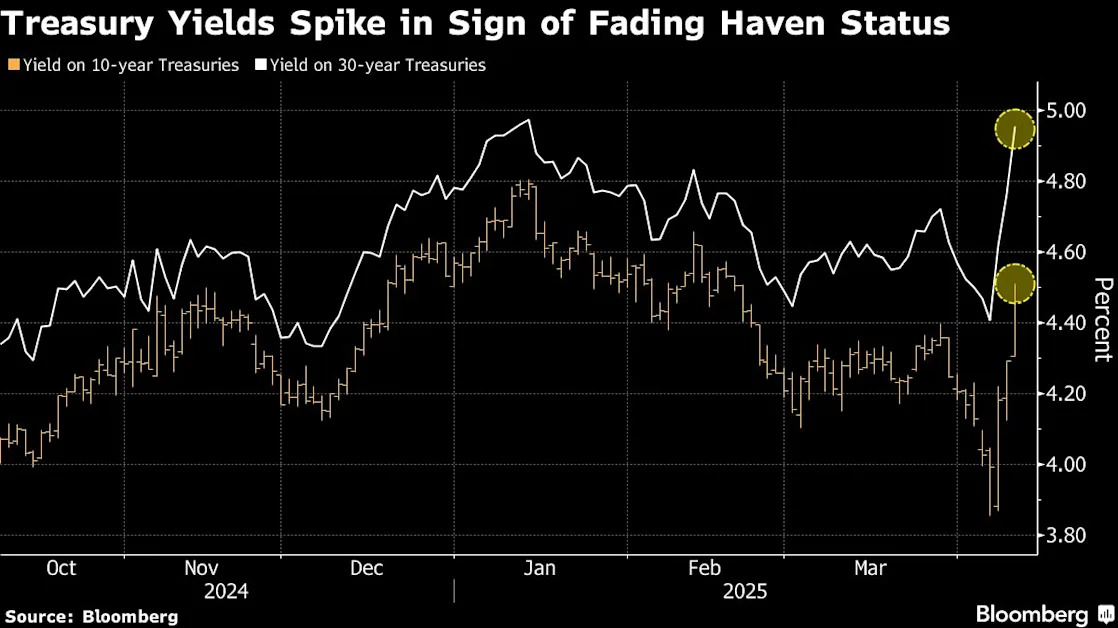

(Bloomberg) -- A pullback from US Treasuries sent longer-term yields surging by the most since pandemic struck in 2020, deepening losses in what’s supposed to be a haven from financial turmoil and roiling markets abroad as investors sold government bonds.

The yield on 30-year Treasuries briefly pushed over 5% in Asia and the pressure seeped into other markets, with yields rising sharply in Australia, the UK and in the developing world.

The selloff eased during the US trading day as stocks rebounded and the results of a 10-year note sale by the US Treasury alleviated some concerns that key buyers may start stepping back due to the turmoil unleashed by President Donald Trump’s trade war.

But yields remained elevated — if below the day’s previous peaks — soon after the auction results were announced, with the 30-year up 8 basis points at around 4.85% and the 10-year up 10 basis points at 4.4%.

By driving up the borrowing costs across the financial system, the jump in yields is threatening to deal another shock to a global economy already at risk of a recession as Trump’s tariffs upend world trade. There’s also lingering worries that crucial overseas investors — like China — may sell US Treasuries to retaliate or that markets are at risk of seizing up as investors battered by recent turmoil rush to raise funds.

“This is creating a triple whammy for the economy – a trade war, uncertainty and now higher rates,” said Priya Misra, portfolio manager at J.P. Morgan Investment Management.

The surge in yields, which set the baseline for everything from mortgage costs to loan rates, is working against what Treasury Secretary Scott Bessent had singled out as a key goal of Trump’s economic policy — helping consumers by pulling down borrowing costs. He downplayed any worries of a systemic crisis in a television interview, saying it was “uncomfortable but normal deleveraging that’s going on in the bond market,” and he predicted it wouldn’t persist.

The scale of the moves has fueled speculation that investors abroad may respond by selling bonds. Such investors are crucial to financing the US government’s budget deficit, raising the specter of a buyers strike like the one that rapidly swept former UK Prime Minister Liz Truss from office when her fiscal plans unnerved investors.

That weighed on Treasuries in the run up to the 10-year auction, and yields pulled back some when the results allayed some of those immediate concerns.

“There was a collect sigh of relief,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management.

The fall in bond prices left investors without havens as European and Asian stocks tumbled again, with Europe’s Stoxx 600 sinking about 3%. But the equity selloff halted in the US, where stocks rebounded on renewed hopes that Trump will negotiate his tariffs downward and he moved to talk up the market, in what appeared to be one of his strongest signs of concern about the rout set off.

The sharp and unusual spike in Treasury yields in recent days vexed traders who offered various explanations, including the risk that the government’s budget deficit will worsen if the economy contracts or the administration uses fiscal policy to offset some of the hit.

Others pointed to a deeper sense of worry and the possibility of hidden risks. Some of the speculation settled on the possibility that hedge funds were forced to rapidly unwind basis trades, which use leverage to bet on small market discrepancies, as happened during the selloffs that erupted in 2020.

George Saravelos, global head of FX strategy at Deutsche Bank AG, warned “we entering unchartered territory in the global financial system” and that “if recent disruption in the US Treasury market continues we see no other option for the Fed but to step in with emergency purchases of US Treasuries to stabilize the bond market.”

What Bloomberg’s Strategists Say...

“This is a perfect storm for Treasuries, and the price action is reflecting that. Margin calls will be coming thick and fast, and Treasuries will not escape liquidation.”

Simon White, macro strategist

Some investors speculated that global reserve managers, for example China, could be re-evaluating their positions in US government debt given the seismic impact of Trump’s trade policies. Both China and Japan had already been reducing their Treasuries holdings for some time, at least according to official data.

“Is this sovereign selling? That’s the one everyone keeps asking,” said Julian Brigden, co-founder of Macro Intelligence 2 Partners. “This is an economic war. It’s absolutely the sell the US trade.”

--With assistance from Masahiro Hidaka, Garfield Reynolds, Sagarika Jaisinghani and Ruth Carson.

(Updates to add comment in 10th paragraph.)

More stories like this are available on bloomberg.com