A double-digit earnings hit to American building product companies is on the horizon as tariffs stir up industry headwinds.

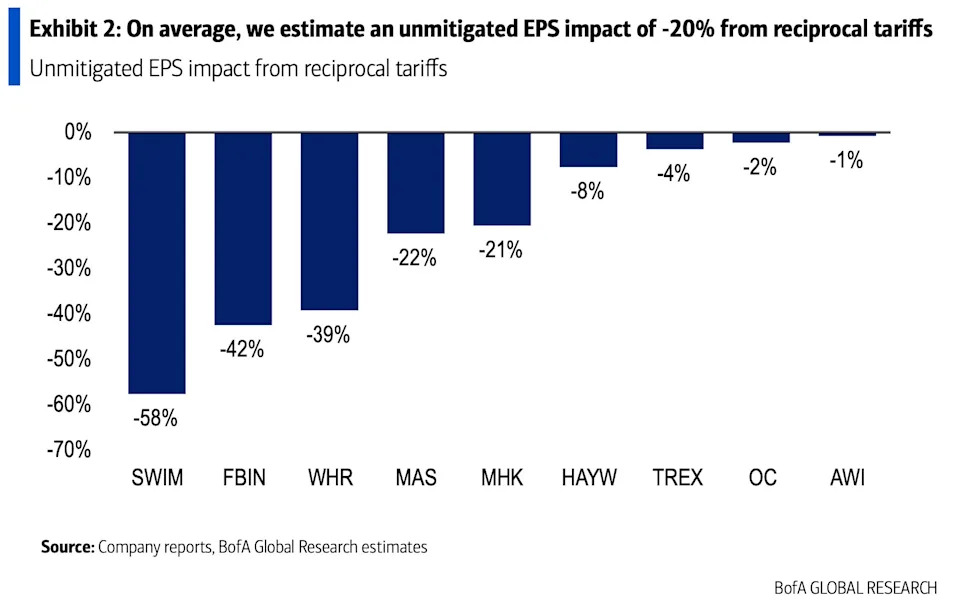

Bank of America said unmitigated earnings-per-share could tank 20% across the sector unless current tariff announcements are adjusted. Earnings are the chief driver of a stock's performance.

Last Wednesday, President Donald Trump unleashed a slew of tariffs that far surpassed market expectations . Some countries now face steep duties, which is likely to trigger price hikes on building components sourced outside the US.

Construction product and distributor firms suffered a 12% market plunge since the announcement, BofA noted.

"We believe the announcement was most negative for plumbing manufacturers (FBIN/ MAS ) that have shiſted production out of China into SE Asia in recent years and still have China exposure," bank analysts wrote Tuesday. "Mohawk and Whirlpool could be relatively well positioned vs. competitors that have a smaller US manufacturing footprint, but could face demand destruction in a weak economic backdrop."

Some companies are bound to see a bigger EPS decline, with the Latham Group and Fortune Brands Innovation potentially facing a 58% and 42% earnings drop, the bank said. However, these estimates could change meaningfully based on how trade policy evolves.

But overall, the bank's forecasts show how tariffs are injecting extreme uncertainty into the US housing market. While US levies may have helped ease mortgage rates since Wednesday, industry insiders are turning cautious about higher home prices to come.

A National Association of Home Builders survey recently estimated that the cost of a home will rise $9,200 because of tariffs.

BofA notes that some manufacturers have already announced price hikes to offset changing trade headwinds , though product volumes are at risk of falling if tariffs impact demand.

On average, the bank expects that prices will need to climb 1.5% to counterbalance new duties.

Read the original article on Business Insider