Cathie Wood’s ARK Invest has adopted a unique strategy following President Donald Trump’s Apr. 2 announcement of “reciprocal tariffs.”

The investment firm’s strategy involves buying the dip in Coinbase Global (Nasdaq: COIN) stocks and offloading the stocks of its own spot Bitcoin exchange-traded funds (ETFs).

Since the declaration of “Liberation Day,” ARK Invest has bought Coinbase Global (COIN) stocks worth more than $26 million. The investment firm purchased COIN stocks worth $13 million on Apr. 4 and $13 million on Apr. 7.

COIN has slipped from the high point of $185.6 on Apr. 2 to $161.74 in pre-market hours on Apr. 8, reflecting a decline of more than 12% since the tariffs announcement.

The firm has also acquired $9 million in Amazon (Nasdaq: AMZN) stocks and $15 million in Nvidia Corp. (Nasdaq: NVDA) stocks since the announcement. The tech stocks has been stumbling since Apr. 2.

Though it increased its position in these stocks, ARK Invest sold $12 million in ARK 21Shares Bitcoin ETF (ARKB) stocks on Apr. 7.

Note that the U.S. Securities and Exchange Commission approved the listing of spot Bitcoin ETFs in January 2024, and ARK Invest, along with 21 Shares, has been offering the ARKB ETF in the U.S. since then. As per SoSoValue , ARKB held net assets worth $3.72 billion as of Apr. 7.

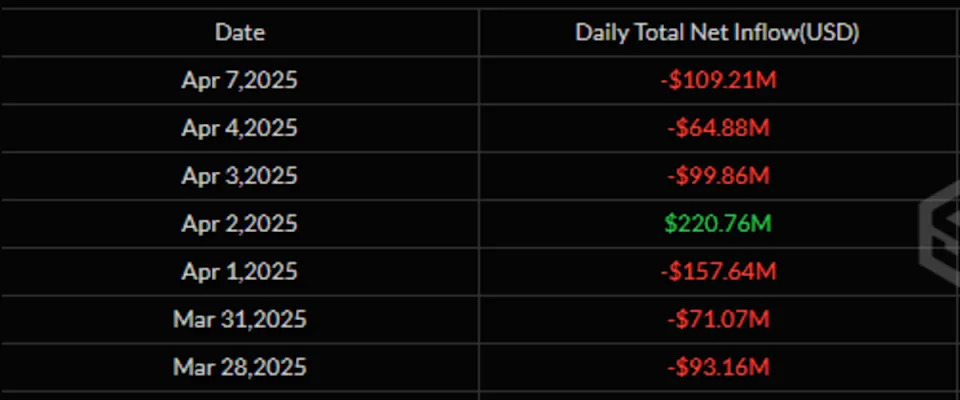

Though Bitcoin ETFs had been bleeding since February, there was some respite mid-March onwards. But as panic gripped the market around Trump’s announcement, Bitcoin ETFs didn’t witness a single day of positive inflow since March 28.

Spot Bitcoin ETFs have seen $274 million wiped out since Apr. 3.

Bitcoin was trading at $79,709.45 at press time, as per Kraken's price feeds .