(Bloomberg) -- As debate heats up on Wall Street over when the Federal Reserve will complete its current course of quantitative tightening, strategists are looking for more guidance on Wednesday when the US central bank releases the minutes of its latest policy meeting.

While most market-watchers are forecasting an end to the balance-sheet unwind sometime late this year, the exact timing is far from certain. That’s drawing attention to minutes from the July gathering, which may also offer clues on the path of interest rates.

Over the past week, the New York Fed posted a series of research notes on monetary policy implementation and reserve balances, themes that are key to the eventual end of QT. To Steven Zeng, a US rates strategist at Deutsche Bank, this is the type of signaling policymakers could use as they move closer to winding down the program.

“It’s possible they published those notes to address the recent chatter about what’s going on in repo — and QT needing to stop,” he said. “Those pieces don’t come out of a vacuum.”

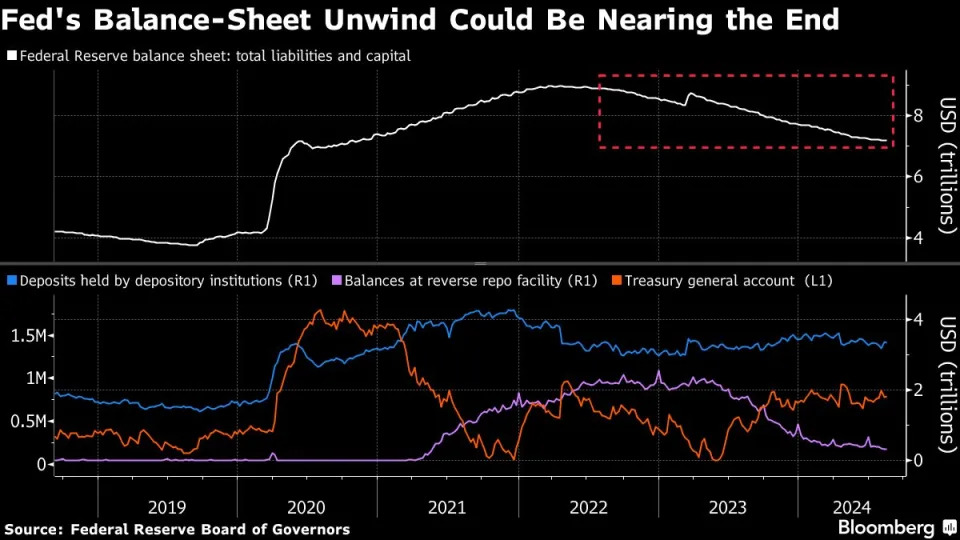

The central bank has been winding down its holdings since June 2022, during which time the balance sheet has shrunk by about $1.7 trillion to $7.2 trillion. In June, policymakers lowered the cap for how much Treasuries it will allow to mature without being reinvested each month to $25 billion from $60 billion, a step meant in part to ease potential strain on money-market rates.

The central bank has used July to announced important new tools that relate to funding markets in the past. In July 2013, the committee discussed the implementation of the Fed’s overnight reverse repurchase agreement facility, or RRP, a barometer or excess liquidity in the financial system. In July 2021, they launched the Standing Repo Facility for domestic and foreign firms.

This time, market participants are attuned to any updates on bank reserve balances. Policymakers have said they still see abundant levels, though there’s concern over whether that will last if QT continues. Usage of the Fed’s RRP fell below $300 billion this month, while overnight repo rates have been elevated outside of typical mid-month and month-end periods, suggesting primary dealers are struggling to stomach so much Treasury supply.

“There seems to be an increased focus on reserves,” said Gennadiy Goldberg, head of US interest rates strategy at TD Securities. “It shows that reserves are on the Fed’s mind more than they have been in recent months, which suggests we may get some conversations around the appropriate level of reserves at a forthcoming FOMC meeting. It also suggests increased odds that QT’s days are numbered.”

Even with reserves around $3.3 trillion, some in the market are concerned about liquidity in the financial system and how much further the Fed’s portfolio of assets can shrink before worrisome cracks — similar to those seen five years ago ahead of an acute funding squeeze — start to appear.

Among other issues, Wall Street is looking for policymakers to address whether developments in Treasury issuance and record dealer holdings has affected their QT plans, Zeng said.