The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how maintenance and repair distributors stocks fared in Q4, starting with Distribution Solutions (NASDAQ:DSGR).

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 9 maintenance and repair distributors stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9% since the latest earnings results.

Best Q4: Distribution Solutions (NASDAQ:DSGR)

Founded in 1952, Distribution Solutions (NASDAQ:DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Distribution Solutions reported revenues of $480.5 million, up 18.6% year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates.

The stock is down 4.2% since reporting and currently trades at $26.62.

Read why we think that Distribution Solutions is one of the best maintenance and repair distributors stocks, our full report is free.

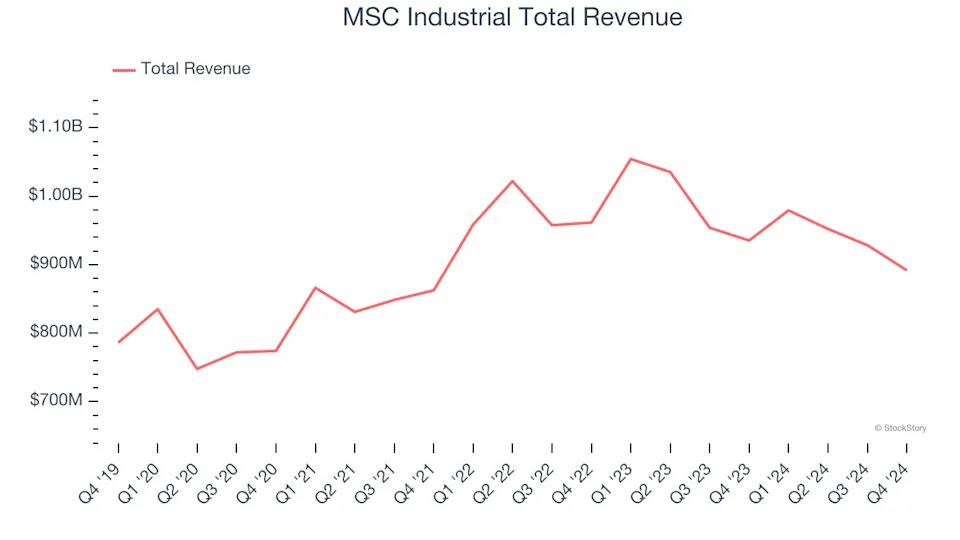

MSC Industrial (NYSE:MSM)

Founded in NYC’s Little Italy, MSC Industrial Direct (NYSE:MSM) provides industrial supplies and equipment, offering vast and reliable selection for customers such as contractors

MSC Industrial reported revenues of $891.7 million, down 4.7% year on year, falling short of analysts’ expectations by 0.8%. The business performed better than its peers, but it was unfortunately a mixed quarter with a solid beat of analysts’ EBITDA estimates but a slight miss of analysts’ organic revenue estimates.

The stock is down 6.7% since reporting. It currently trades at $74.

Is now the time to buy MSC Industrial? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Transcat (NASDAQ:TRNS)

Serving the pharmaceutical, industrial manufacturing, energy, and chemical process industries, Transcat (NASDAQ:TRNS) provides measurement instruments and supplies.

Transcat reported revenues of $66.75 million, up 2.4% year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Transcat delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 19.6% since the results and currently trades at $80.

Read our full analysis of Transcat’s results here.

VSE Corporation (NASDAQ:VSEC)

With roots dating back to 1959 and a strategic focus on extending the life of transportation assets, VSE Corporation (NASDAQ:VSEC) provides aftermarket parts distribution and maintenance, repair, and overhaul services for aircraft and vehicle fleets in commercial and government markets.

VSE Corporation reported revenues of $299 million, up 27.1% year on year. This result beat analysts’ expectations by 1.8%. Overall, it was a stunning quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

VSE Corporation scored the fastest revenue growth among its peers. The stock is up 10.3% since reporting and currently trades at $111.37.

Read our full, actionable report on VSE Corporation here, it’s free.

Fastenal (NASDAQ:FAST)

Founded in 1967, Fastenal (NASDAQ:FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

Fastenal reported revenues of $1.82 billion, up 3.7% year on year. This number lagged analysts' expectations by 1%. It was a slower quarter as it also produced a significant miss of analysts’ adjusted operating income estimates.

The stock is down 2.1% since reporting and currently trades at $73.20.

Read our full, actionable report on Fastenal here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .