(Bloomberg) -- Cryptocurrencies recovered from an earlier plunge in a whipsaw day of trading triggered by President Donald Trump’s onslaught of tariffs on US trading partners.

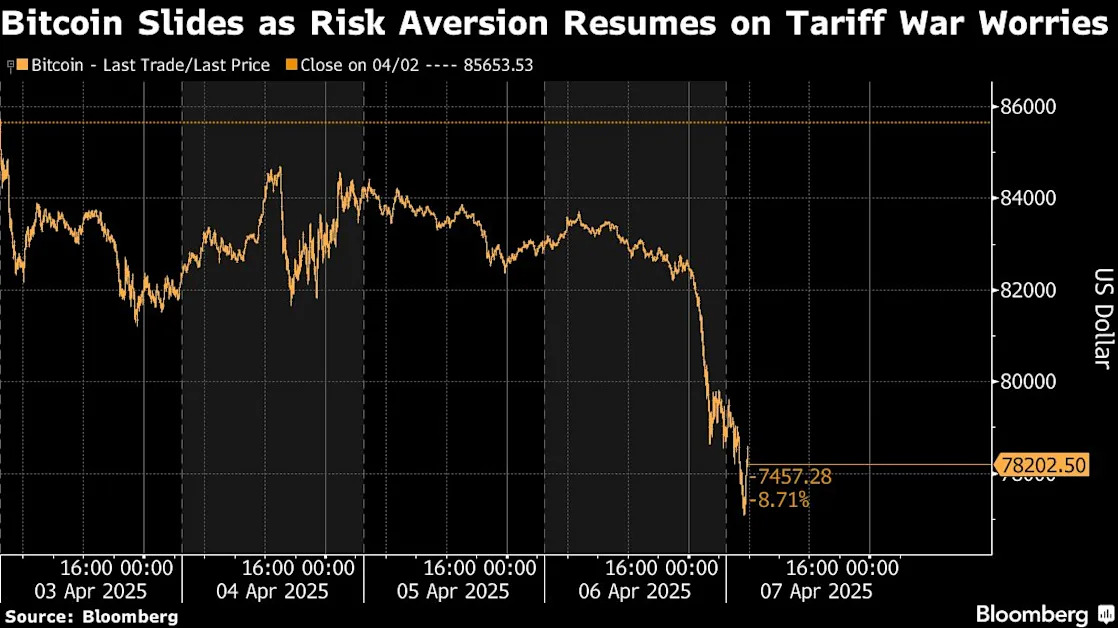

Bitcoin was little changed near the $79,000 level at 2:17 p.m. in New York after sinking as much as 5.6% to $74,425 early Monday, the lowest since the day after the 2024 election that returned the pro-crypto Trump to the White House and sparked a massive rally in digital assets that peaked on the day of his inauguration in January. Smaller tokens that saw even steeper declines early Monday also recovered, with XRP, Solana and Cardano all trading little changed.

The total market capitalization of all cryptocurrencies earlier fell about 11% to $2.5 trillion, roughly where it stood when Trump sealed his victory, according to CoinGecko data.

Crypto joined other markets roiled by volatility as traders try to assess the potential macroeconomic ramifications of Trump’s sweeping tariffs, which have already wiped trillions of dollars in value from global equities and dashed hopes that crypto would withstand the pressure better than other assets. Asian and European stocks sank, while US stocks swung wildly: The S&P 500 was litle changed after tumbling as much as 4.7% and rallying as much as 3.4% in the first hour of US trading on Monday.

The crypto industry was incredibly supportive of Trump’s second term, ranking it as one of the biggest bankrollers of his campaign last year. In return, US authorities have dismissed or paused most high-profile investigations into crypto businesses, while lawmakers are pushing ahead with new legislation to regulate the sector.

“Crypto came into 2025 expecting a Trump tailwind and got a Category 5 storm instead,” said Matthew Graham, chief executive and founder of crypto-focused venture capital firm Ryze Labs. “We expected the tailwind, and in return, he stiffed us.”

Coinglass data show about $1.5 billion worth of bullish crypto wagers were liquidated in the past 24 hours, the most this year.

Options markets suggest the selling pressure may continue “with the skew for puts picking up considerably,” said Sean McNulty, head of APAC derivatives at digital-asset prime brokerage FalconX.

Open interest — or the total number of outstanding contracts — for put options with a Bitcoin strike price of $70,000 is currently higher than for any other expiry, according to data from derivatives exchange Deribit. That highlights a growing demand for further downside protection.

Digital assets had shown some resistance to the panic that roiled markets after Trump first unveiled his tariff program, hinting at a possible breakaway from the gravitational pull of technology stocks. Monday’s gyrations indicate that the high positive correlation between crypto and the Nasdaq 100 that has prevailed since the Covid-19 pandemic may persist.

“Crypto is typically a leading indicator for risk assets,” said Julia Zhou, COO at crypto market maker Caladan.

--With assistance from Emily Nicolle.

(Updates chart and pricing throughout, adds quote in fifth paragraph.)