There are always at least some great stocks to buy at any given time. Finding stocks to buy and hold for the ultra-long haul, however, can be a different story. The underlying companies should be leaders of industries that are perpetually in demand. These organizations also need to be capable of adapting as needed to changes in the marketplace, whether those changes be technological leaps, evolving consumer preferences, or new competition.

Not too many companies fit this particular bill. However, there are a few names of this ilk that can be bought and held for a generation (or more), building more and more wealth the longer you and your heirs own them. Here's a closer look at three of your best bets among these tickers.

1. Amazon

There's no denying that Amazon 's (NASDAQ: AMZN) highest-growth days are in the past. The e-commerce market is mostly mature, and its competition is finally figuring out how to be, well, competitive.

It's not like this company doesn't have a strong second act lined up, though. In fact, it's got a couple of compelling growth engines revving already.

One of these engines is, of course, cloud computing.

Although Amazon Web Services (AWS) only accounts for less than one-fifth of the company's revenue, this arm drives nearly two-thirds of its operating income. It's still growing in a big way, too. Through the first half of the year, AWS' top line is up 18%, and there's much more of the same in store. Market research outfit Mordor Intelligence suggests the global cloud computing market is set to grow at an annualized pace of more than 16% through 2029.

The other key growth driver to be excited about is Amazon's advertising business.

You already know Amazon was launched as an e-commerce outfit, making little to no profit in its early days in exchange for the eventual dominance of the online shopping market it enjoys now. eMarketer reports that Amazon's share of the United States' retail market is on the order of 40%. It's increasingly monetizing the massive amount of web traffic Amazon.com draws, too.

But it's doing it in a different way. In addition to earning a small fee on its third-party sellers' sales or turning a small profit on sales of its own goods, Amazon now also collects money from third-party sellers that wish to prominently feature their products at the site. It did nearly $12.8 billion worth of this high-margin ad business during the second quarter alone, up 20% year over year.

Neither of these business models are particularly complicated or impossible for a rival to replicate. Both operations are capable of growing indefinitely, though, and Amazon already dominates each one. It's already the market leader of both, and Amazon is positioned to capture at least its fair share of each market's future growth.

2. PepsiCo

Coca-Cola is the typical go-to name for investors looking to add a dividend-paying consumer goods stock to their portfolio -- and understandably so. Almost everyone is familiar with its brands, and the company's not only paid a dividend like clockwork for decades, it has raised its annual dividend payments every year for the past 62 years. Nice.

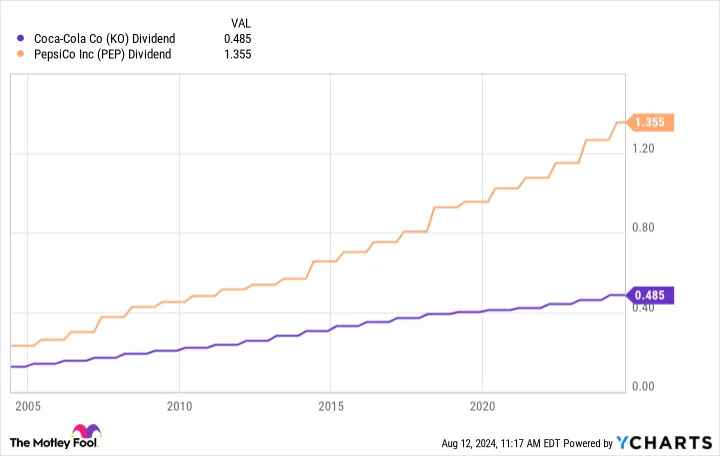

Coca-Cola isn't actually your best income-driving bet from the beverage arena, however. That honor belongs to rival PepsiCo (NASDAQ: PEP) . While it's only raised its annual dividend in each of the past 52 years, it's been raising it at a much faster clip than its archrival.

That's not PepsiCo stock's only difference from Coca-Cola. In contrast with Coca-Cola's more modest stock buybacks, PepsiCo's outstanding share count has fallen at a considerably faster pace than its rival's has over the course of the past 20 years.

A more aggressive stock-repurchase program is obviously a key reason PepsiCo's dividend growth has outpaced Coca-Cola's. Nevertheless, PepsiCo has demonstrated an ability and willingness to bolster its shareholders' net value to a degree Coke simply hasn't.

This will never be a high-growth name, to be clear. But slow and steady wins the race. The key to creating generational wealth with PepsiCo is buying it and then reinvesting its dividend payments in more shares of the stock. This slow accumulation of shares consistently accelerates your overall net growth the whole time you're holding this often-overlooked consumer staples name.

3. Berkshire Hathaway

Finally, add Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) to your list of stocks that could create lasting generational wealth.

It's not a stock in the traditional sense. Rather, Berkshire is a basket of stocks hand-picked by Warren Buffett and his lieutenants. From this perspective, it's not unlike a mutual fund.

Even that comparison somehow doesn't do it justice. A stake in Berkshire Hathaway is in many ways a means of letting Buffett manage your money for you based on his proven, value-minded approach to picking stocks. You need to be willing to make the same long-term commitment he is to a particular business. If you're truly generationally minded, that's no problem.

That being said, Warren Buffett's stock-picking prowess still isn't the top reason you might want to own Berkshire for the long haul.

Although it's rarely discussed, the majority of Berkshire Hathaway's value doesn't come from the stocks it's holding. As of the latest look, only about one-third of Berkshire's market cap of more than $900 billion reflects the sum total of all its equity investments.

The remainder reflects the value of all the wholly owned private companies that also help make up the conglomerate. These include battery company Duracell, underwear brand Fruit of the Loom, insurer Geico, flooring outfit Shaw Industries, and railroad BNSF, just to name a few. These are cash-generating businesses that arguably fare better in the long run by not being publicly traded, allowing them to sidestep misguided influence from short-term-minded shareholders.

That's what Berkshire Hathaway's performance suggests, anyway. Although it can lag the S&P 500 from time to time, in the long run, it reliably beats the overall market. That's why it's another one of those names you'll just want to buy and then leave alone for years on end, trusting in the underlying premise of the investment itself. Just remember that -- unlike PepsiCo -- there are no dividend payments to reinvest here. It's all capital appreciation.

Before you buy stock in Berkshire Hathaway, consider this: