(Bloomberg) -- Emerging-market equities are set to extend their best monthly performance since September as a rebound in Chinese shares gain momentum on more fiscal measures.

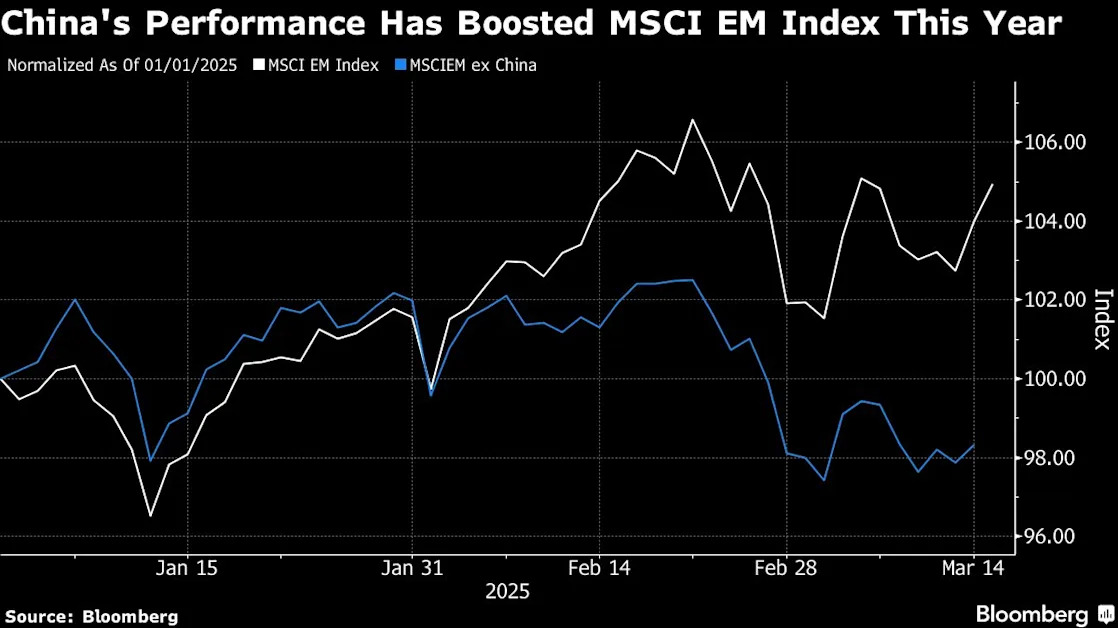

The MSCI Emerging-Market Index has risen nearly 3% in March, on track for the largest advance in six months, driven mainly by advances in Chinese equities. After a DeepSeek-fueled rally, investors have focused on further steps to revive consumption that would help sustain additional gains.

There are signs that domestic demand is picking up, with retail sales and industrial output rising faster-than-expected for the January-February period.

The latest efforts reinforce China’s priority to boost consumption and “this could help to broaden out the momentum we have seen in China stocks this year, primarily led by tech,” said Charu Chanana, chief investment strategist at Saxo Markets. “An improving earnings outlook could see broader participation from consumer, travel and health-care names,” she added.

Chinese shares have largely shrugged off the raft of economic data published Monday, though sentiment in the broader emerging market space has improved amid views that President Donald Trump’s tariff may not be as severe as initially expected. A slump in the greenback in March also boosted emerging-market stocks and currencies, with the MSCI EM currency index rising by 0.9% this month, the largest monthly gain since September.

Dollar bonds from China and South Korea were among the best performers across emerging markets on Monday, according to a Bloomberg index.

The laggards were led by Kenya, after the government agreed with the International Monetary Fund not to proceed with the final review of its existing facility and seek a new program.

In contrast, there was less impact on Romania’s bonds after Moody’s Ratings lowered the outlook on the country’s debt, increasing the risk it could be cut to junk. While political turmoil is hindering efforts to narrow the budget gap before a presidential election re-run, analysts at Erste Group Bank AG said the Moody’s move was merely bringing the firm in line with S&P Global Ratings and Fitch Ratings.

The Romanian market also got a boost last week when former far-right frontrunner Calin Georgescu was excluded by the electoral bureau from the race. Current far-right candidate George Simion would likely win the first round of the May presidential election, but lose in a runoff, a poll showed.

--With assistance from Ravil Shirodkar.