(Bloomberg) -- Citigroup Inc.’s strategists have abandoned a once-popular “Trump trade.”

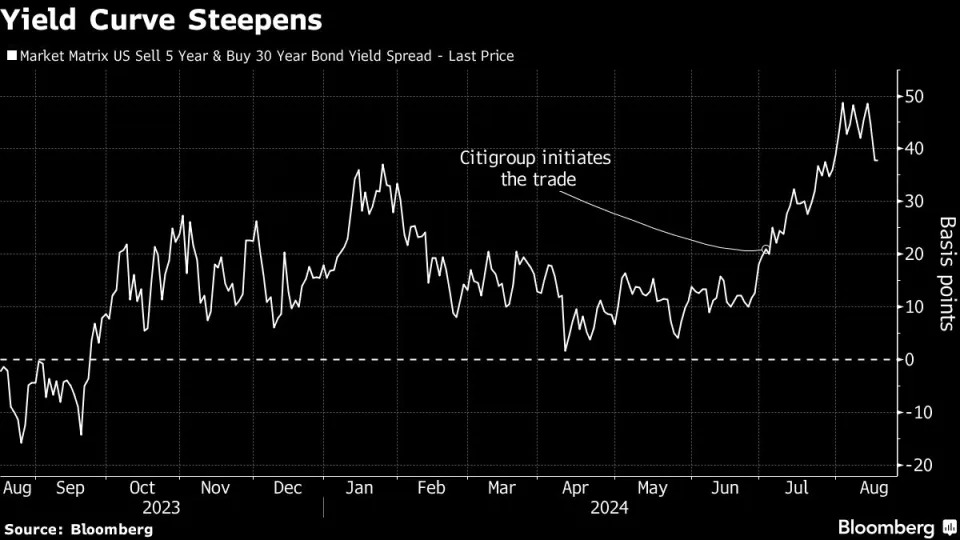

The bank’s global macro strategy team on Friday recommended clients exit any remaining bets that 30-year Treasuries will underperform five-year notes, after taking profit on half of the position earlier this month. The gap between five-year and 30-year yields has increased to 38 basis points, from around 20 basis points when Citigroup first recommended the trade.

Strategists led by Dirk Willer touted the so-called curve steepener trade after President Joe Biden’s poor debate performance in late June appeared to clear Donald Trump’s path to retake the White House.

The former president’s support for looser fiscal policy and steep tariffs are generally expected to deepen the federal deficit and fuel inflation, which would undermine longer-term bonds. The trade would also benefit from a Federal Reserve move to cut interest rates, leading shorter-maturity notes to outperform.

By Aug. 2, Willer and his colleagues were advising investors start trimming the position, after a surprising rise in unemployment sent five-year yields to the lowest since May 2023, a move the strategists deemed as excessive.

Citigroup unwound the remainder of the trade as Trump’s odds of winning the Nov. 5 election in the betting market slipped following Kamala Harris’s replacement of Biden as the Democratic nominee.

This week’s stronger-than-expected retail sales and lower-than-forecast jobless claims also suggest that Fed Chair Jerome Powell is less likely to signal aggressive policy easing at a symposium in Jackson Hole, Wyoming next week, according to the strategists. The rate market has fully priced in a quarter-point cut at the Fed’s next policy meeting in September and a 16% of a chance for a jumbo half-point reduction.

“Election trades have disappeared from the field of vision of the market and will likely not come back prior to the September FOMC,” Willer wrote in a note. “The combination of strong retail sales and lower claims means that Powell will be hard pressed to be more dovish than market pricing in the upcoming Jackson Hole meeting.”

The Treasury yield curve typically steepens as the Fed starts to lower interest rates, leading policy-sensitive shorter-term bonds to outperform.

Willer said the steepener remains the “right trade in the bigger picture,” but it’s costs about 12 basis points a month to hold the position. As a result, “we tactically take profits on this trade.”