(Bloomberg) -- US stocks have gone from euphoria to the brink of a correction in a matter of weeks. Now, US inflation data due Wednesday are poised to give the S&P 500 another jolt of volatility, as options traders see it.

Options markets expect the S&P 500 Index to swing 1.5% in either direction on Wednesday after the consumer-price index report, according to data compiled by Piper Sandler. That’s above an average move of 0.8% during CPI sessions in the past 12 months, and the largest implied move ahead of such data in at least two years.

It’s already a precarious time for stocks, with the S&P 500 teetering on the brink of a correction — down roughly 9% from an all-time high it hit just three weeks ago. Strategists are souring on stocks, with Citigroup Inc. downgrading its view on expectations of more negative data prints ahead, JPMorgan Chase & Co. and RBC Capital Markets starting to temper their bullish calls and Morgan Stanley’s Michael Wilson warning on rising volatility.

With a softer jobs report out of the way, CPI is one of the last significant pieces of economic data before the Federal Reserve’s meeting next week. The report is seen as key to helping set expectations for the central bank’s path ahead, at a time when traders have been ramping up bets on additional rate cuts this year.

“Any sign that inflation isn’t cooling as fast as previously thought will ignite more turbulence,” said Brent Kochuba, founder of options platform SpotGamma.

Crystal Ball

Any signs of persistent inflation — or conversely, big progress on bringing it down — may fuel wild stock swings in either direction once the data is released at 8:30 a.m. in Washington. For now, the reading is expected to be a middling outcome, one that shows inflation slowing only gradually. The core February reading, excluding food and energy costs, is estimated to rise 0.3%, less than January’s 0.4%, according to the median estimate of economists surveyed by Bloomberg.

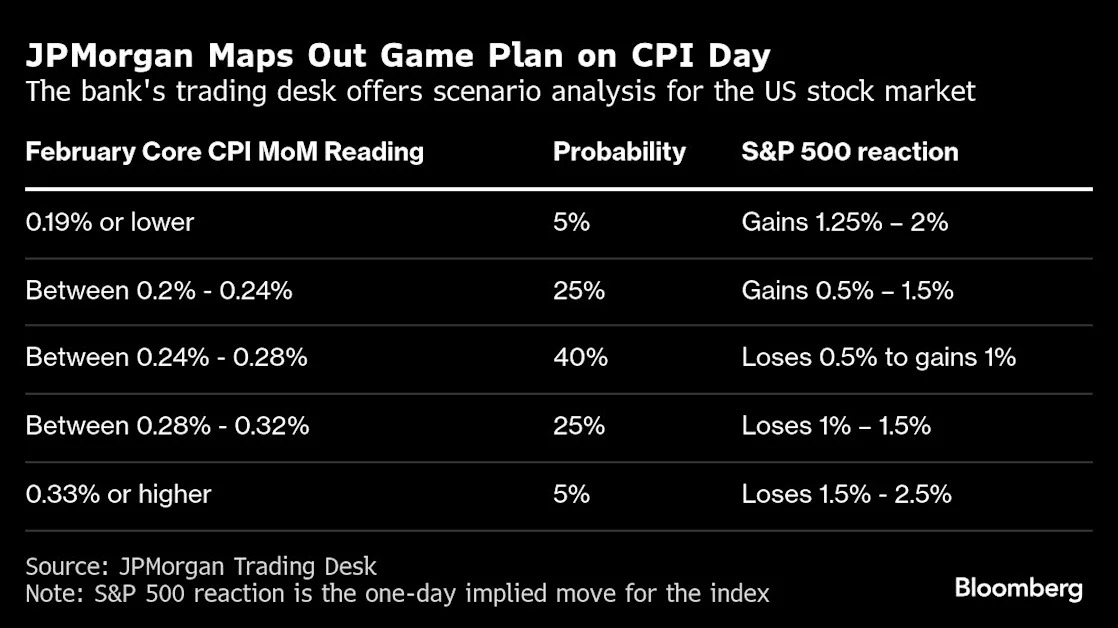

The S&P 500 could drop as much as 2.5% if the core CPI jumps at least 0.33% from the previous month, according to JPMorgan’s market intelligence team led by Andrew Tyler. However, he sees just a 5% chance of such an outcome.

In the most likely scenario laid out by the team, core CPI will come in between 0.24% and 0.28% from a month earlier, with the S&P 500 dipping 0.5% or rising as much as 1%, according to Tyler. A print below 0.19% may spark a rally between 1.25% to 2% in the index, he added.

Economic Anxiety

Markets were not always so beholden to CPI data. Last year, stocks had relatively muted reactions to consumer-price signals as inflation eased and the focus shifted to the employment part of the Fed’s dual mandate, following the central bank’s aggressive cycle of rate increases.

Now, concerns about slowing growth amid a full-fledged trade war, as well as sticky inflation and the Fed’s path to contain it have boosted implied volatility across the market as traders seek protection against losses in their portfolios. The Cboe Volatility Index — also known as Wall Street’s fear gauge — has increased steadily to near 30, a level typically seen during times of market stress.

While the increase has been muted compared to market shocks over the past year, it has closed above 20 for seven consecutive days, its longest streak since August. The heightened fear that economic growth is slowing while inflation is still high is what’s stoking volatility, said Brooke May, managing partner at Evans May Wealth.

“I wouldn’t be surprised if we saw US stocks rally if CPI comes in cooler than expected,” May said. “But a stubbornly high number could rattle investors.”