(Bloomberg) -- It’s been a whirlwind of a week for US stocks as tariffs hit a fever pitch, sending the S&P 500 into a tailspin that briefly drove it below a closely watched technical level.

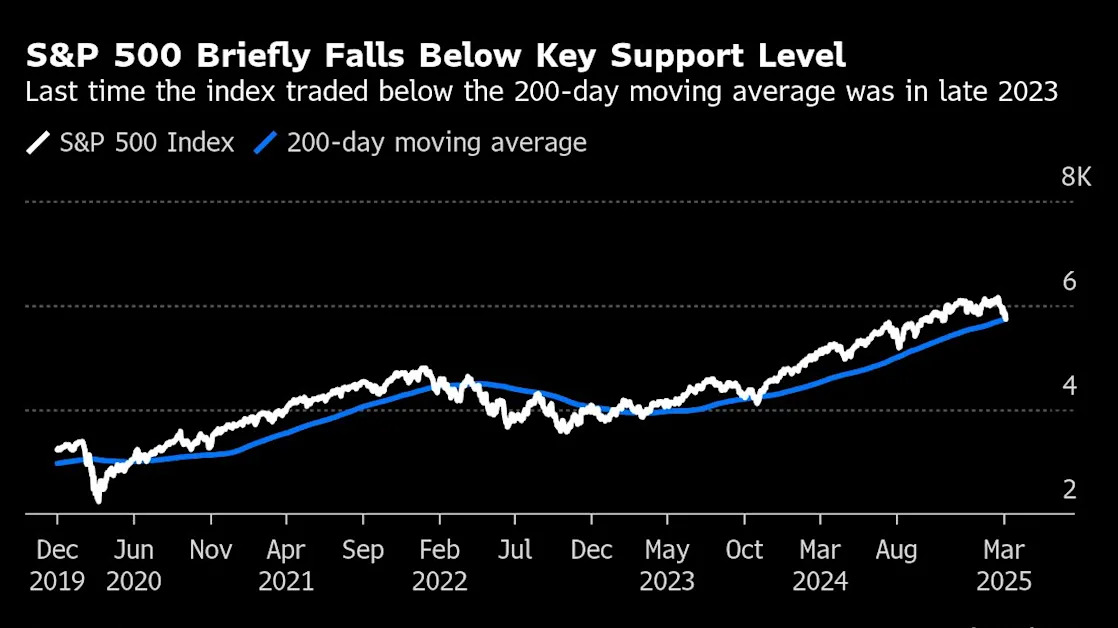

The benchmark is now on pace for its worst weekly loss in six months, ending Thursday 1.8% lower as a bevy of tariff headlines bruised sentiment. The S&P 500 breached its 200-day moving average for the first time since November 2023, temporarily dropping through the crucial support level.

The last time that happened, it set the stage for a recovery within days, but the extreme swings in the market are threatening to muddy any signals traders were hoping to elicit from the momentary break.

“While stocks can bounce from that key support level, we may not have seen the final low yet,” said Jonathan Krinsky, chief market technician at BTIG.

Krinsky recommends watching the Cboe VIX Index, overall signals from the options market and the market’s general reaction to news around trade, the economy and developments in artificial intelligence for signs of a market bottom.

The VIX, a measure of volatility known as the “fear gauge,” climbed to its highest level since mid-December. Moreover, the latest data from Bespoke Investment Group show that the current rate of intraday volatility in stocks ranks in the 98th percentile among the company’s readings since 1983. In other words, volatility was higher than present levels only 2% of the time.

The intense volatility of this week was “part of a correction,” Krinsky added. “You can’t have one without the other.”

The S&P 500 is currently down 6.6% from the record touched on Feb. 19. A 10% slide from that all-time high would meet the technical definition of a correction.

And while the weakness in tech stocks — which have been the biggest drivers of the S&P 500’s gains over the past two years — has garnered the most attention, the gloom may be more widespread. The percentage of S&P 500 members that trade above their own 200-DMAs fell to just about 50% earlier this week, the lowest share since November 2023.

At the same time, the appetite for risk has evaporated, and investors have run to take cover in relative safe havens. Out of all the S&P 500 sectors, health care and consumer staples have fared the best this year. Meanwhile, two Goldman Sachs baskets of unprofitable tech companies and heavily shorted stocks have been in a freefall.

“It feels the market is taking on a more defensive tone,” said JC O’Hara, chief technical strategist at Roth Capital Partners. “Market participants are laser-focused on the agenda from Washington and that is something that they cannot forecast with ‘relative’ ease.”