High expectations aren't bad as long as you deliver the goods. Data analytics and artificial intelligence (AI) software company Palantir Technologies (NYSE: PLTR) did that when it announced Q2 earnings, sending investors racing to buy up shares. The AI hype has been intense for the past few years, but Palantir is one of the few companies delivering real-world results.

Now, the question is whether Palantir's business performance justifies buying what has become one of Wall Street's hottest stocks.

Here's what you need to know.

Artificial intelligence momentum is still going strong

Palantir built its name by working with the government. The company develops custom software through its platforms, Gotham and Foundry, that analyze data in real time. The company has said it doesn't replace human intelligence but augments it . Palantir's technology has helped the U.S. with highly classified work, including an alleged role in finding infamous terrorist Osama bin Laden years ago.

Today, Palantir still enjoys a tight relationship with the government, which contributes over half of its total revenue. The rest has come from Palantir's expansion into the private sector, using its software to help enterprises with various applications, from supply chain optimization to fraud detection.

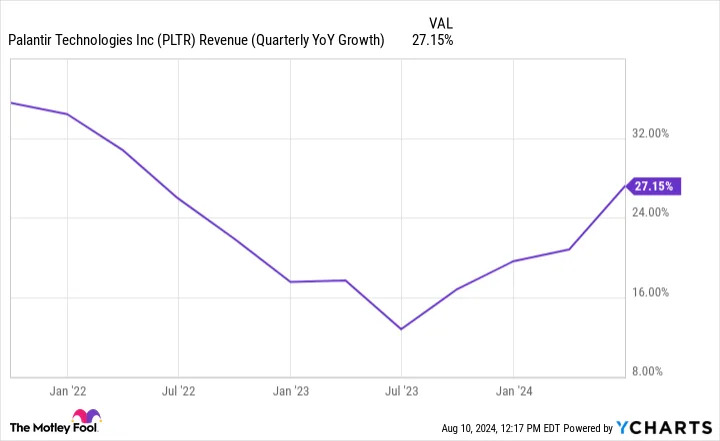

Last spring, the company launched AIP, a platform dedicated to commercial artificial intelligence applications. CEO Alex Karp has noted the tremendous demand for AIP, which has played a significant role in accelerating the company's revenue growth since last summer.

Second-quarter earnings continued to show that AI momentum is still going strong. The company's U.S. commercial customer count increased to 295, an 83% year-over-year bump and a 13% increase from the prior quarter. Remaining deal value, or booked business that hasn't been invoiced yet, for U.S. commercial clients grew even faster, 103% from the year-ago quarter. In other words, Palantir's commercial growth is not only rampant, but it's still accelerating .

There were other good tidbits from Palantir's Q2 performance, but its strong AI momentum was the key takeaway.

The financials say Palantir has a moat

The company's financials keep improving, supporting the idea that Palantir has competitive advantages and a unique product. Two metrics jump out here.

First, Palantir's gross profit margin is consistently increasing, which implies that Palantir has pricing power.

Additionally, the company's Rule of 40 number supports this. The Rule of 40 combines a company's revenue growth rate with the percentage of revenue it converts to operating income to determine whether a business can profitably grow. It flushes out potentially weak companies that grow by selling their product at a loss. As the metric's name implies, companies should target a combined revenue growth rate and operating margin of at least 40. Using its adjusted operating margin, Palantir's was a robust 57% in Q1, which improved to 64% in Q2.

An increasing Rule of 40 number also indicates a strong business model.

But is the stock's juice worth the squeeze?

These numbers paint the picture of a great company, but that's only half the battle; the price you pay also matters.

The stock trades at over 85 times its estimated 2024 earnings. A high enough growth rate can justify a steep valuation, but it's hard to make that case here. According to the most recent consensus analyst estimates, Palantir will grow its earnings an average of 24% annually over the next three to five years.

Investors can use the PEG ratio to compare a stock's valuation to its growth. Generally, I like to pay a PEG ratio of 1.5 or less for a stock, maybe a ratio of 2 for an exceptional company. But Palantir's current PEG ratio of 3.5 is well beyond that. The company would have to dramatically outperform expectations over time to justify buying the stock at its current price.

Could that happen? Of course, but there looks to be more risk than reward here. If the market gets shaky again like it did a couple of weeks ago, investors might be able to scoop up shares at a more reasonable price. A fair price is all a long-term investor needs for a stock like this.

Before you buy stock in Palantir Technologies, consider this: