(Bloomberg) -- Currency-options traders are signaling that the euro’s bullish momentum may not last past the coming weeks amid the lingering threat of a deepening trade war.

The common currency has soared about 4% this week, for its biggest three-day advance in almost a decade, after Germany unveiled plans for hundreds of billions of euros for defense and infrastructure spending, jolting yields on the nation’s government debt higher.

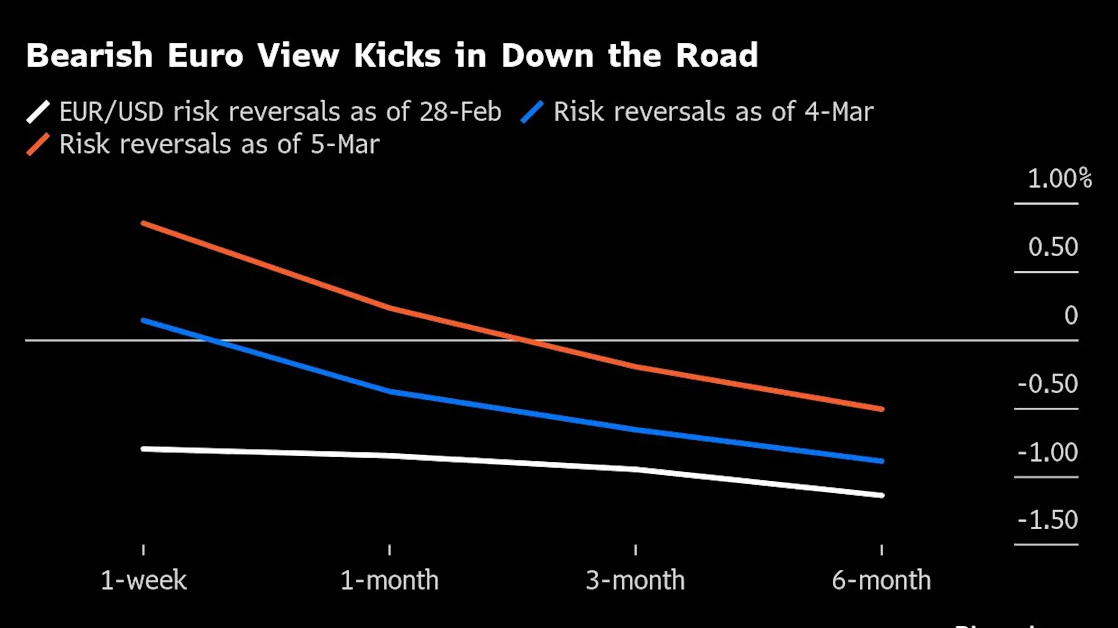

For the first time in six months, investors are paying more for one-week and one-month call options that bet on the common currency to rise, than for puts that look for it to fall. And some hedge funds are even wagering on an additional 10% surge in the euro.

However, the bullish options stance wanes in the medium-term. Three- and six-month risk reversals, which reflect the relative premium of calls over puts, are still trading in favor of puts.

“We are now tactically bullish EUR/USD,” said Meera Chandan, co-head of global FX strategy at JPMorgan Chase in London.

The potential for a halt to hostilities between Ukraine and Russia, increased fiscal support from European Union nations and the related sentiment boost could push the euro toward at least $1.12, near last year’s peak, she said.

Still, US tariffs may once again weigh on the euro in the coming months, she said.