(Bloomberg) -- Australia’s central bank board doesn’t share the market’s confidence that a series of further interest-rate cuts will follow last month’s easing, Deputy Governor Andrew Hauser said, adding that it’s still too soon to declare victory over inflation.

“The board will continue to take decisions, meeting by meeting, in the interests of all Australians,” Hauser, the Reserve Bank’s No.2 official, said in a speech in Sydney on Wednesday. “In so doing, our goal is to remove inflation from the list of things people have to worry about.”

Hauser pointed out that while progress in driving inflation back toward the RBA’s 2-3% target has been “good,” future decision-making will nonetheless be data-dependent. “We are not declaring success,” he said in response to a question after his speech. “We’re not there yet.”

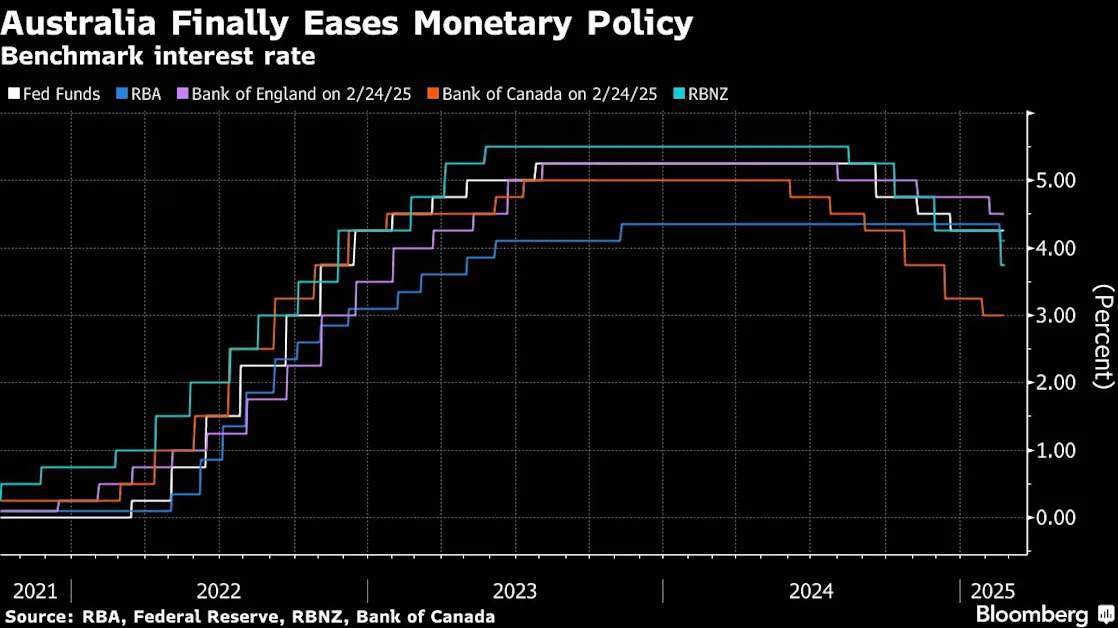

The RBA has adopted a hawkish tone since it reduced rates for the first time in four years to 4.1%, highlighting a still-tight labor market and global uncertainties. Yet financial market pricing implies the potential for more than two rate cuts this year, with traders currently seeing about 58 basis points of easing by December.

“We have taken our foot a little bit off the brake, we haven’t got our foot on the accelerator,” Hauser said during the Q&A at a conference hosted by the Australian Financial Review, describing how he assessed last month’s rate cut.

In his speech, Hauser laid out two key uncertainties that will shape Australia’s policy outlook — global tariffs and the domestic labor market.

“The bigger macroeconomic risk for us would be if the imposition of US tariffs on third countries triggered a global trade war that impaired our trade and financial linkages more broadly,” he said.

In the Q&A, the deputy governor added that it isn’t clear whether a “persistent attack on the supply chains of the world economy” will bring inflation down as it lowers activity, or refuel it.

“If inflation were to pick up we’d have to respond in one way. If inflation falls, we’ll respond in another,” Hauser said.

Meantime, hiring in Australia has been surprisingly resilient to higher borrowing costs, with unemployment currently standing at a historically low 4.1%. Hauser was asked about this extraordinary tightness and said that policymakers are “very alert” to the possibility of the job market overheating.

--With assistance from Matthew Burgess.

(Adds comments from Q&A throughout.)