Reynolds has gotten torched over the last six months - since August 2024, its stock price has dropped 21% to $24.56 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Reynolds, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even with the cheaper entry price, we're swiping left on Reynolds for now. Here are three reasons why we avoid REYN and a stock we'd rather own.

Why Do We Think Reynolds Will Underperform?

Best known for its aluminum foil, Reynolds (NASDAQ:REYN) is a household products company whose products focus on food storage, cooking, and waste.

1. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

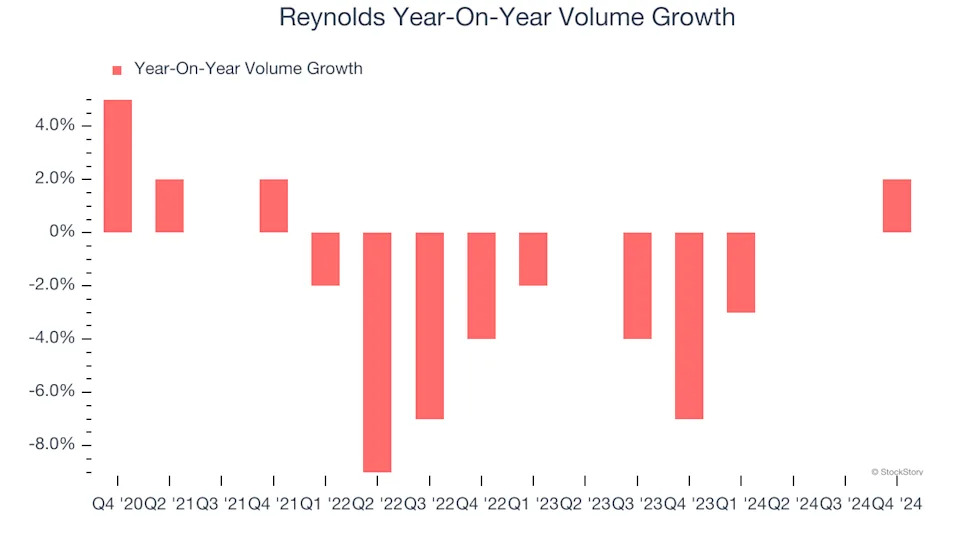

Reynolds’s average quarterly sales volumes have shrunk by 1.7% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Reynolds’s revenue to drop by 1.1%, a decrease from its 1.3% annualized growth for the past three years. This projection is underwhelming and implies its products will face some demand challenges.

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

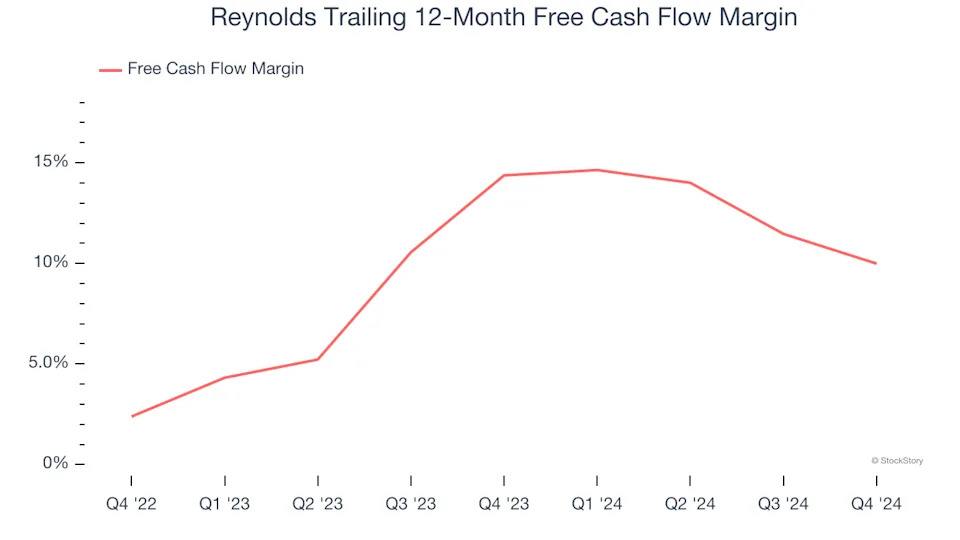

As you can see below, Reynolds’s margin dropped by 4.4 percentage points over the last year. This decrease warrants extra caution because Reynolds failed to grow its revenue organically. Its cash profitability could decay further if it tries to reignite growth through investments.

Final Judgment

Reynolds doesn’t pass our quality test. After the recent drawdown, the stock trades at 13.9× forward price-to-earnings (or $24.56 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks .

Stocks We Would Buy Instead of Reynolds

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .