(Bloomberg) -- Canada’s largest pension fund has found a winning formula to cut its borrowing costs: be more predictable.

Canada Pension Plan Investment Board started selling Canadian-dollar debt on a more regular and predictable schedule a few years ago, and that’s drawn loyalty from some investors. CPPIB is following a playbook that many provincial governments in Canada stick to, in part to meet pre-determined budget goals.

“We’ve tried to be as predictable and transparent as possible in the Canadian market,” CPPIB Managing Director Sam Dorri said in an interview with Bloomberg News. That includes committing to issuing half of its debt in the Canadian dollar market and splitting the volumes into deals maturing in five and 10 years.

Redesigning CPPIB’s issuance program has given certainty to both sellers and dealmakers, said Ryan Goulding, principal portfolio manager at investment firm Leith Wheeler Investment Counsel.

The strategy is paying off. CPPIB’s 2034 bond with a 4.3% coupon is trading at narrower spreads compared with an Ontario bond with a similar maturity, a rare flip in a market where governments tend to enjoy cheaper borrowing than other public sector entities. Ontario is considered one of the highest quality names in public sector debt market.

Over time, the pension fund has been able to sell new bonds at less of a premium to existing securities, known as a narrower new issue concession. That premium has shrunk to just under one basis point on the most recent deal from 1 basis point to 1.5 basis point about a year ago, according to Dorri.

Other pension funds are embracing the programmatic strategy, too. British Columbia Investment Management Corp. launched its debt issuance program in 2023 focusing on consistent, well-telegraphed issuances, according to Chris Weitzel, senior managing director of fixed income at the fund. That means selling about C$2 billion ($1.46 billion) in Canada each year in the foreseeable future, Weitzel said.

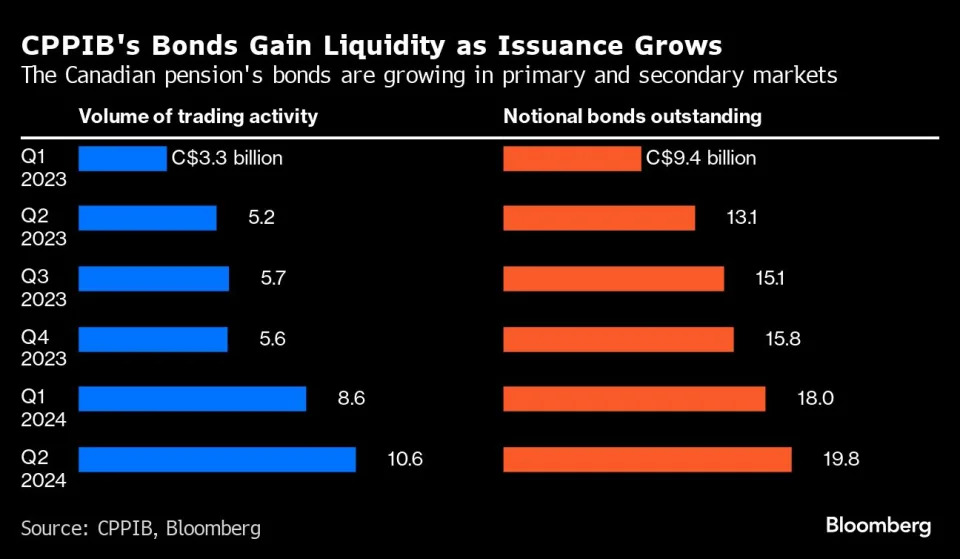

The more programmatic issuance has also propelled liquidity of CPPIB bonds faster than expected — in fact a year ahead of plan, Dorri said. Trading volumes for CPPIB bonds have grown to as much as C$4 billion a month, while they have more than tripled on a quarterly basis since early last year, according to Dorri.

“We’re right in the same trading volume range as our provincial peers,” Dorri said.

CPPIB has sold around C$98 billion of debt since 2015, according to its website. Its net assets rose to C$646.8 billion as of the end of June, the company said in a statement.

“Ultimately CPP will be able to issue at much tighter spreads, and more importantly, have access to funding whenever they want,” Leith Wheeler’s Goulding said.

--With assistance from James Crombie.

(Updates with CPPIB’s latest asset under management in the penultimate paragraph)